The ₱0.00 Prescription: How Zero Balance Billing is Changing the LGU Landscape

For decades, the "Zero Balance" promise—the idea that a patient can enter a hospital and leave without paying a single centavo—was a luxury reserved for the few admitted to national DOH-run facilities. However, the signing of the ₱6.793 trillion 2026 National Budget has fundamentally shifted the healthcare geography of the Philippines. With a dedicated ₱1 billion allocation, the Department of Health (DOH) is finally bringing Zero Balance Billing (ZBB) to selected local government unit (LGU) hospitals.

At Global Markets Eruditio, we often discuss how domestic policy impacts the broader economy. This ₱1 billion "kickstart" is more than a health initiative; it is a strategic move to reduce out-of-pocket spending and boost the disposable income of millions of Filipinos. In the world of Forex, such fiscal expansions can influence investor sentiment toward the Philippine Peso (PHP), especially when compared to major currency pairs like the USD/PHP.

Breaking the "GL" Cycle: A New Era of Transparency

One of the most significant aspects of the 2026 ZBB rollout in LGU hospitals is the removal of political "Guarantee Letters" (GLs). Previously, patients in LGU facilities often had to seek "endorsements" from local politicians to have their bills waived—a process that was both time-consuming and prone to patronage politics.

Automatic Entitlement: Under the new DOH guidelines, any Filipino admitted to a basic or ward-type accommodation in a participating LGU hospital is automatically eligible.

Streamlined Funding: The ₱1 billion fund will be released directly to the hospitals. This ensures that the hospital has the liquidity to cover medicines, laboratory tests, and professional fees upfront.

Role of PhilHealth: The ZBB policy works in tandem with the Philippine Health Insurance Corporation. PhilHealth pays its share first, and the DOH fund "tops up" the remainder to ensure the patient's bill hits zero.

The Merit-Based Rollout: Which LGUs Get Priority?

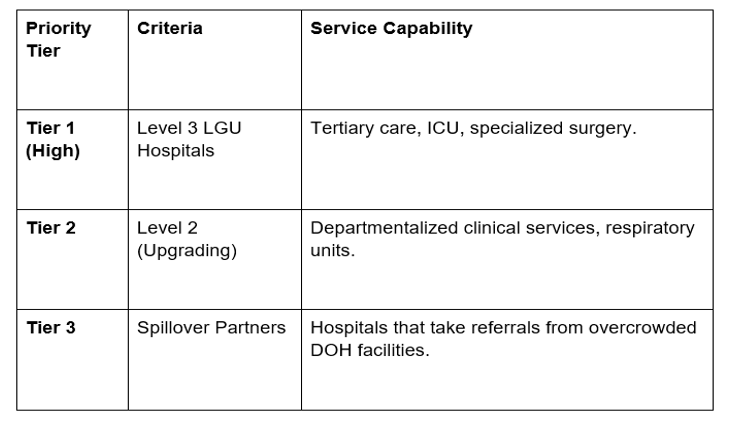

Because ₱1 billion is a starting figure (health advocates estimate that a full nationwide LGU rollout would require nearly ₱147 billion), the DOH is being selective. Not every LGU hospital will qualify on Day 1.

The DOH has announced that Level 3 LGU Hospitals will be prioritized. These are facilities that operate similarly to national specialty centers, equipped with Intensive Care Units (ICUs), surgical theaters, and residency programs. By rewarding high-performing LGU hospitals with ZBB funding, the DOH is effectively incentivizing local mayors and governors to upgrade their facilities to meet higher national standards.

Economic Implications: Health as a Market Driver

For those engaged in Forex trading for beginners, understanding "Macro-Economic Resilience" is key. When a government successfully implements a social safety net like ZBB, it reduces the "precautionary savings" of the middle and lower class. Instead of hoarding cash for a medical emergency, families can spend that capital back into the economy, driving retail and manufacturing growth.

Governance Risk: A transparent, non-political ZBB system improves the Philippines’ standing in global transparency indices. This can lead to a more stable PHP as foreign investors gain confidence in the government's fiscal management.

Human Capital: A healthier workforce is a more productive workforce. As the Philippines aims for upper-middle-income status by 2028, these health reforms are essential "structural supports" for the economy.

The GME Perspective: Trading with Eruditio

At Global Markets Eruditio (GME Academy), our mission is the "removal of ignorance" in both finance and governance. We teach our students to look beyond the headlines. While the ₱1 billion for ZBB is a positive social signal, traders must also monitor the USD/PHP exchange rate for inflationary pressures that might arise from high government spending.

If the 2026 budget leads to significant debt-to-GDP increases without a corresponding rise in productivity, the Peso could face headwinds. However, if health infrastructure leads to a more robust domestic market, the long-term outlook remains bullish.

Stop Guessing, Start Mastering the Market

Understanding how domestic laws like the 2026 GAA affect your financial future is the first step toward true independence. Don't let market volatility or complex health policies confuse you. Learn to read the underlying trends that move the world's most traded currency pairs.

Are you ready to turn economic news into a trading edge?

Join our FREE Forex workshop today and discover the strategies professional traders use to navigate the Philippine and global markets.