The Pivot Point: BSP Signals Easing Cycle Is Nearing the Finish Line

The Bangko Sentral ng Pilipinas (BSP) has officially signaled that its cycle of monetary easing—intended to spur the economy through lower borrowing costs—is approaching its end. As inflation returns to the target band and growth remains lackluster, the central bank’s messaging has shifted from aggressive support to cautious "risk management."

At the GME Academy, we view this pivot as a critical juncture for USD/PHP traders. The era of "cheap money" in the Philippines is plateauing, which creates a new set of dynamics for the Peso and the local stock market as we head into the first policy meeting of 2026.

1. The Inflation Rebound: Breaking the 10-Month Streak

For nearly a year, inflation in the Philippines was exceptionally benign, staying below the BSP's 2% to 4% target range. That streak ended in January 2026.

January Print: Headline inflation quickened to 2.0%, up from 1.8% in December.

The Target Band: While 2.0% is only the bottom edge of the target, the upward trajectory gives the Monetary Board a reason to pause.

Driver: Analysts point to housing and utilities as the primary push factors, ending the 10-month period of "sub-2%" readings that had justified five consecutive rate cuts in 2025.

2. The Growth Dilemma: Missed Targets and Slumping Confidence

The primary reason the BSP has been "Dovish" since August 2024 is the sputtering Philippine economy.

2025 GDP Performance: The economy grew by only 4.4% for the full year 2025, significantly missing the government’s 5.5%–6.5% target.

The "Corruption Drag": Economists note that a sweeping anti-corruption drive targeting infrastructure projects (specifically flood control) inadvertently stalled government spending. This, combined with "governance concerns," has gutted business sentiment.

Governance & Trade: The BSP specifically cited "uncertainty over global trade policy" as a headwind, likely referring to shifting U.S. tariff dynamics and their impact on Philippine exports.

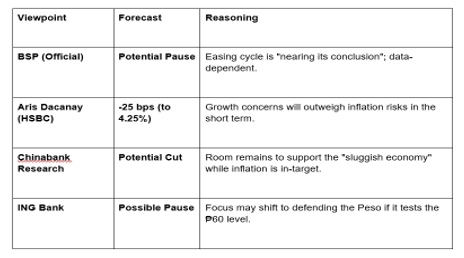

3. The Road to Feb 19: One Last Cut?

The Monetary Board will meet for its first rate-setting session of the year on February 19, 2026. The benchmark policy rate currently stands at 4.5%.

4. Forex Impact: The ₱60.00 Psychological Barrier

For Forex traders, the BSP’s "caution" is a defense mechanism for the Peso.

Narrowing Differentials: If the BSP cuts to 4.25% while the U.S. Federal Reserve holds rates steady, the "interest rate differential" would shrink to its narrowest level in decades (roughly 50 bps). This typically weakens the Peso.

The "Maybe" Cut: Governor Eli Remolona Jr. has been vocal that a February cut is not a "sure thing." This uncertainty helps prevent a speculative sell-off of the Peso.

The Peso Floor: Remolona recently stated that while ₱60:USD 1 is possible, the BSP will intervene to prevent "sharp movements," though they won't defend a specific level at all costs.

The GME Academy Analysis: "Trade the Plateau"

At Global Markets Eruditio, we advise our students to stop looking for "Rate Cut Trades" and start looking for "Yield Stability Trades." The BSP has already delivered 200 basis points of cuts; the market has largely priced this in.

How to Position Your Portfolio:

● Fixed Income: With the easing cycle ending, bond yields are likely to bottom out. This is often the last window to lock in yields before they potentially drift sideways or higher if inflation picks up in Q2.

● Equities: Look for "Defensive" stocks. If the BSP pauses, the "monetary stimulus" for the PSEi will slow down, shifting the focus back to corporate earnings and government fiscal execution.

Join our FREE Monetary Policy Deep Dive

Learn how to track the BSP Monetary Board Highlights to spot the "Hawkish" shifts before they hit the headlines. We’ll show you how to trade the USD/PHP during the Feb 19 meeting and how to adjust your strategy for a "Neutral" interest rate environment.