The Balancing Act: Decoding the December 2025 CPI Report

In the world of Forex trading, inflation data is the ultimate compass. On January 23, 2026, the latest Consumer Price Index (CPI) report for the December 2025 quarter was released, revealing a 0.6 percent quarterly rise and a 3.1 percent annual increase.

UK Economy on a Knife-Edge: Growth Stalls as the Inflation Fire Cools

The latest S&P Global Flash UK PMI data for November 2025 presents a nuanced and challenging picture for the UK Economy and the Pound Sterling (GBP). While the headline figures confirm a sharp slowdown in private sector activity, a key bright spot emerged: the pace of output price inflation is easing, fueling speculation about the next move from the Bank of England (BoE).

The US Economy's Double-Edged Sword: Faster Growth Meets Fraying Price Stability

The latest economic signals from the United States have delivered a potent mix for global markets: accelerating economic expansion paired with an unwelcome intensification of price pressures.

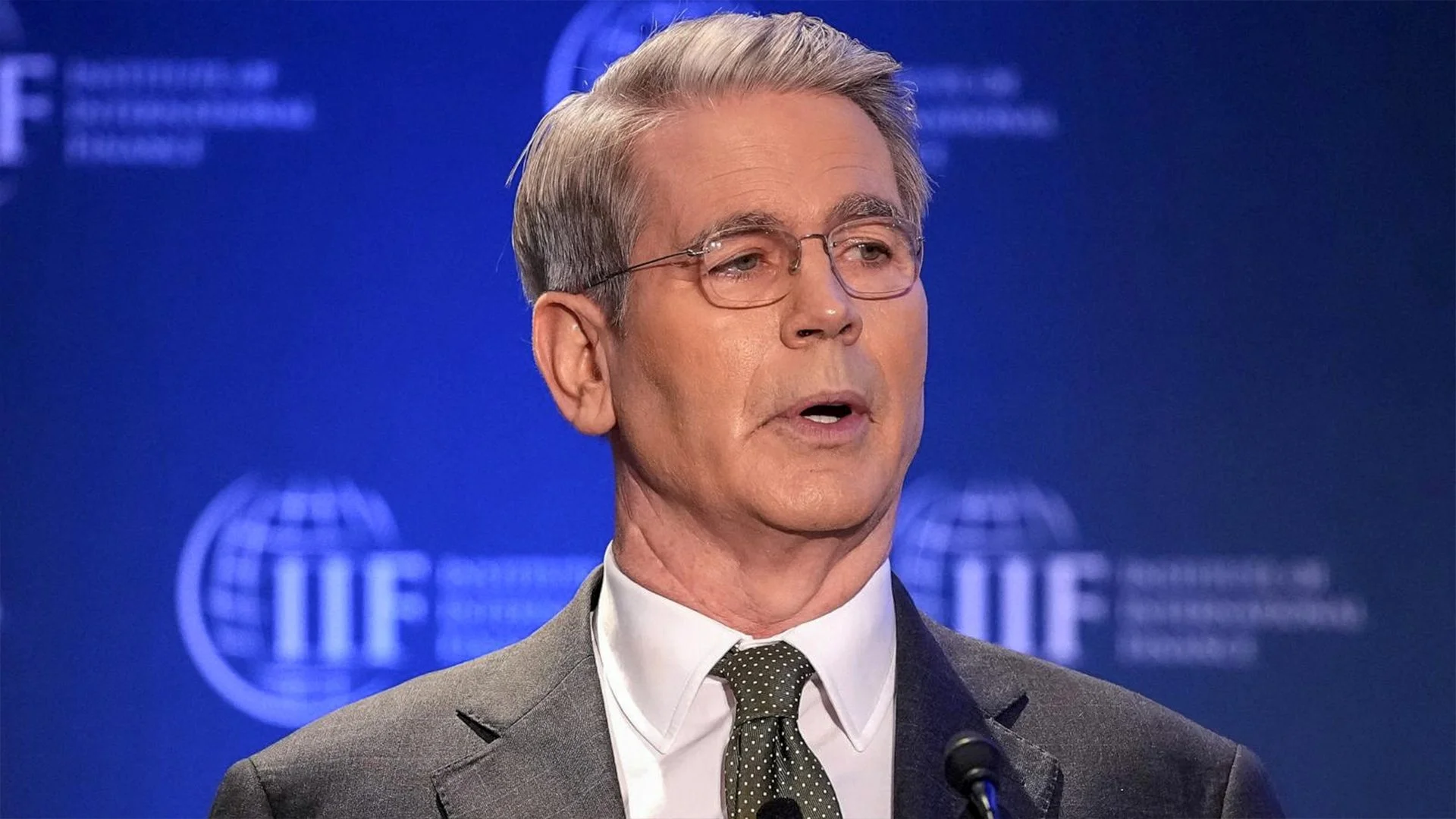

Boston Fed Highlights Economic Outlook, Monetary Policy, and Banking Innovation

In a recent address at the Boston Fed’s 24th Annual Regional and Community Bankers Conference, a Federal Reserve official shared key insights into the U.S. economy, monetary policy, and trends in regional banking. These perspectives are especially important for Forex traders, as shifts in interest rates, inflation, and banking dynamics directly influence currency movements and trading opportunities.

Bessent Dismisses “Tariffs as a Tax” Narrative — Says AI Could Drive U.S. Job Boom Amid Falling Mortgage Rates

In a recent MSNBC interview, U.S. Treasury Secretary Bessent struck an optimistic tone about the American economy, dismissing fears that tariffs automatically translate into higher consumer costs and highlighting what he called a “gigantic drop in mortgage rates.”

How Tokyo’s Consumer Prices Could Affect the Yen and Your Trades

Tomorrow, the Statistics Bureau of Japan will release the Tokyo Consumer Price Index (CPI) excluding fresh food — a key measure of monthly consumer price changes in Japan’s largest city. For Forex traders, this report is like taking an early “temperature reading” of inflation: it gives clues about future Bank of Japan (BoJ) policy and the strength of the Japanese yen (JPY).

Fed Governor Christopher Waller to Speak: Why Forex Traders Are Watching

Tomorrow, Federal Reserve Governor Christopher Waller will deliver remarks on monetary policy and inflation at the Economic Club of Miami. For traders, his words are like an early weather forecast: he can hint at whether the economic skies will be sunny (growth) or stormy (inflation).