Fueling the Future: How the PH-UAE Oil Partnership Rewrites the Economic Playbook

In the fast-paced world of global trade, energy security isn't just about keeping the lights on—it's about stabilizing the heartbeat of the national economy. A major development is unfolding as the Abu Dhabi National Oil Company (Adnoc) enters advanced talks to secure a long-term oil supply for the Philippines.

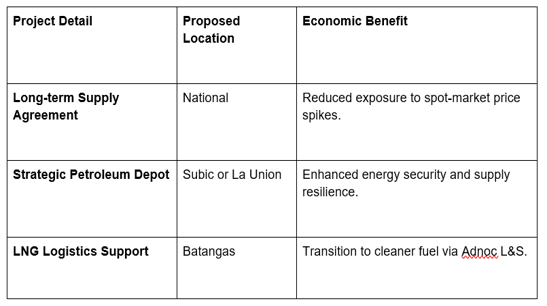

This isn't a mere transaction; it is a strategic alignment. Beyond just selling crude, Adnoc is exploring the establishment of a strategic petroleum depot in Subic or La Union. At Global Markets Eruditio, we analyze these developments through the lens of market impact. For anyone interested in Forex trading, this news is a textbook example of how "real-world" infrastructure deals can influence currency strength and national resilience.

More Than Just Oil: The Strategic Petroleum Depot

The proposal to build a petroleum storage facility is a potential game-changer for the Philippines' energy resilience. Currently, the country is highly susceptible to price shocks whenever there is volatility in the US Dollar (USD) or global supply chains.

A strategic depot acts as a shock absorber. By stockpiling reserves, the Philippines can mitigate the immediate impact of global oil price spikes. In Forex trading for beginners, we often discuss how a rising trade deficit—caused by expensive oil imports—can weigh down the Philippine Peso (PHP). A domestic storage facility could stabilize these outflows, providing a psychological and fiscal floor for the local currency.

The CEPA Catalyst: Breaking New Ground

These talks didn't happen in a vacuum. They are the first fruits of the recently finalized Comprehensive Economic Partnership Agreement (CEPA) between the Philippines and the UAE. This marks Manila’s very first free trade pact with a Middle Eastern nation.

From a Forex perspective, this agreement simplifies the flow of capital and commodities.

Aggregated Supply Contracts: Moving away from "spot" tenders toward permanent contracts provides a predictable demand for the US Dollar at fixed intervals, rather than erratic, panicked buying.

100% Foreign Ownership: Under the Downstream Oil Industry Deregulation Act, firms like Adnoc can own 100% of their refining and distribution arms in the PH. This encourages massive Foreign Direct Investment (FDI), which is traditionally a "bullish" (positive) signal for the host country’s economy.

Market Outlook: USD, CAD, and the Energy Sector

While the deal focuses on the UAE, the ripples will be felt across major currency pairs.

USD Impact: Since oil is globally priced in US Dollars, a stable, long-term supply agreement helps the Philippine government plan its dollar reserves more efficiently.

CAD Correlation: For traders watching the Canadian Dollar (CAD)—a major "petrocurrency"—global supply shifts like this often dictate broader sentiment in the energy markets. If the Philippines secures its own supply lines, it becomes less reactive to the global volatility that often drives pairs like USD/CAD.

Why This Matters for Your Trading Journey

At GME Academy, we believe that the best traders are those who see the "big picture." The Adnoc-Philippines partnership is a prime example of how geopolitical diplomacy directly affects the charts you see every day. When a country secures its energy future, it builds the foundation for a stronger, more stable currency.

Understanding the relationship between energy, trade agreements, and Forex is what separates a gambler from a professional. This isn't just news; it's a map of where the market is headed.

Are You Ready to Decode the Markets?

The world of Forex trading is constantly moving, driven by deals like the PH-UAE CEPA and the fluctuating power of the US Dollar. If you want to learn how to turn these headlines into actionable trading strategies, we have a seat for you.

Join our FREE Forex Workshop today! At Global Markets Eruditio, we break down complex global events into simple, tradable insights. Learn how to manage your risk, understand the impact of global trade, and master the major currency pairs with confidence.