The "Nike Swoosh" Recovery: Will the Philippine Economy Bounce Back?

The Philippine economy is currently navigating a period of significant recalibration. Following a bruising corruption scandal that shook investor confidence and froze critical public works, multilateral institutions are signaling that the nation is poised for a rebound. However, the path forward looks less like a sharp "V" and more like a "Nike swoosh"—a gradual, steady bend upward rather than an immediate snapback.

For those watching the Forex markets, particularly the relationship between the Philippine Peso (PHP) and major pairs like EUR/USD or the US Dollar (USD), this trajectory suggests a period of "restrained realism."

The Cost of the "Corruption Shock"

The primary drag on recent performance stems from a massive graft investigation involving state-funded flood control projects. This scandal didn't just dent public trust; it physically halted infrastructure spending. As public works projects stalled, the ripple effect was felt across the industrial and construction sectors.

Key statistics from the latest updates:

Third Quarter 2025: Economic output hit a four-year low of 4%.

World Bank 2025 Outlook: Cut to 5.1% (down from 5.3%).

ADB 2025 Estimate: Lowered to 5% (down from 5.6%).

Despite these cuts, the Philippines remains a competitive player in Southeast Asia, tying with Indonesia and trailing only Vietnam in terms of growth speed.

Monetary Easing: The BSP’s Balancing Act

To counteract the domestic slowdown, the Bangko Sentral ng Pilipinas (BSP) has been aggressive. In December 2025, the central bank cut its benchmark interest rate by 25 basis points to 4.5%. This brought the total reductions in the current easing cycle to 200 basis points since August 2024.

For Forex Trading, lower interest rates often lead to a weaker domestic currency in the short term, but they are designed to stimulate long-term growth by:

Lowering Borrowing Costs: Making it easier for households and businesses to access credit.

Boosting Investment: Encouraging the resumption of infrastructure projects once the "governance dust" settles.

Supporting Consumption: Keeping private spending robust while inflation remains benign.

Traders looking at US Dollar strength must weigh these domestic cuts against the global environment, where central bank policy remains a primary driver of volatility.

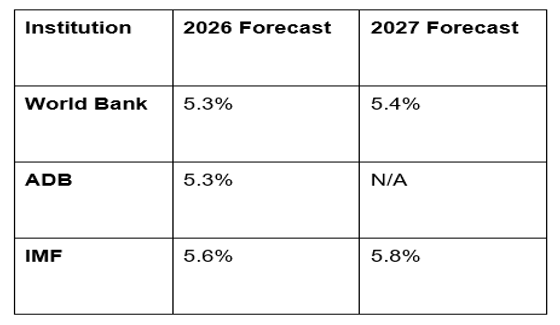

Potential vs. Reality: The 2026-2028 Horizon

The World Bank and the IMF both suggest that while a rebound is certain, the Philippines may not hit its "underlying potential" of 6% expansion until 2028.

The GME Academy often highlights that fundamental shifts, like the liberalization of the telecoms and renewable energy sectors in the Philippines, provide the long-term structural "floor" for the economy. However, as Global Markets Eruditio experts point out, these reforms take time to manifest in the GDP data.

What This Means for Forex Traders

In Forex Trading for Beginners, it’s easy to focus only on technical charts. However, the "Nike swoosh" outlook reminds us that fundamental news—like the resumption of public spending or the conclusion of a corruption probe—can be the catalyst for major currency trends.

The Philippine Peso will likely face headwinds from the current interest rate cuts, but a successful rebound in infrastructure could lead to a surge in Foreign Direct Investment (FDI), eventually providing support for the currency against the USD or CAD.

Level Up Your Economic Analysis

Understanding the macro-drivers of a country’s economy is what separates the professionals from the amateurs. Whether you're tracking the US Dollar or emerging market shifts, you need a solid foundation.

Join our FREE Forex Workshop

Learn how to read economic updates from the World Bank and IMF like a pro. We’ll show you how to turn global news into actionable trading strategies.