The Price of Secrecy: Malacañang Retains P4.5 Billion in “Secret Funds” for 2026

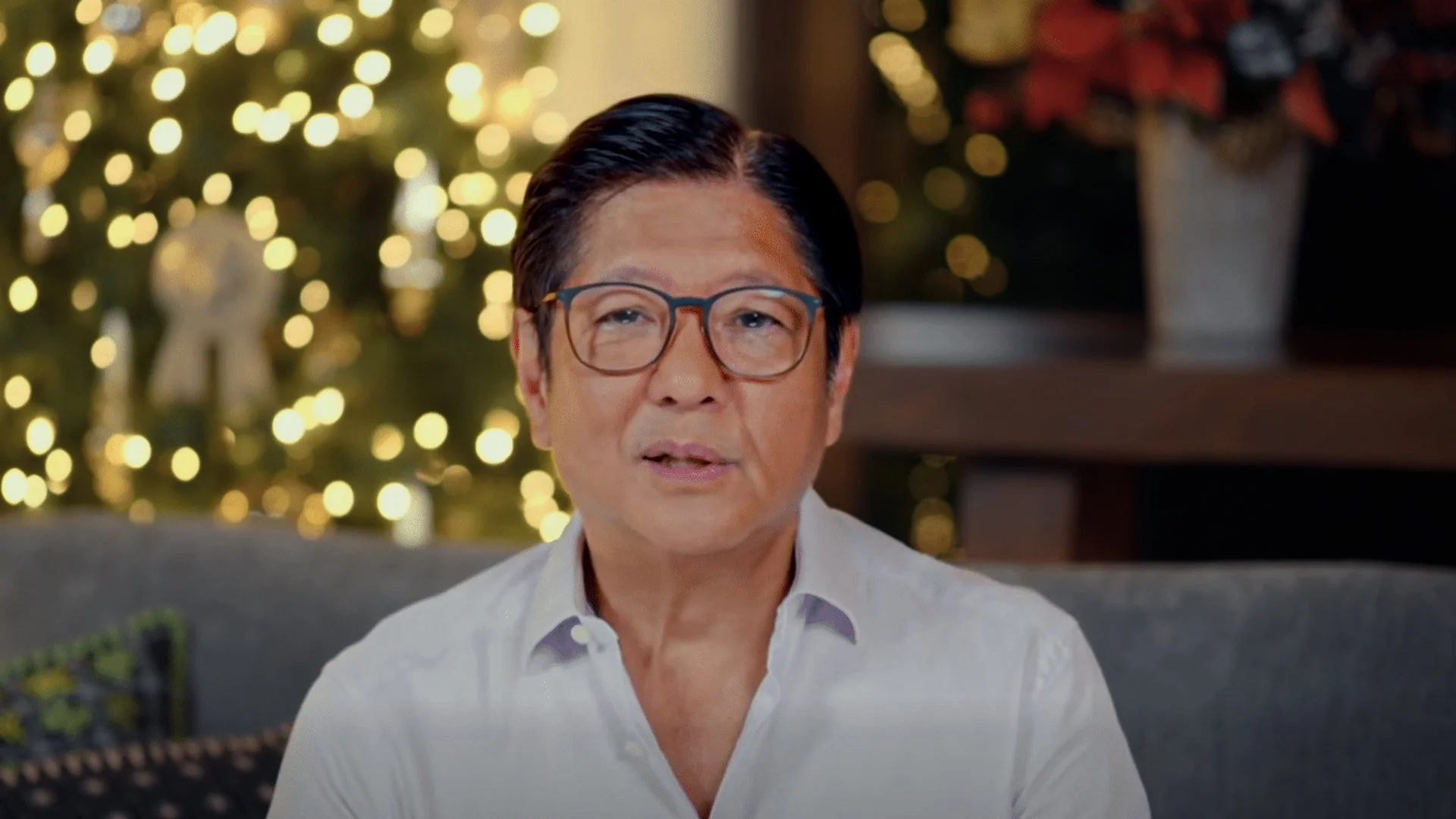

As President Ferdinand "Bongbong" Marcos Jr. officially signed the ₱6.793 trillion National Budget for 2026 into law on January 5, one figure has reignited a fierce national debate: the ₱4.5 billion allocated to the Office of the President (OP) for Confidential and Intelligence Funds (CIF).

Often referred to as "secret funds" due to their exemption from standard public auditing, these allocations have become a flashpoint for critics who argue for greater transparency in a year marred by high-profile corruption scandals. At Global Markets Eruditio (GME Academy), we analyze these fiscal decisions not just as political news, but as indicators of "Governance Risk" that can influence foreign investor confidence and the long-term stability of the Philippine Peso (PHP).

Breaking Down the 2026 CIF Pot

While the total CIF across all government agencies saw a slight dip this year—falling to ₱11.8 billion from last year’s ₱12.1 billion—the Office of the President has successfully retained the "lion's share" of the budget.

Office of the President (OP): ₱4.5 Billion (38% of the total CIF).

Comparison to Intelligence Agencies: The OP’s secret fund is three times larger than that of the National Intelligence Coordinating Agency (NICA), which is allocated only ₱1.47 billion.

The Oversight Gap: In contrast, the agencies tasked with fighting corruption—the Commission on Audit (COA) and the Office of the Ombudsman—received a mere ₱10 million and ₱51.47 million in CIF, respectively.

The Palace Defense: "Commander-in-Chief" Mandate

Malacañang officials were quick to defend the multibillion-peso allocation. Executive Secretary Ralph Recto and Budget Secretary Rolando Toledo emphasized that these funds are essential for the President’s role as the "chief architect of national security and foreign policy."

The administration’s defense rests on three pillars:

National Security: Addressing internal and external threats that require covert surveillance.

Existing Safeguards: The Palace maintains that the funds are "transparent" because they are reported directly to the Senate President, the Speaker of the House, and the COA under a 2015 Joint Circular.

Veto of Unprogrammed Funds: Marcos sought to balance the optics by vetoing ₱92.5 billion in "unprogrammed appropriations" (extra-budgetary items added by Congress), claiming a commitment to fiscal discipline.

Why Traders and Investors Care

In the world of Forex trading for beginners, we often talk about "Political Risk." When a government allocates massive amounts of money to opaque categories, it creates a "Transparency Discount."

Market Sentiment: High discretionary spending without granular auditing can lead to concerns about "fiscal leakage." If international credit rating agencies perceive an increase in corruption risk, it could lead to a downgrade or a stagnation of the Philippines’ investment-grade status.

Peso Volatility: Corruption scandals often lead to political instability. As we have seen with the ongoing "Cabral Files" investigation, uncertainty in the executive branch can lead to capital flight, putting downward pressure on the USD/PHP exchange rate.

Budget Credibility: While the 4.3% GDP surge in the US has strengthened the Dollar, the Philippines must prove it is using its 2026 budget to drive real growth—not just political patronage—to keep the Peso competitive.

The GME Perspective: Trading Governance

At GME Academy, we teach our students to look at the "National Budget" as a company’s balance sheet. When a CEO (the President) allocates 38% of the "R&D" budget (the CIF) to their own private office rather than the specialized departments (NICA), it raises questions about operational efficiency.

For traders, the 2026 budget signing is a signal to watch for institutional reactions. If budget watchdogs or the Supreme Court challenge these allocations, expect a spike in market volatility.

Stay ahead of the news that moves the charts.

The 2026 budget is a roadmap for the Philippine economy over the next twelve months. Understanding the friction between "secret funds" and "fiscal transparency" is key to predicting market sentiment.

Join our FREE Forex Workshop to learn how to incorporate "Macro-Political Analysis" into your trading plan.