Plenary Power: House Junking of Marcos Impeachment Solidifies 2026 Stability

In a decisive show of administration strength, the House of Representatives voted overwhelmingly on February 10, 2026, to uphold the dismissal of two impeachment complaints against President Ferdinand "Bongbong" Marcos Jr. (PBBM). The plenary session concluded with a 284-8 vote (with four abstentions), effectively ending the shortest impeachment attempt in recent Philippine history.

At the GME Academy, we monitor "Governance Resilience" as a key factor for the Philippine Stock Exchange (PSEi). The speed and unity with which the House dismissed these raps signal that the "Marcos-Romualdez" alliance remains firmly in control of the legislative agenda, reducing political risk for the remainder of the year.

1. The Plenary Vote: A Supermajority Manifestation

The adoption of House Resolution 746 and Committee Report 111 was not just a procedural step; it was a political statement.

Overwhelming Consensus: The 284-8 vote indicates that even members of the minority joined the majority in rejecting the complaints.

Party Support: Leaders from the Lakas-CMD, NPC, and NUP manifested their support, arguing that the complaints were "distractions" from pressing economic issues like inflation and the infrastructure slump.

The "Nexus" Argument: Justice Committee Chair Rep. Gerville "Jinky Bitrics" Luistro noted that the complaints failed to establish any "factual nexus" between the President’s actions and an impeachable offense.

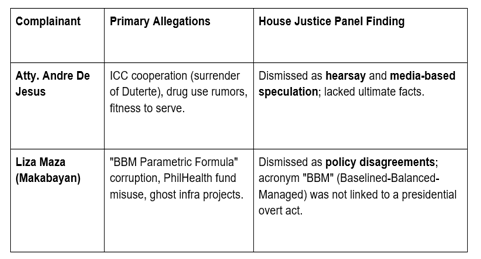

2. The Complaints: Policy vs. Malice

The two complaints, while high on rhetoric, were found by the Committee on Justice to be "fundamentally insufficient in substance."

3. The "Parametric Formula" Debate

A significant portion of the debate centered on the "BBM Parametric Formula"—a system used by the DPWH to allocate infrastructure funds.

The Allegation: The Makabayan bloc argued the formula was a tool for "institutionalized corruption" and kickbacks.

The Defense: Rep. Ysabel Maria Zamora clarified that the formula was a technical policy crafted by the DPWH, not the President personally. Under the "alter ego" doctrine, policy errors are not impeachable offenses unless direct criminal intent is proven.

The GME Academy Analysis: "Market Stability Confirmed"

At Global Markets Eruditio, we anticipate that the dismissal of the PBBM impeachment raps will act as a "Risk-Off" event for the local market.

Trader's Takeaway for 2026:

PSEi Sentiment: The removal of the "impeachment cloud" allows foreign investors to focus on the country’s 5.0% GDP growth targets. Expect a relief rally in blue-chip stocks like SM, ALI, and BDO.

USD/PHP Outlook: While the Sara Duterte impeachment continues to cause "political noise," the stability of the Presidency provides a much-needed anchor for the Peso. We expect USD/PHP to hold steady within the 56.20 – 56.60 range.

Rule of Law vs. Rhetoric: As Rep. Luistro stated, this decision reinforces that impeachment is a "constitutional safeguard, not a weapon of harassment." This provides long-term predictability for the 2026-2027 fiscal cycles.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to learn how to trade "Political Relief Rallies"? We’ll show you how to correlate congressional votes with Peso Volatility and how to spot the best entry points in a stable governance environment.