The Takaichi Overhaul: PM Accelerates Bold 2-Year Plan to Rebuild Japan’s Economy and Defense

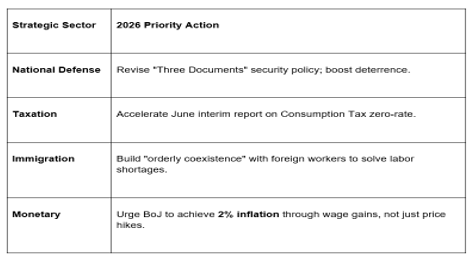

Following a resounding supermajority win in the February 2026 Lower House election, Prime Minister Sanae Takaichi has moved with striking speed to operationalize her "crisis management" doctrine. In a series of high-level directives issued on Thursday, February 19, 2026, Takaichi signaled a fundamental break from decades of incremental fiscal policy, ordering a total overhaul of the national budget and a rapid acceleration of tax reform talks.

At the GME Academy, we are characterizing this as the "Takaichi Pivot"—a high-stakes experiment in combining ultra-proactive fiscal spending with a "hard" national security posture.

1. The Two-Year Budget Overhaul

Prime Minister Takaichi has directed her Cabinet to "fundamentally review" the way Japan constructs its budget. The goal is to move away from the chaotic reliance on frequent supplementary budgets that have defined Japanese fiscal policy for years.

Strategic Multi-Year Funding: The overhaul aims to include all necessary funds in the initial budget and create frameworks for multi-year fiscal commitments.

The Two-Year Timeline: Takaichi warned that this total systemic restructuring—designed to improve predictability for private investors—will take roughly two years to complete.

Fiscal Sustainability: Despite the spending push, the PM reaffirmed her commitment to long-term market confidence, stating that the goal remains stably lower the debt-to-GDP ratio (which currently sits near 240%).

2. The Tax Cut Bridge: A Refundable Credit System

To address the immediate "pinch" of 3% inflation, Takaichi is accelerating a two-track tax strategy.

Consumption Tax Suspension: The PM is pushing to eliminate the 8% sales tax on food for a two-year period starting in fiscal 2026. This is viewed as a "bridging measure" to support households while broader reforms are built.

Refundable Tax Credits: In the long term, the administration plans to introduce a "tax credit with cash payments" system. This acts as a "negative income tax," providing direct support to low-income earners who don't pay enough income tax to benefit from traditional cuts.

Funding the Gap: To fill the estimated ¥5 trillion annual revenue shortfall, the government is looking at reviewing existing subsidies, special tax measures, and utilizing higher-than-expected tax revenues rather than issuing fresh deficit-financing bonds.

3. Defense and the "Free and Open Indo-Pacific"

A cornerstone of the Takaichi mandate is the hardening of Japan's regional posture.

Deterrence First: The PM has ordered the "fundamental reinforcement" of defense capabilities, aiming to hit the 2% of GDP spending target two years early.

Strategic Alliances: Reaffirming the Japan-U.S. Alliance as the cornerstone, Takaichi is seeking to "evolve" the Free and Open Indo-Pacific (FOIP) concept.

Economic Security: The administration is treating technology—specifically 2-nanometer semiconductors (Rapidus) and AI—as defense assets, pledging over ¥10 trillion in public support to ensure Japan is not dependent on foreign tech.

GME Academy Analysis: "Trading the Landslide"

At Global Markets Eruditio, we are tracking the massive divergence between Japan's record-high Nikkei and the jittery JGB (Bond) market.

Trader's Takeaway for February 2026:

The "Takaichi Premium": Equities are cheering the end of "excessive austerity" and the focus on 17 strategic growth industries. However, the 10-year JGB yield has spiked toward 2.3% as traders question the feasibility of funding tax cuts without new debt.

FX Watch: While Takaichi refused to comment on market moves, her "pro-growth" stance initially weakened the yen. If the Bank of Japan stays accommodative to "support the overhaul," we could see the yen test new historic lows against the dollar.

Strategic Investment: The focus on Rapidus and data centers makes Japanese tech-infrastructure firms a primary "long" play for the first half of 2026.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is Japan entering a "New Abenomics" era or a fiscal trap? We’ll break down the Katayama-Takaichi June Funding Roadmap and show you how to hedge against yen volatility in the 2026 market.