Cyberfraud Surge: AMLC Flags P35.49 Billion in ‘Suspicious’ Transactions

The Philippines is facing a "strong internal threat landscape" as cyber-enabled crimes and swindling dominate the nation's illicit financial flows. According to the Anti-Money Laundering Council's (AMLC) latest evaluation released in February 2026, over 1.29 million Suspicious Transaction Reports (STRs) were filed between 2021 and the first half of 2024, totaling a staggering P35.49 billion.

The report underscores how the pandemic-induced shift to digital platforms accelerated a "potentially irreversible" spillover of organized crime into the cyber domain, leaving financial institutions and regulators racing to keep pace

1. The Predicate Crimes: Volume vs. Value

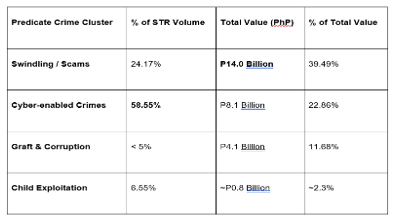

While cyberfraud is the most frequent reason for flagging a transaction, traditional "swindling" (estafa and investment scams) still accounts for the highest monetary loss.

Cyberfraud (Volume Leader): Nearly 59% of all STRs (758,621 reports) were linked to cyber-enabled crimes such as phishing, vishing, and account hacking.

Swindling (Value Leader): By contrast, swindling represented only 24% of the volume but a massive P14 billion (39.5%) of the total value.

The "Micro-Transaction" Shift: Notably, while the number of cyberfraud reports surged from 2021 to 2022, their total value fell by half. The AMLC notes this suggests criminals are moving toward a higher volume of smaller, lower-value transactions to avoid detection by traditional bank thresholds.

2. A "Homegrown" Crisis

One of the most startling revelations in the AMLC's Third National Risk Assessment is the domestic nature of these threats.

99.88% Domestic: Almost all STRs linked to e-commerce violations were domestic transactions.

Regional Hotspots: Over 50% of domestic suspicious activity originates from the National Capital Region (NCR), Calabarzon, and Central Luzon.

Inflow Risks: Despite the domestic focus, the council flagged P3.42 billion in suspicious inflow remittances, often linked to transnational scam centers operating within Southeast Asian "vulnerable zones."

3. The Graft and Corruption Component

Beyond digital scams, the AMLC continues to track "Graft and Corrupt Practices," which remain a persistent threat to the country's financial integrity.

P4.1 Billion Flagged: Graft accounted for 11.7% of the total suspicious value recorded in the period.

Recent Enforcement: The report comes on the heels of major AMLC actions, including the freezing of P25 billion in assets linked to flood control project anomalies and the conviction of foreign nationals for laundering illicit funds through Philippine real estate.

The GME Academy Analysis: "Regulatory Tightening is Imminent"

At Global Markets Eruditio, we anticipate that this data will trigger a new wave of compliance requirements for Philippine financial institutions.

Trader and Compliance Takeaway for 2026:

Format X Transition: The AMLC has mandated a transition to "Reporting Format X" starting January 2026, aimed at capturing more granular data on beneficial ownership and transnational organized crime.

FATF Status: Following the Philippines' successful exit from the FATF Grey List in February 2025, these reports are critical for maintaining the country's "Medium" vulnerability rating and preventing a re-listing.

Digital Banking Risk: We expect stricter "Know Your Customer" (KYC) protocols for e-wallets and digital banks, as they remain the primary channels for the "micro-transaction" swindling identified by the council.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is your business ready for the 2026-2030 National AML Strategy? We’ll break down the AMLC’s Third National Risk Assessment and show you how to navigate the new "Format X" reporting standards.