The Breaking Point: Philippine Peso Hits New Historic Low Against the US Dollar

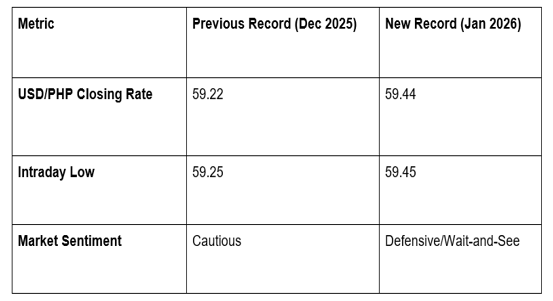

On January 14, 2026, the Philippine financial landscape shifted as the local currency slumped to its weakest level in history. Capping a volatile week, the Philippine Peso (PHP) closed at an all-time low of 59.44 against the US Dollar (USD), breaching the previous record of 59.355 set just days earlier.

For the Filipino community and global investors alike, this isn't just a number on a screen; it represents a significant economic crossroads. At Global Markets Eruditio, we believe that understanding the "why" behind these market shifts is the first step toward navigating them successfully. While a record-breaking drop can be alarming, it also serves as a masterclass in how global macroeconomics impacts local pockets.

The Perfect Storm: Why is the Peso Sinking?

The current weakness of the Peso isn't caused by a single event, but rather a "perfect storm" of international and domestic pressures. In Forex trading, we often look at the "Interest Rate Differential"—the gap between the interest rates of two countries.

The Rebounding Greenback: The US Dollar has found renewed strength as the Federal Reserve maintains a "higher-for-longer" stance on interest rates. This makes the USD more attractive to investors looking for safe, high-yielding assets.

The Trade Deficit: The Philippines remains a net importer, especially of crude oil and rice. As the prices of these essential commodities fluctuate, the demand for dollars to pay for them increases, putting further downward pressure on the Peso.

Geopolitical and Local Sentiment: Rising geopolitical risks abroad and recent domestic fiscal concerns have led investors to become defensive, often favoring safe-haven currencies over emerging market units like the PHP.

Winners, Losers, and the Ripple Effect

In Forex trading for beginners, one of the first lessons is that a currency's movement is a double-edged sword. There is rarely a "bad" move in the market—only different impacts depending on your position.

The Beneficiaries:

OFW Families: Overseas Filipino Workers sending home US Dollars or Canadian Dollars (CAD) see their remittances stretch further when converted into Pesos.

Exporters: Local businesses selling goods abroad become more price-competitive in the global market.

The Challenges:

Import Costs: Everything from fuel to electronics becomes more expensive, which can reignite inflation.

Foreign Debt: The government and private firms with dollar-denominated debt now require more Pesos to pay back their obligations, potentially straining the national budget.

Navigating Volatility with GME Academy

At GME Academy, we teach our students that market volatility is where opportunity lives—if you have the discipline to handle it. Whether you are watching the EUR/USD for global trends or the USD/PHP for local impact, the principles of risk management remain the same.

The Bangko Sentral ng Pilipinas (BSP) has signaled it will allow market forces to determine the exchange rate, intervening only to prevent "excessive swings." This means the era of a "cheap" dollar may be behind us for a while. For the proactive trader, this is the time to refine strategies that account for a strong US Dollar environment.

Take Control of Your Financial Future

A weakening currency can feel like a loss of control, but it doesn't have to be. By learning how the Forex market operates, you can position yourself to benefit from these global shifts rather than being a victim of them.

Don't just watch the news—learn to trade it. We invite you to join our FREE Forex Workshop, where we will break down the current state of the Peso and show you how to trade major currency pairs with confidence. From understanding the USD to mastering technical analysis, we give you the tools to thrive in any economy.