US Core CPI Holds at 3.0%: Is the Dollar Gearing Up for Its Next Big Move?

After being delayed by nine days due to the U.S. government shutdown, the Bureau of Labor Statistics (BLS) finally released the Consumer Price Index (CPI) data for September — and it didn’t disappoint traders looking for clues about the next move of the U.S. Dollar (USD).

UK Private Sector Shows Signs of Life — What It Means for Forex Traders

The UK's private sector edged back toward growth in October, according to the latest S&P Global “Flash” composite PMI data. The headline index climbed to 51.1 — up from 50.1 in September and comfortably above the 50.0 threshold that separates contraction from expansion.

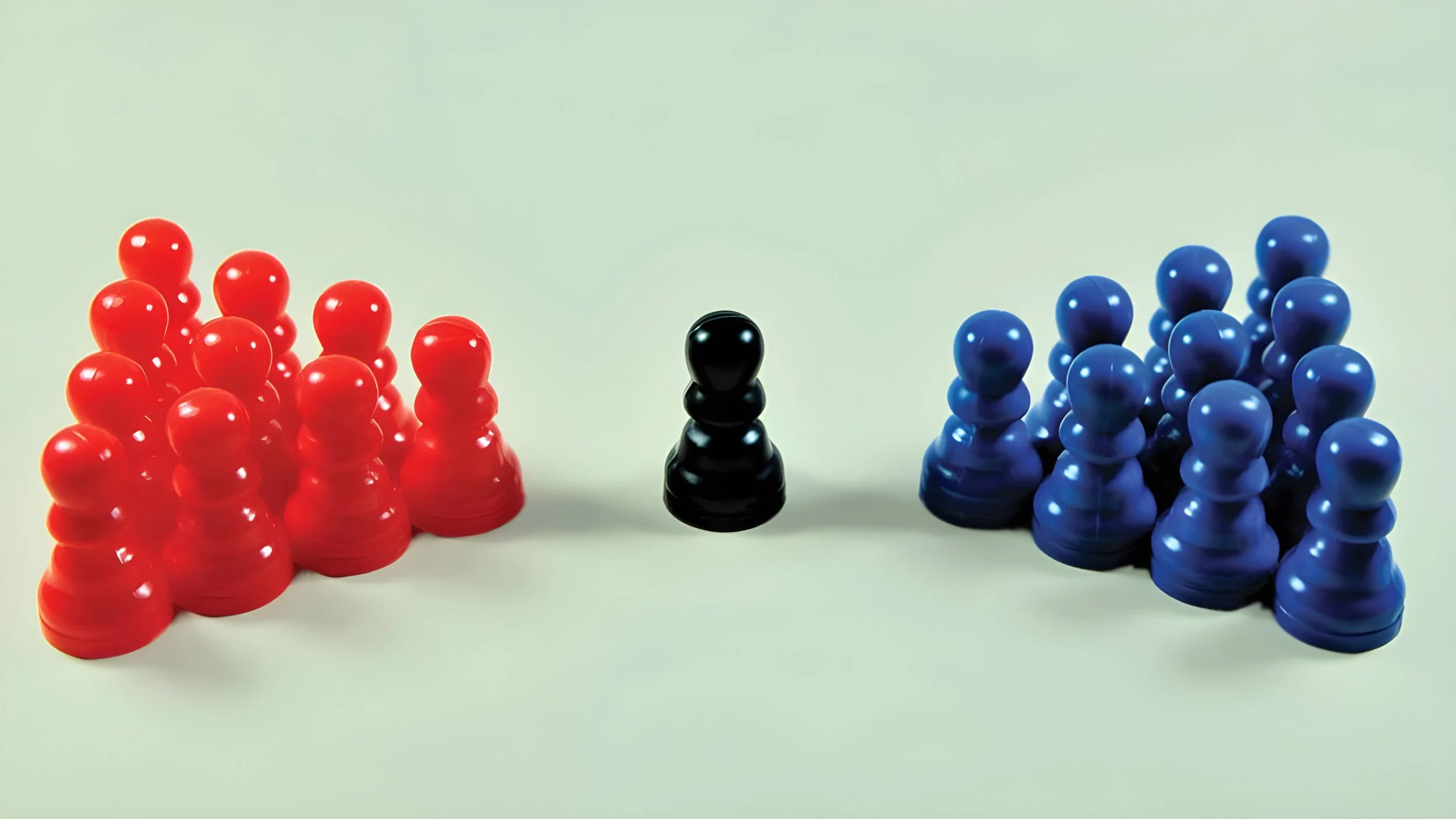

Breaking News: U.S. Ends Trade Talks with Canada – What Forex Traders Need to Know

In a dramatic announcement, President Donald Trump has officially terminated all trade negotiations with Canada following a controversial advertisement released by the Canadian government. The ad, which cost $75 million, falsely depicted former President Ronald Reagan criticizing tariffs—a move the Ronald Reagan Presidential Foundation has called “fraudulent.”

RBA Governor Michele Bullock’s Fireside Chat: What Her Words Reveal About Australia’s Economic Direction

When the Reserve Bank of Australia (RBA) Governor speaks, global traders listen — and this week’s fireside chat at the Nomura Research Forum in Washington, D.C. was no exception. Michele Bullock, the RBA’s first female Governor, offered candid insights into Australia’s economy, labor market, and inflation — giving Forex traders key clues about where the Australian Dollar (AUD) might be heading next.

U.S. Consumer Inflation Expectations in Focus: Will September Data Move the Dollar?

On September 12, 2025, markets will turn their attention to the University of Michigan (UoM) Consumer Inflation Expectations report, one of the earliest indicators of how households expect prices to change over the next 12 months. Released monthly, this survey provides critical insight into potential inflation trends, which can influence consumer behavior, wage negotiations, and Federal Reserve policy decisions.

U.S. Consumer Sentiment in Focus: Will Confidence Boost the Dollar on September 12?

On September 12, 2025, traders will turn their attention to the University of Michigan (UoM) Consumer Sentiment Index, one of the most closely watched surveys of household confidence in the United States. Released monthly, this index provides a forward-looking gauge of consumer behavior, which accounts for more than two-thirds of U.S. economic activity

U.S. Unemployment Rate Holds Steady at 4.2 Percent in August

The Bureau of Labor Statistics released its latest unemployment figures in September, showing that the U.S. unemployment rate held steady at 4.2% in August, matching market forecasts. While the figure came in exactly as expected, it did inch higher than July’s 4.1%, hinting at early signs of labor market cooling.

U.S. Employment Costs Rise Slightly in July at 0.3 Percent

On August 1, 2025, the Bureau of Labor Statistics released its Employment Cost Index (ECI) report, showing that labor costs rose 0.3% in July. This matched market forecasts of 0.3% and edged slightly above the previous month’s 0.2%.

U.S. Services PMI Surges: Can the Dollar Keep Its Edge in Forex?

The U.S. services sector just gave traders something to think about. The Institute for Supply Management (ISM) reported that its Services PMI climbed to 52.0 in August, the highest since February.

Jobless Claims Tick Higher: Will the U.S. Dollar Lose Steam in Forex?

The U.S. labor market just flashed a yellow light. The latest Department of Labor report showed 237,000 Americans filed for unemployment benefits last week, an increase of 8,000 from the week before.

Reading the Jobs Report Like a Fed Insider: Lessons from Waller

Every month, the U.S. Jobs Report lands like a market earthquake. Payrolls rise or fall, unemployment ticks up or down, and wages either cool or heat up. For the average citizen, it’s a snapshot of the labor market. But for the Federal Reserve, it’s one of the most important signals guiding monetary policy.

Understanding Neutral Policy: What Waller Means by Moving Interest Rates Toward Neutral

Federal Reserve Governor Christopher Waller recently signaled that U.S. monetary policy is moving toward a neutral stance. But what does that really mean, and why should Forex traders—even beginners—pay attention?

How Tokyo’s Consumer Prices Could Affect the Yen and Your Trades

Tomorrow, the Statistics Bureau of Japan will release the Tokyo Consumer Price Index (CPI) excluding fresh food — a key measure of monthly consumer price changes in Japan’s largest city. For Forex traders, this report is like taking an early “temperature reading” of inflation: it gives clues about future Bank of Japan (BoJ) policy and the strength of the Japanese yen (JPY).

Pending Home Sales Report Today: Why It Matters for You and the US Dollar

The National Association of Realtors (NAR) is set to release its Pending Home Sales Index for July today—August 28, 2025—at 10 a.m. ET. This closely watched report offers one of the clearest forward-looking signals of the U.S. housing market's momentum, delivering important clues for Forex trading, particularly in currency pairs tied to the U.S. dollar.