Resilient Labor: Australia’s Unemployment Holds at 4.1% as Full-Time Work Surges

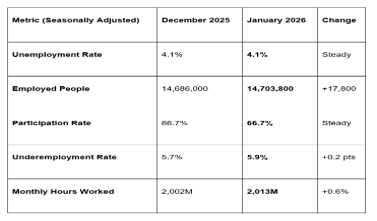

Australia’s labor market kicked off 2026 with a show of surprising strength. According to the latest data from the Australian Bureau of Statistics (ABS) released on Thursday, February 19, 2026, the national unemployment rate remained steady at 4.1% in January.

The data reveals a workforce that is working harder—and longer—to combat the persistent cost-of-living pressures that defined the previous year. While the headline figure was stable, the "under the hood" metrics suggest a significant pivot toward full-time job stability at the expense of part-time roles.

1. The January Snapshot: Full-Time Growth Leads the Way

In seasonally adjusted terms, employment increased by 17,800 people, bringing the total number of employed Australians to over 14.7 million. However, the real story lies in the composition of these jobs:

The Full-Time Surge: Full-time employment saw a massive jump of 50,500 people.

The Part-Time Retreat: This was partially offset by a decline of 32,700 part-time workers, suggesting many Australians are successfully transitioning into more secure, permanent roles to maximize income.

Hours Worked: Monthly hours worked in all jobs rose by 11 million hours (0.6%) to a total of 2,013 million. ABS Head of Labour Statistics Sean Crick noted that fewer people than usual took leave in January, contributing to a growth in hours that outpaced the growth in headcount.

2. Participation and Underemployment: The "Cooling" Signal

Despite the job gains, the participation rate remained at 66.7%, down from a record high of 67.3% seen in early 2025.

The Underemployment Tick: The underemployment rate increased to 5.9%. This is a critical metric for the Reserve Bank of Australia (RBA), as it indicates that while people have jobs, many still desire more hours than they are currently being given.

Youth Outlook: Youth underemployment rose by 1.0 percentage point to 14.8%, reversing a brief improvement seen in December.

3. State-by-State Breakdown

The labor market remains highly fragmented across the country. Tasmania currently faces the most pressure, while Western Australia continues to be the nation's economic powerhouse.

Western Australia (3.4%): Remains the tightest labor market in the country.

New South Wales (4.1%): Aligned perfectly with the national average.

Victoria (4.2%): Seeing a slight softening in suburban Melbourne.

Tasmania (4.9%): Recorded the highest unemployment rate in the nation for January.

GME Academy Analysis: "The RBA’s Dilemma"

At Global Markets Eruditio, we believe these numbers justify the Reserve Bank of Australia’s recent decision to hike the cash rate to 3.85% on February 3.

Trader's Takeaway for February 2026:

Hawkish Outlook: The RBA is focused on "persistent inflation." The fact that unemployment didn't rise despite higher rates suggests that the economy can handle further tightening. If February's CPI data stays hot, a May rate hike to 4.10% is firmly on the table.

Real Wage Drag: While employment is high, real wages (inflation-adjusted) are still struggling to find positive territory. This is a "warning sign" for discretionary retail stocks like those on the ASX 200.

Productivity Gap: Hours worked are up, but productivity remains stagnant. This suggests that businesses are adding hours rather than innovating, which could lead to a "profit squeeze" later in 2026.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the "Aussie Job Boom" losing its spark? We’ll break down the Indeed 2026 Hiring Trends Report and show you how to identify the most resilient sectors for your portfolio.