The Long Game: Why the Philippines is Sidestepping a US Free Trade Deal—For Now

In the fast-moving geopolitical landscape of 2026, "Free Trade" is often the ultimate goal for emerging economies. However, in a surprising turn of diplomatic strategy, the Philippines is currently saying "not yet" to a bilateral Free Trade Agreement (FTA) with the United States.

Philippine Ambassador to the US, Jose Manuel Romualdez, confirmed on February 10, 2026, that while the Trump administration has signaled an "openness" to negotiate, Manila is prioritizing immediate tariff resolutions over a broad, long-term pact.

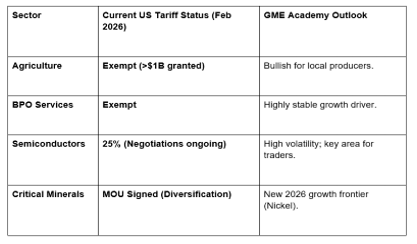

At the GME Academy, we view this as a sophisticated "Stabilization First" strategy. In a year defined by trade volatility, the Philippines is choosing to lock in specific exemptions rather than getting bogged down in years of complex FTA negotiations.

1. The "Stabilization" Strategy: Why Wait?

For decades, an FTA with the US has been a cornerstone of Philippine economic ambition. So why the hesitation now?

The Reciprocal Tariff Reality: Since August 2025, the US has imposed a 19% reciprocal tariff on most Philippine goods.

Prioritizing Wins: Ambassador Romualdez noted that the government has already successfully secured exemptions for over $1 billion worth of agricultural exports.

The "One-Thing-at-a-Time" Rule: The Philippines wants to solidify these specific tariff wins before moving into the high-stakes, multi-sector demands of a full FTA. As Romualdez put it: "We are not prepared to go into discussions... until we have more or less solidified our agreement on the tariffs."

2. The Semiconductor & BPO Shield

The most critical sectors for the Philippines in 2026 are Semiconductors and Business Process Outsourcing (BPO). These are the "Twin Pillars" of the national economy.

The Semiconductor Tension

In January 2026, President Trump issued a proclamation imposing a 25% ad valorem duty on semiconductors to address national security concerns.

The Risk: If applied broadly, these tariffs would devastate the Philippine electronics sector, which accounts for nearly 60% of total exports.

The Defense: The US Semiconductor Industry Association is currently lobbying Washington to reduce or exempt Philippine-made chips, highlighting that many of these factories are actually US-owned companies operating in Manila and Clark.

BPO: The Untouchable Sector

Despite fears of "onshoring" policies, the Philippine BPO sector remains exempt from current tariff policies.

The Logic: US corporations rely on the Philippines to maintain profitability amid rising domestic production costs. Taxing the services that help American companies save money would be counterproductive for the "America First" agenda.

3. Legislative Groundwork: Ready for the Future

While the Philippines is sidestepping the FTA today, it is not idle. Recent laws have been passed to make the country a more attractive "FTA Partner" when the time eventually comes:

Investors' Lease Act Amendments: Foreigners can now lease private land for up to 99 years (up from 50), a key demand from US investors.

CREATE MORE Act: Streamlined tax incentives and a more predictable regulatory environment for high-value manufacturing.

Liberalized Sectors: Major reforms in telecommunications, airlines, and renewable energy have removed the hurdles that historically stalled trade talks.

The GME Academy Analysis: "Tactical Patience"

At Global Markets Eruditio, we teach our students that in trading and diplomacy, timing is everything.

Trader's Takeaway for 2026:

USD/PHP Stability: The stabilization of tariff exemptions for the agricultural and BPO sectors provides a "fundamental floor" for the Philippine Peso. The news that the US is open to an FTA is a long-term PHP Bullish signal, even if talks aren't immediate.

Watch the "Chips": Any news of a reduction in the semiconductor tariff (from 25% to 19% or lower) will be a massive trigger for the local electronics industry and the PSEi.

Critical Minerals Pivot: The recent MOU on nickel processing signals that the US is looking to the Philippines to decouple its battery supply chain from China. This is a "silent" trade deal that could be more lucrative than a traditional FTA in the short term.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to learn how to trade "Geopolitical Divergence"? We’ll show you how to track Trade Exemptions and use them to predict the next big move in USD/PHP and the PSEi.