The Fed's Favorite Gauge: US Labor Costs Slow to 0.8% in Q3, Easing Inflation Fears and Shifting the USD Outlook

The long-delayed Employment Cost Index (ECI) for September 2025, a critical measure of labor costs closely monitored by the Federal Reserve (Fed), showed that total compensation costs for civilian workers grew by 0.8% in the third quarter (Q3). This quarterly reading, a deceleration from previous quarters and slightly below consensus expectations, signals a welcome cooling in US wage pressures and reinforces the argument for a gradual easing cycle, impacting the fundamental outlook for the US Dollar (USD).

The U.S. Bureau of Labor Statistics (BLS) finally published its September 2025 ECI after a significant delay caused by the federal government shutdown. The ECI is widely regarded as the most comprehensive and cleanest measure of labor compensation, as it adjusts for shifts in occupational and industry composition—factors that often distort other wage metrics. Its moderation in Q3 is a pivotal development for markets wrestling with the trajectory of inflation and the future path of USD interest rates.

The Key Deceleration: Labor Costs Lose Steam

The September 2025 ECI data confirms that the robust compensation growth seen in previous quarters is starting to taper off, a direct sign of easing labor market tightness.

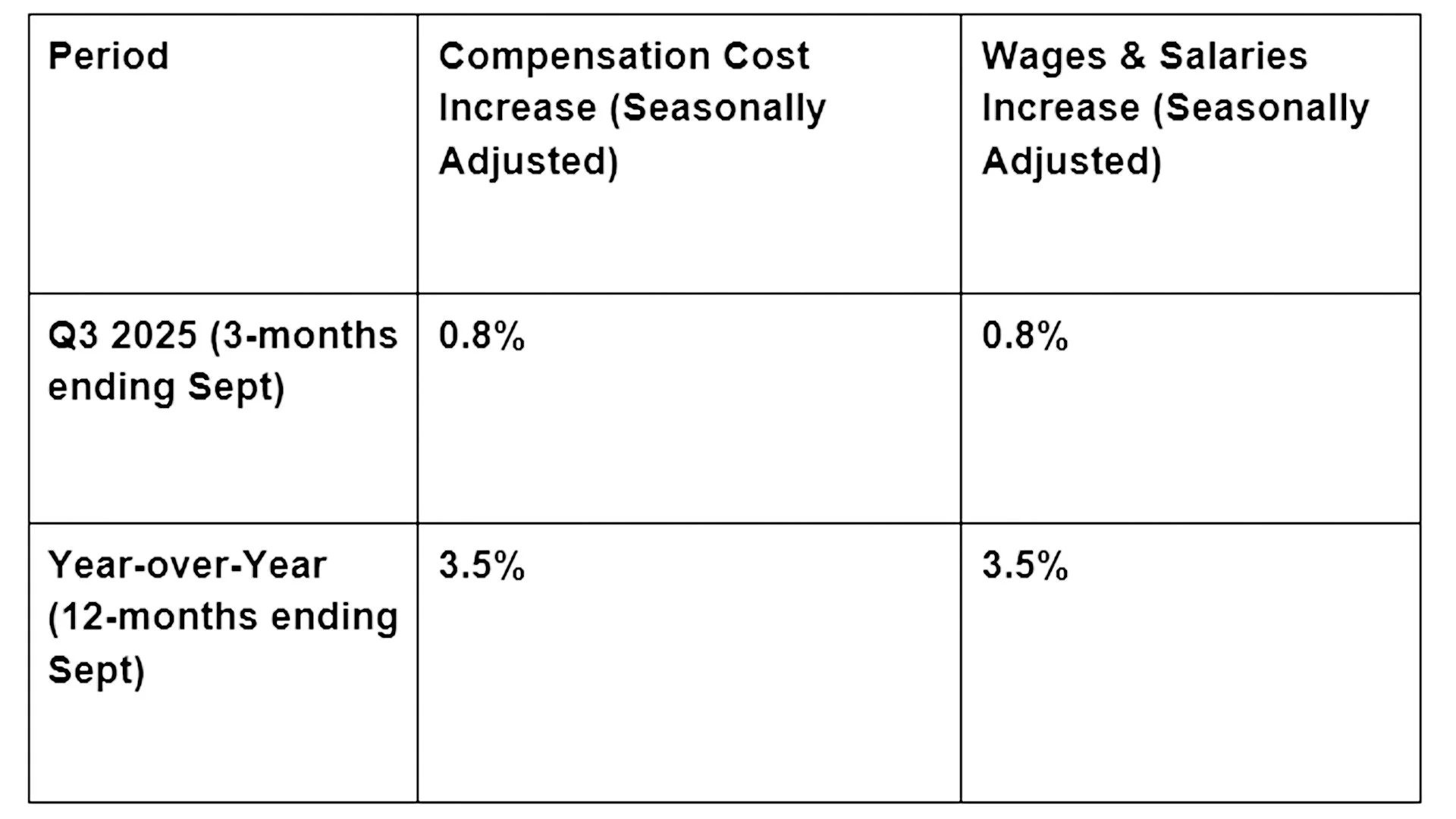

Quarterly and Annual Figures (Civilian Workers):

The quarterly increase of 0.8% is a slowdown compared to the 0.9% rise recorded in Q2 2025. Moreover, the annual increase of 3.5% marks the slowest year-over-year gain since the second quarter of 2021, according to market analysis.

Private Industry Breakdown

Annual Growth: Compensation for private industry workers increased 3.5% over the year, with wages and salaries up 3.6% and benefit costs up 3.5%.

Real Wage Growth: A crucial measure for consumer health, inflation-adjusted (constant dollar) wages and salaries for private industry workers increased only 0.6% over the year. This modest real increase suggests that while workers are seeing nominal pay bumps, their purchasing power is only creeping up slowly, which could eventually restrain consumer demand.

Forex Trading Implications: The Fed's Green Light for Easing

The ECI is arguably the most important labor market release for Forex Traders and the Fed. It is a leading indicator for core services inflation, as labor is the largest cost component for service-producing businesses.

USD Reaction and Policy Outlook

The ECI moderation supports the dovish narrative that the labor market is no longer a significant driver of persistent inflation.

Dovish Signal: The slowdown in compensation growth is a key piece of data for the Fed, validating its current cautious approach. It suggests that wage pressures are receding, reducing the risk of a price-wage spiral. This makes the case stronger for the Fed to continue its rate easing, which is fundamentally bearish for the US Dollar (USD).

Trading Currency Pairs: Traders focusing on Forex Trading for Beginners should note that weaker ECI data generally leads to a softer USD. This can create upward momentum in cross-currency pairs like EUR/USD or GBP/JPY, as the USD component of the pair loses ground against currencies where central banks may be maintaining a tighter monetary policy stance.

Real Wages and Consumer Spending

The meager 0.6% real wage increase for private workers raises a second concern for the US economy: the health of the consumer.

If real wage growth remains weak, consumer spending—the engine of the US economy—is likely to slow down, increasing the probability of a broader economic slowdown or even a mild recession. This overall downside risk to the US economy further reinforces the bearish sentiment toward the USD. Analyzing these complex interactions is a key skill emphasized in programs focused on Global Markets Eruditio.

Data Integrity and Future Schedule

It is important to note the delay: the publication of the September 2025 ECI was held up by over five weeks due to the federal government shutdown, which also resulted in a decreased survey response rate for September. Traders must consider this factor when evaluating the data's reliability.

The delayed release has also pushed back the subsequent reporting schedule. The next ECI news release for December 2025 has been rescheduled for Tuesday, February 10, 2026. This calendar shift is vital for traders planning their analysis around future high-impact economic data.

The third-quarter ECI provides strong evidence that the intense wage inflation era is subsiding. For the USD, this signals a transition from a strengthening currency (driven by expectations of high interest rates) to one more susceptible to easing monetary policy.

Are You Positioned for the Labor Market Cooldown?

The Employment Cost Index is the Fed's labor market crystal ball. Its deceleration signals a fundamental shift in the USD's outlook.

Master the skill of interpreting the ECI and translating complex labor statistics into high-probability currency trades.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn how to analyze the ECI and its influence on USD currency pairs, securing a comprehensive understanding of the forces that move the market.