The Impeachment Trio: House Transmits Third Complaint Against VP Sara Duterte

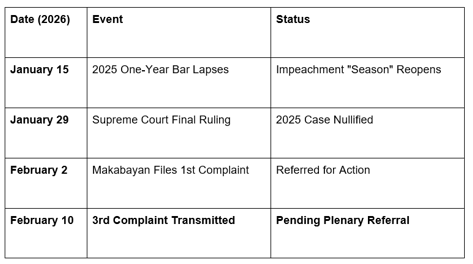

The political atmosphere in the Philippines has reached a fever pitch as the House of Representatives formally moved to process a third impeachment complaint against Vice President Sara Duterte. On the night of February 9, 2026, House Secretary General Cheloy Velicaria-Garafil confirmed the transmittal of the 98-page document to the office of Speaker Faustino “Bojie” Dy III.

At the GME Academy, we view this development as a significant "Governance Shock." In 2026, political stability is a primary driver of the Philippine Peso (PHP) and foreign direct investment. This triple-complaint scenario signals a prolonged period of executive-legislative friction that traders must watch closely.

1. The Third Strike: Who is Behind the Complaint?

Unlike purely partisan filings, this third complaint carries the weight of a broad coalition.

The Complainants: A group of Catholic clergy (including several priests and nuns), civil society leaders, and legal practitioners led by lawyer Armando Ligutan.

The Endorsement: The complaint was formally endorsed by Rep. Leila de Lima (Mamamayang Liberal), a long-time critic of the Duterte family.

The Ministerial Role: Secretary General Garafil emphasized that her role in transmitting the complaint was strictly ministerial, meaning the House has verified that the document meets the basic legal requirements to proceed to the Speaker.

2. The Grounds for Impeachment

The 98-page complaint is an "improved version" of previous attempts, focusing on a wide array of alleged constitutional and criminal violations:

Confidential Funds Misuse: Allegations surrounding over P500 million in OVP funds (2022-2023) and P112.5 million in DepEd funds (2023).

Assassination Threats: The "Contracting to Murder" allegation involving President Ferdinand Marcos Jr., the First Lady, and former Speaker Martin Romualdez.

Unexplained Wealth: Alleged failure to disclose properties in her Statement of Assets, Liabilities, and Net Worth (SALN).

High Crimes: Accusations of sedition, political destabilization, and bribery within the Department of Education.

3. The "One-Year Bar" Trigger

The timing of these filings is strategic. The one-year bar rule in the Philippine Constitution prevents more than one impeachment proceeding against the same official within a single year.

The Strategy: By having three complaints taken up in plenary simultaneously and referred to the Committee on Justice, the House effectively "locks in" the impeachment process for the next 12 months.

The Judicial Backdrop: This follows the January 29, 2026, Supreme Court ruling which denied with finality the House's motion to reconsider the 2025 impeachment attempt, declaring it unconstitutional for violating the one-year bar.

The GME Academy Analysis: "Political Volatility vs. Market Resilience"

At Global Markets Eruditio, we anticipate that the USD/PHP will see increased volatility as these complaints move to the Committee on Justice.

Trader's Takeaway for 2026:

Short-Term Peso Pressure: Political "noise" often leads to a temporary weakening of the Peso as foreign investors hedge against uncertainty. Watch the 56.80 level as a potential resistance point for USD/PHP.

Speaker Bojie Dy’s Role: As the new Speaker of the 20th Congress, Faustino "Bojie" Dy III now holds the gavel on whether these complaints are fast-tracked or allowed to simmer in committee. His leadership style is seen as more "consensus-driven" compared to the previous term.

Defense Response: The VP’s legal team, led by Michael Poa, has dismissed the complaints as "politically motivated harassment." If the defense manages to stall the "sufficiency in substance" hearings, market jitters may calm by Q2 2026.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready to trade the "Duterte-Marcos Divide"? We’ll show you how to use Sentiment Analysis to trade PHP pairs during high-stakes political events.