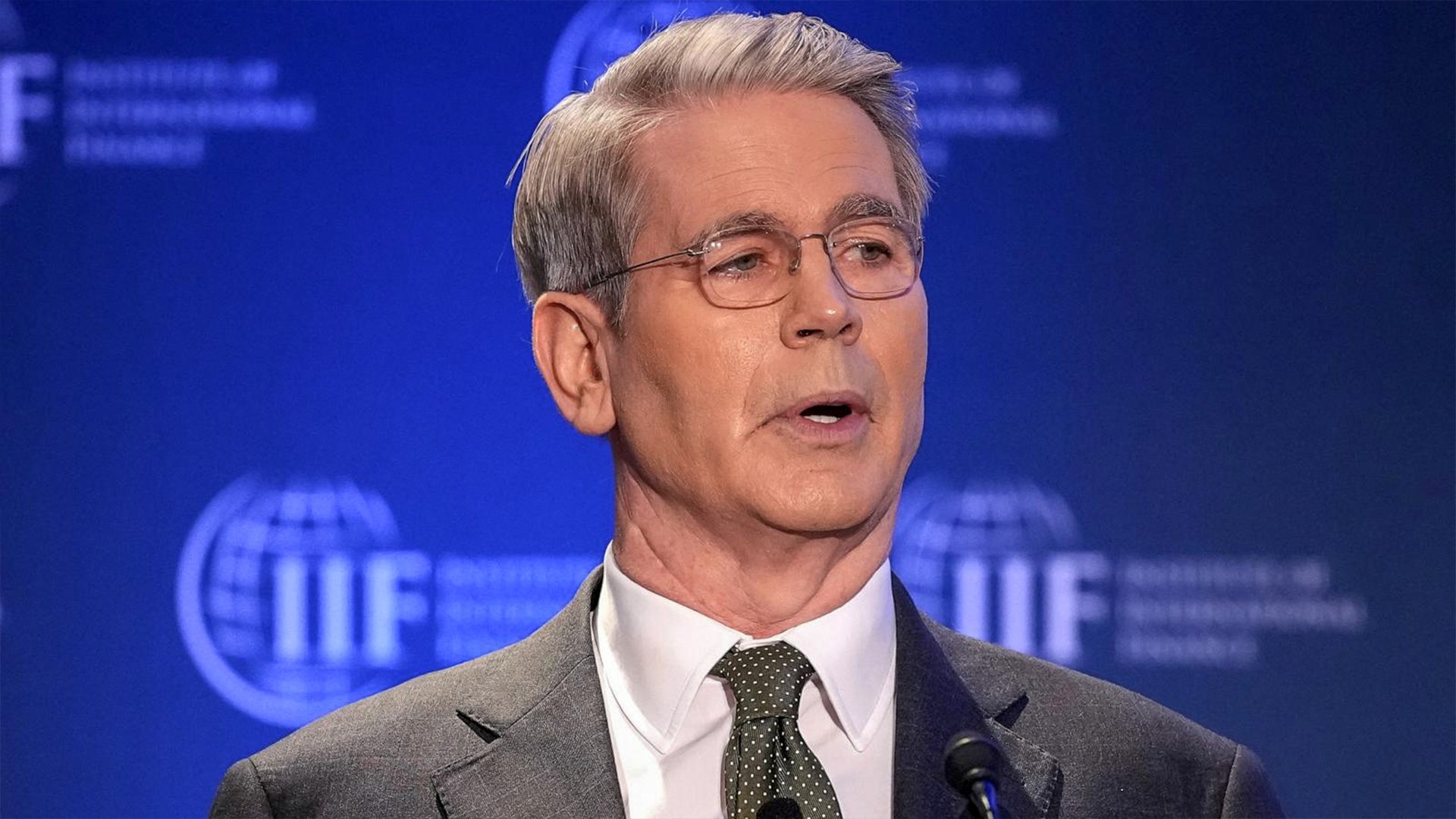

Bessent Dismisses “Tariffs as a Tax” Narrative — Says AI Could Drive U.S. Job Boom Amid Falling Mortgage Rates

A Confident Economic Outlook from Treasury Secretary Bessent

In a recent MSNBC interview, U.S. Treasury Secretary Bessent struck an optimistic tone about the American economy, dismissing fears that tariffs automatically translate into higher consumer costs and highlighting what he called a “gigantic drop in mortgage rates.” He also pointed to artificial intelligence (AI) as a potential driver of “substantial job growth” in the coming years — signaling that the U.S. economy may be entering a new phase of post-inflation expansion.

For Forex traders, these statements are far from just political soundbites. They reflect a growing confidence in U.S. economic resilience, which could shape the US Dollar’s (USD) direction across major currency pairs such as EUR/USD, USD/JPY, and GBP/USD.

Tariffs: Not Always a Tax on Consumers?

Bessent’s rejection of the long-held idea that “tariffs are a tax on consumers” challenges conventional economic wisdom. Traditionally, tariffs raise import costs, which are often passed on to consumers in the form of higher prices. But according to Bessent, that relationship is not always direct.

“There’s a misconception that tariffs always burden consumers,” she said. “The reality is more complex — sometimes domestic industries absorb the costs, or global price shifts balance them out.”

This statement suggests that U.S. trade policy might continue embracing selective tariffs without fear of immediate consumer backlash. For Forex markets, this could mean a stronger USD if tariffs protect domestic industries and boost U.S. production, especially in key sectors like manufacturing and semiconductors.

However, it also introduces uncertainty — particularly for emerging market currencies that depend heavily on exports to the U.S. The Mexican peso (MXN), Chinese yuan (CNY), and South Korean won (KRW) could see short-term volatility depending on how new tariffs are structured and perceived.

The “Gigantic Drop” in Mortgage Rates

Bessent’s mention of a “gigantic drop in mortgage rates” added another layer to the economic discussion. After months of elevated borrowing costs, the recent decline in mortgage rates has injected renewed optimism into the U.S. housing market. Lower mortgage rates typically signal a more dovish market outlook — but in this case, they might also reflect improving inflation expectations and greater investor confidence in U.S. fiscal management.

For the Forex market, falling mortgage rates can influence the US Dollar in two ways:

Short-term weakness — as lower yields make the USD slightly less attractive to yield-seeking investors.

Long-term stability — as reduced housing costs stimulate consumer spending and support broader economic growth.

This dual effect creates interesting trading opportunities for Forex Trading for Beginners, particularly on pairs like EUR/USD or USD/JPY, where short-term sentiment often drives quick swings, while long-term fundamentals provide steady direction.

AI Investments: The Next Engine of Job Growth

Perhaps the most forward-looking statement Bessent made was her confidence in AI-driven job creation.

“AI investments are not just about efficiency — they’re about creating new industries, new roles, and a wave of job opportunities that didn’t exist before,” Bessent said.

Her remarks highlight the U.S. government’s stance that artificial intelligence will complement human labor rather than replace it entirely. If realized, this could mean stronger employment numbers, higher productivity, and sustained consumer spending — all of which tend to support the US Dollar in the Forex market.

AI expansion could also spur capital inflows into U.S. tech sectors, reinforcing the USD’s safe-haven status while improving overall investor sentiment.

Forex Market Takeaways

For traders following this story, here’s how Bessent’s statements might translate into market dynamics:

Stronger USD Outlook: Confidence in AI-driven growth and lower mortgage rates may boost overall U.S. economic sentiment.

Volatility in Emerging Markets: Countries dependent on U.S. trade could see fluctuating currency values as tariff discussions evolve.

Interest Rate Sensitivity: Lower mortgage rates could hint at easing inflation, which may temper expectations for further Fed tightening — a key signal for USD movement.

In short, the Forex market may experience a balancing act between policy optimism and yield differentials, creating ideal conditions for strategic positioning.

Why It Matters for Traders and Investors

For everyday readers and traders, Bessent’s remarks reinforce one key truth: economic narratives shape market psychology. When top officials project confidence — even amid global trade tensions — it influences how investors price currencies, commodities, and risk.

For Forex Trading beginners, this underscores why it’s vital to go beyond charts and learn how to read macroeconomic signals. Platforms like GME Academy (Global Markets Eruditio) teach traders how to interpret such government statements, connecting policy language with market behavior to identify smarter trading opportunities.

Optimism with Caution

Treasury Secretary Bessent’s comments present a cautiously optimistic vision — lower mortgage rates, expanding job potential through AI, and a more nuanced view of tariffs. Together, they suggest that the U.S. economy remains robust, adaptive, and capable of withstanding both external shocks and internal adjustments.

For the Forex community, the next few weeks will be crucial for tracking how the USD reacts to evolving trade headlines and tech-driven optimism.

Join Our FREE Forex Workshop!

At GME Academy, we help traders understand how speeches like Bessent’s move the market — from tariffs to tech to interest rates. Learn how to interpret economic news, identify currency trends, and trade with confidence.

Join our FREE Forex workshop today and turn global headlines into your next trading advantage!