The Data-Driven Sieve: Why the DA’s New Rice Task Force is a Game Changer for the Peso

In a strategic move to insulate the Philippine economy from the volatile swings of global commodity markets, Agriculture Secretary Francisco P. Tiu Laurel Jr. has ordered the immediate formation of an elite Technical Working Group (TWG) for rice importation. Announced on February 9, 2026, this specialized task force is mandated to bring "speed, discipline, and data-driven precision" to the country’s staple food supply chain.

The timing is critical. As the Philippines approaches the end of the first quarter, the government is racing to synchronize foreign arrivals with local harvest cycles. For the casual observer, this may look like simple bureaucracy; however, for those engaged in Forex Trading, the formation of this TWG is a significant fundamental signal. Rice remains the single largest component of the Philippine consumer price index (CPI). By stabilizing rice supply and prices, the Department of Agriculture (DA) is effectively providing the Bangko Sentral ng Pilipinas (BSP) with the breathing room needed to manage the Philippine Peso (PHP) without the constant threat of "supply-side" inflation shocks.

1. Moving Beyond "Firefighting": The Logic of the TWG

For years, rice importation in the Philippines has often been reactive—a "firefighting" approach where permits were issued in bulk when prices had already spiked. Secretary Tiu Laurel is pivoting the DA toward a more surgical model. The new TWG will meet weekly to analyze regional stock levels and global price trends, ensuring that imports serve as a "buffer" rather than a disruptor.

"We have to work fast. It's already February," Tiu Laurel emphasized. The goal is to finalize the May importation policy immediately to ensure that stocks are on the water and ready for distribution before the lean months. By establishing a permanent technical body, the DA is signaling to the markets that the days of speculative "ad hoc" approvals are over.

2. The "No Data, No Entry" Policy: Transparency as a Weapon

One of the most aggressive pillars of the new TWG is the mandate for radical transparency. Under the new rules, private importers and warehouse owners must provide real-time data on their current stock levels. The Secretary was blunt: "No data, no import participation."

This is a direct strike against the practice of "hoarding," where stocks are intentionally withheld from the market to drive up retail prices. By forcing importers to disclose their inventory, the TWG can identify exactly where bottlenecks are occurring. This data-centric approach allows the government to direct imported rice to specific regional "deficits," ensuring that a surplus in Manila doesn't mask a shortage in the Visayas or Mindanao.

3. The Multi-Sectoral "Master Plan"

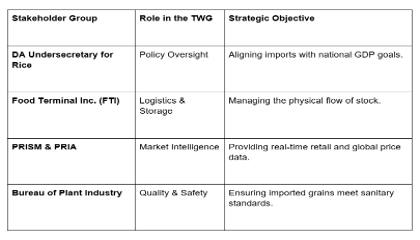

The TWG isn't just a government huddle; it is a multi-sectoral alliance. By including the Philippine Rice Industry Stakeholders Movement (PRISM) and the Philippine Rice Importers Association (PRIA), the DA is ensuring that the private sector is held accountable for the national supply target.

This collaborative structure is designed to create a "harmonized" market. When local farmers are harvesting, the TWG can throttle back imports to protect farmgate prices. Conversely, during the lean season, they can accelerate arrivals to prevent the retail "price spikes" that often weaken consumer sentiment.

4. Forex Implications: Why the USD/PHP Cares About Rice

For students of Forex Trading for Beginners, the connection between a rice task force and a currency pair might seem distant, but it is actually direct. In the Philippines, high food prices lead to high inflation. High inflation forces the BSP to keep interest rates high, which can sometimes "choke" economic growth despite making the currency more attractive for "carry trades."

When the DA stabilizes rice, it creates predictability. A stable inflation outlook allows the Philippine Peso to trade based on broader economic strengths rather than being dragged down by the cost of dinner. For the USD/PHP pair, a successful TWG rollout acts as a "soft floor" for the Peso, as it reduces the likelihood of the sudden capital outflows that often follow inflationary surprises.

The GME Academy Analysis: "Trade the Transparency"

At Global Markets Eruditio, we analyze the "real economy" to predict "market movements." The formation of this TWG is a bullish signal for the Philippine macro-economy. It suggests that the government is finally utilizing big data to manage its most sensitive commodity.

The Strategy for 2026:

If the TWG successfully manages the May import cycle without a spike in the CPI, we expect the BSP to maintain a "neutral to dovish" stance, which is generally positive for the local equity markets (PSEi). As a trader, keep your eyes on the monthly inflation prints; if "Food and Non-Alcoholic Beverages" (the category containing rice) remains stable, it’s a green light for Peso-denominated assets.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready to learn how agricultural policy in the Philippines can create high-probability trading setups in the Forex market? We’ll show you how to link government data with technical charts to find your edge.