Understanding Neutral Policy: What Waller Means by Moving Interest Rates Toward Neutral

What’s Happening Today

Federal Reserve Governor Christopher Waller recently signaled that U.S. monetary policy is moving toward a neutral stance. But what does that really mean, and why should Forex traders—even beginners—pay attention?

Neutral policy is the point where interest rates neither stimulate nor restrict economic growth. Right now, Waller says the federal funds rate is moderately restrictive, sitting roughly 1.25–1.5 percentage points above neutral (Federal Reserve Speech). Moving toward neutral helps support the labor market while keeping inflation near the Fed’s 2% target.

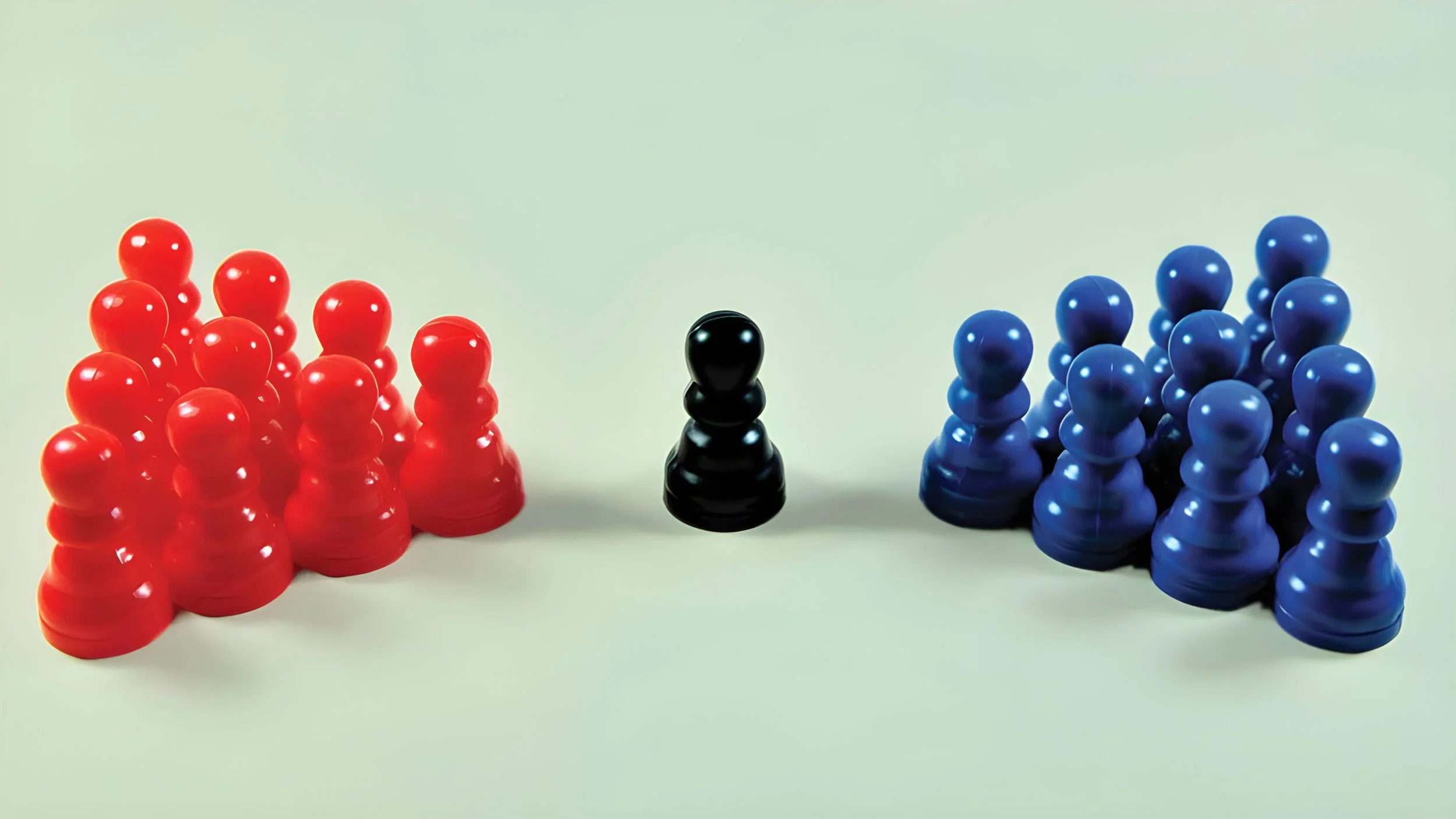

Think of it as the Fed walking a tightrope: keeping the economy balanced—not too hot, not too cold.

Neutral Policy Made Simple

At its core, neutral policy is all about balance:

Rates above neutral → borrowing costs rise, slowing spending and business growth.

Rates below neutral → borrowing is cheap, potentially overheating the economy.

Waller’s approach is gradual: he backed a 25-basis-point cut in July and signaled another in September, aiming to stabilize employment without fueling excessive inflation.

How Currencies React

Interest rate changes directly affect currency strength. Here’s the practical side for Forex traders:

USD/CAD: A Fed cut could weaken the USD vs. the Canadian Dollar.

EUR/USD: Rate cuts may support the Euro against the Dollar.

GBP/JPY: Cross-economy pairs adjust as traders react to global expectations.

Think of your wallet as a currency pair. When U.S. interest rates drop, holding USD is like earning less “interest” on your cash—so traders may prefer currencies with better returns.

For Forex Trading for Beginners, this connection is the foundation of predicting short- and long-term trends.

Why This Matters for You

Neutral policy isn’t just financial jargon—it affects everyday life:

Loans: mortgages, car loans, and credit cards could become cheaper.

Investments: stock and bond markets react to interest rate changes (Investopedia – How Rates Affect Stocks).

Prices: a stronger or weaker USD impacts imports, exports, and the cost of daily goods.

Even if you don’t trade, the Fed’s decisions ripple into your wallet and spending power.

Reading the Signals Like a Trader

Traders monitor several indicators to understand Fed moves:

Labor market trends: Waller highlighted slowing private-sector job growth (Bureau of Labor Statistics).

Inflation readings: PCE inflation is slightly elevated due to tariffs, but underlying inflation is near 2%.

Forward guidance: Waller signaled a 25-basis-point cut in September, with additional cuts possible depending on incoming data.

Keeping an eye on these indicators helps anticipate USD trends and Forex pair movements.

What Could Happen Next

If the Fed successfully moves toward neutral:

Employment may stabilize, avoiding a sharp slowdown.

Inflation could stay near the 2% target without overheating.

The USD could weaken moderately, creating opportunities in pairs like USD/CAD, EUR/USD, and GBP/JPY.

Why Ordinary Citizens Should Care

Neutral policy doesn’t only matter for traders:

Loans for big purchases could become more affordable.

Everyday goods may see more stable prices.

Retirement & investments gain more predictability.

By understanding Waller’s message, you can connect central bank moves to real-life decisions—whether in trading, spending, or saving.

Final Takeaway

Christopher Waller’s call to move interest rates toward neutral is more than a policy update—it’s a signal that the U.S. economy is entering a balancing act between growth and stability.

Whether you’re just starting with Forex Trading for Beginners or expanding your skills with Global Markets Eruditio, recognizing the importance of neutral policy gives you an edge in interpreting economic news and making smarter financial decisions.

The Fed is walking the tightrope—will your strategy keep its balance?