The Fed Chair Sweepstakes: Trump’s Comments Send Markets into a Tailspin

In the high-stakes world of global finance, few events carry as much weight as the appointment of the Federal Reserve Chair.

The Great Economic Tug-of-War: Trump Challenges the Fed as Oil Prices Slump

In a high-stakes week for the American economy, President Donald Trump has reignited his war of words with the Federal Reserve, calling for "meaningful" interest rate cuts while simultaneously promising to drive energy costs into the dirt.

UK Economy on a Knife-Edge: Growth Stalls as the Inflation Fire Cools

The latest S&P Global Flash UK PMI data for November 2025 presents a nuanced and challenging picture for the UK Economy and the Pound Sterling (GBP). While the headline figures confirm a sharp slowdown in private sector activity, a key bright spot emerged: the pace of output price inflation is easing, fueling speculation about the next move from the Bank of England (BoE).

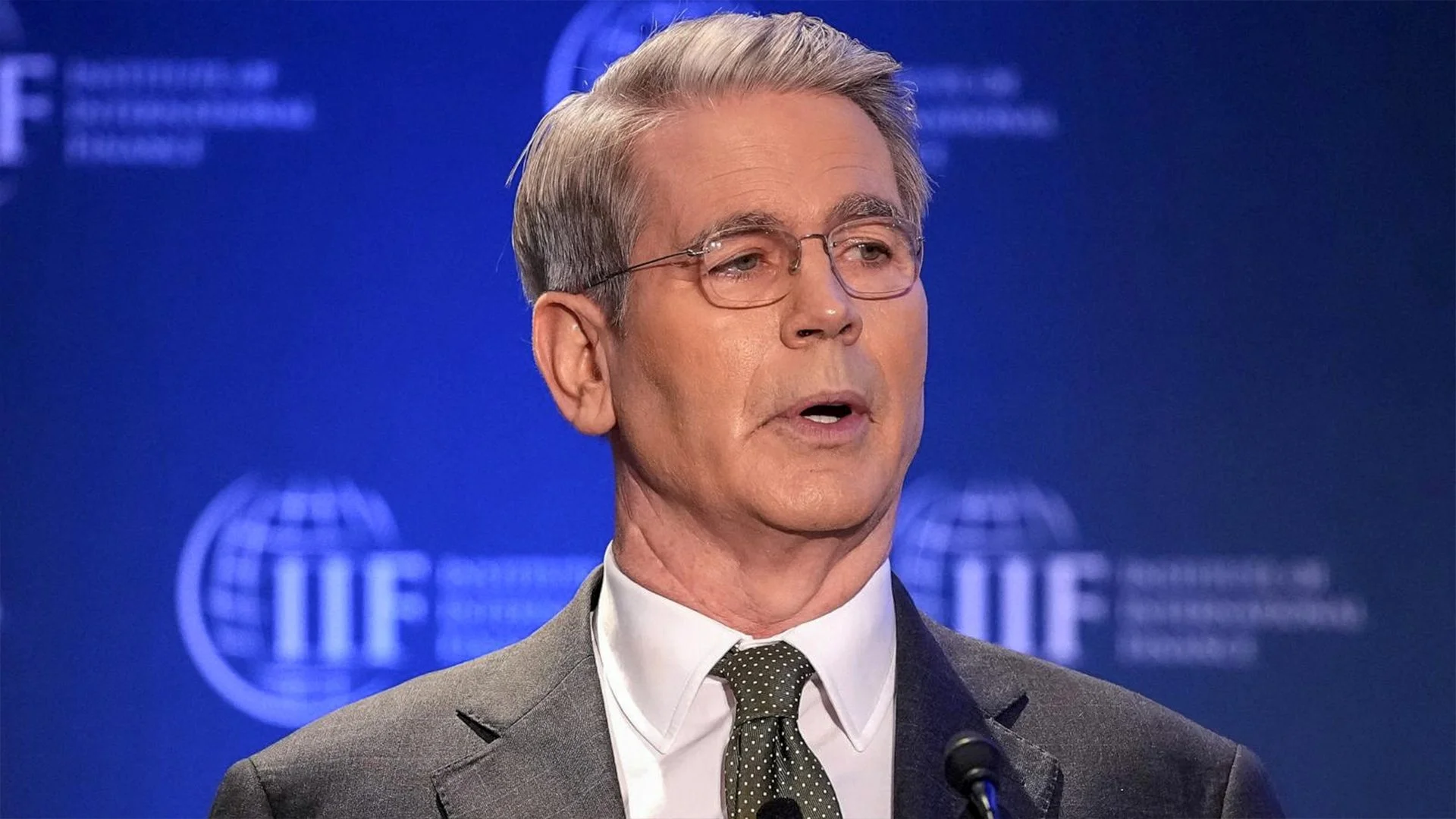

Boston Fed Highlights Economic Outlook, Monetary Policy, and Banking Innovation

In a recent address at the Boston Fed’s 24th Annual Regional and Community Bankers Conference, a Federal Reserve official shared key insights into the U.S. economy, monetary policy, and trends in regional banking. These perspectives are especially important for Forex traders, as shifts in interest rates, inflation, and banking dynamics directly influence currency movements and trading opportunities.

Bessent Dismisses “Tariffs as a Tax” Narrative — Says AI Could Drive U.S. Job Boom Amid Falling Mortgage Rates

In a recent MSNBC interview, U.S. Treasury Secretary Bessent struck an optimistic tone about the American economy, dismissing fears that tariffs automatically translate into higher consumer costs and highlighting what he called a “gigantic drop in mortgage rates.”

ADP’s Job Data Sends Mixed Signals — Is the U.S. Labor Market Losing Its Momentum?

The ADP employment data, long considered a preview of the official U.S. jobs report, is quickly becoming a market mover — and this week’s update left traders puzzled.

Private Sector Jobs Are Slowing – What This Means for Forex Traders

The private sector is the engine of most economies—it drives job creation, spending, and growth. But recent reports show that hiring is slowing down, with businesses adding fewer jobs than before.