The Hidden Cracks: Australian Jobless Rate Holds Steady at 4.3%, But Soaring Underemployment Hints at RBA Headaches

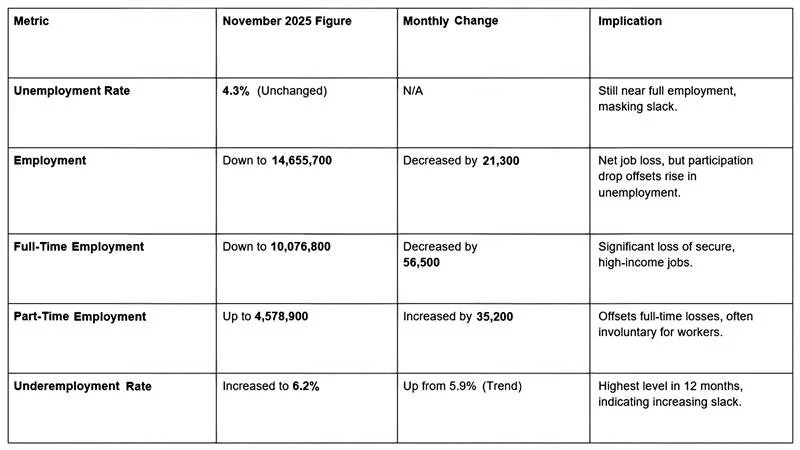

Australia's November 2025 Labour Force Survey presents a complex picture, with the headline unemployment rate holding steady at 4.3% in seasonally adjusted terms. However, a sharp decline in full-time employment (down 56,500) and a corresponding jump in the underemployment rate (up to 6.2%) suggest underlying slack is growing in the labor market. This shift towards part-time work complicates the Reserve Bank of Australia’s (RBA) decision-making, providing a mixed signal that fuels volatility in the Australian Dollar (AUD).

The Australian Bureau of Statistics (ABS) latest figures for November 2025 have delivered a classic "mixed bag," offering data points for both hawks (those expecting the RBA to keep rates high) and doves (those expecting the RBA to cut rates). The stability of the unemployment rate at 4.3% signals continued tightness, but the sharp deterioration in job quality and hours worked provides the RBA with evidence of cooling demand.

The Quality Crisis: Full-Time Job Losses Mask the Headline

The most critical insight from the November data comes not from the headline unemployment figure, but from the changes in the type of employment and the total hours worked.

The Softening Details (Seasonally Adjusted):

The significant loss of over 56,000 full-time positions, which was partially masked by a rise in part-time work, is a clear signal that the underlying strength of the labor market is deteriorating. The resulting jump in the underemployment rate—workers who have a job but want more hours—is a direct measure of labor market slack or spare capacity. This overall underutilisation of labor is exactly what the RBA aims to achieve to tame wage growth and, subsequently, inflation.

RBA Policy and Forex Trading: A Mixed Signal AUD

These figures land directly in the middle of a crucial monetary policy debate for the Reserve Bank of Australia (RBA), creating tension in the AUD/USD and AUD/JPY currency pairs.

RBA's Dilemma

The RBA's primary objective is to bring inflation back within its 2-3% target band. Labor market tightness is a key driver of domestic inflation via wage growth.

Argument for Tightness (Hawkish): The headline unemployment rate holding at 4.3% remains historically low and is at or below the RBA's own estimated level of full employment (forecast to rise to 4.4% by year-end 2025). This tightness provides the RBA with a justification to maintain current cash rates (currently 3.60%) or even consider a hike if inflation remains persistent.

Argument for Easing (Dovish): The surge in the underemployment rate to 6.2% and the sharp drop in total full-time employment provide evidence that the RBA's rate hikes this year are working. This growth in slack reduces the bargaining power of workers and lowers the pressure for sustained high wage growth (currently forecast to decline to 3.0% by late 2027), thus strengthening the case for a pause, or even a future rate cut.

Forex Impact: AUD/USD Volatility

For Forex Traders, this mixed report generates volatility but not a clear, sustained direction, at least initially.

AUD Pressure: The loss of full-time jobs and the rise in underemployment are fundamentally bearish for the Australian Dollar (AUD), as they increase the probability of an RBA rate cut in the coming months. This puts downward pressure on the AUD/USD pair, a concept taught in detail in the Forex Trading for Beginners curriculum.

Global Divergence: However, the immediate reaction of AUD/USD is often moderated by the actions of other central banks, such as the recent rate cut by the US Federal Reserve (Fed). The policy divergence—where the Fed is easing while the RBA is pausing but signaling caution—is the primary driver for pairs like AUD/USD.

The key takeaway for those applying principles of Global Markets Eruditio is to watch the underemployment rate as the true measure of labor market health, as it gives the RBA the best ammunition to justify a future shift toward easing monetary policy.

Are You Trading the Headline or the Hidden Labor Market Cracks?

The underemployment rate provides a deeper, more actionable signal than the headline unemployment number. Ignoring this depth means missing the RBA's real focus.

Master the skill of interpreting complex labor reports to predict RBA policy.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn how to translate Australia's nuanced labor force data into high-probability trades on the AUD/USD currency pair, securing a comprehensive understanding of the forces that move the market.