Cashing Out? The BSP Just Made Big Withdrawals Less of a Headache

In a move to balance tight financial security with customer convenience, the Bangko Sentral ng Pilipinas (BSP) has fine-tuned the rules for large-value cash transactions. As of February 6, 2026, banks are now instructed to apply "Enhanced Due Diligence" (EDD) more intelligently, focusing on the individual customer's overall profile rather than scrutinizing every single trip to the teller.

For Forex Trading for Beginners, this update is a crucial lesson in how national monetary authorities manage "Liquidity Risk" and "Financial Integrity"—two factors that directly influence the strength of the Philippine Peso (PHP) against major currency pairs like the USD/PHP.

1. The ₱500,000 Threshold: What Changed?

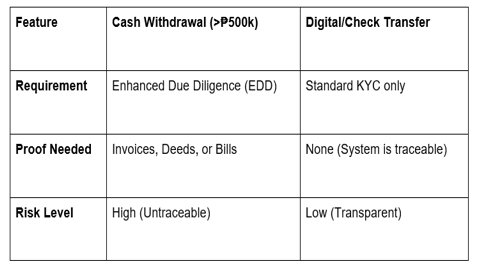

The core rule remains the same: any over-the-counter cash withdrawal exceeding ₱500,000 (or its US Dollar equivalent) triggers a closer look from the bank. However, the new memorandum signed by BSP Governor Eli Remolona Jr. clarifies the execution:

Per-Customer, Not Per-Transaction: Banks will now look at a customer’s total activity. If your business regularly handles large sums, a ₱500k withdrawal may be seen as "normal," reducing unnecessary delays.

Documentation Made Simple: If you have a legitimate reason—like paying a hospital bill or a deed of sale for a vehicle—you only need to show that specific proof.

Traceable is Better: The BSP explicitly stated that digital transfers (InstaPay, PESONet) or checks do not require this extra documentation.

2. Why the Crackdown? The "Envelope" Economy vs. Corruption

This regulatory tweak isn't just about paperwork; it's a response to a massive national scandal. Investigators are currently probing anomalous flood control projects involving ₱24.7 billion in frozen assets.

Former Finance Secretary Cesar Purisima has been a vocal advocate for these curbs, warning that the Philippines’ reliance on "envelopes and bags of banknotes" makes it too easy for corruption to hide. By forcing large transactions into the banking system, the government creates a "paper trail" that makes illegal kickbacks significantly harder to move.

3. Staying Off the "Gray List."

The high stakes of these rules involve the Financial Action Task Force (FATF). The Philippines successfully exited the FATF "Gray List" in early 2025 after years of reform. Governor Remolona warned that failing to curb money laundering tied to recent graft scandals could risk dragging the country back onto the watch list.

For Forex traders, being on the Gray List is bad news. It increases the cost of doing business and can weaken the PHP as international investors perceive higher risks. The BSP’s new "streamlined" EDD is designed to show the world that the Philippines is serious about security without strangling legitimate commerce.

The GME Academy Analysis: "Follow the Trail"

At Global Markets Eruditio, we teach our students that "Cash is King, but Digital is Data." In the modern era of Forex Trading, the shift toward digital payments is a net positive for currency stability. A transparent financial system attracts foreign direct investment (FDI), which in turn strengthens the local currency.

What This Means for You:

Business Owners: Ensure your "Customer Profile" at your bank is updated with your latest business permits to avoid flags during large withdrawals.

Forex Traders: Watch for AMLC (Anti-Money Laundering Council) reports. Large asset freezes often signal a cleaning up of the financial system, which can bolster long-term confidence in the USD/PHP.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to learn how national regulations like the "₱500k Rule" impact the daily volatility of the Peso? We’ll teach you how to read the macro-economic signals that the pros use.