The Missing Links: Why the Philippines Needs a Whistleblower Law to Slay the Corruption Dragon

In the wake of the multi-billion peso "flood control" scandal that has rocked the Philippine government in early 2026, the call for systemic reform has moved beyond local protests to the international stage. On February 10, 2026, Kirbee Tibayan, the United Nations Office on Drugs and Crime (UNODC) country representative, issued a blunt assessment: the Philippines is fighting a modern war against corruption with an outdated legal arsenal.

At the GME Academy, we believe that transparency is the best disinfectant for any economy. For the Philippines to regain its status as an investment darling in Southeast Asia, it must address the "legislative gaps" that allow illicit funds to stay hidden.

1. The Whistleblower Paradox: Information Without Protection

Tibayan’s most urgent recommendation is the passage of a National Whistleblower Protection Act. Currently, the Philippines relies on a patchwork of agency-level policies (like those in the PCSO or PPA) rather than a unified national law.

The Reality: Most corruption cases are "inside jobs." Without a whistleblower, the public would never know about bid-rigging or ghost projects.

The Gap: Because there is no national law, an employee who reports a Cabinet official risks immediate termination, harassment, or worse.

The Solution: A national law would provide legal immunity, monetary rewards (often 1%–5% of recovered funds), and physical protection for those who speak out.

2. Breaking the Vault: Relaxing the Bank Secrecy Act

The Philippines remains one of the few countries in the world with ultra-strict bank secrecy laws that hinder prudential supervision.

● The "Gray List" Risk: BSP Governor Eli Remolona Jr. recently warned that the country risks returning to the FATF "Gray List"—a watchlist for money laundering—if it cannot prove it can trace "dirty money."

● The Legislative Push: There are currently two major bills in motion:

House Bill 6683: Focuses on investigating bank accounts of BSP-supervised firm officials.

Senate Bill 1047: A broader version that would allow the BSP to examine accounts in cases of "reasonable doubt" of fraud or bribery.

● Tibayan’s View: "The law is very tight." Relaxing it doesn't mean ending privacy; it means giving investigators a "key" to the vault when there is clear evidence of a crime.

3. Freedom of Information (FOI): Beyond the Executive

While the Philippines has had an Executive Order (EO) on FOI since 2016, it only covers the executive branch.

The Accountability Gap: The legislative and judicial branches remain largely exempt from the same level of digital transparency.

Public Procurement Transparency: Tibayan emphasized that the new Government Procurement Act is a great step, but it needs an FOI law that mandates all branches of government to disclose project data, budgets, and audit reports in real-time.

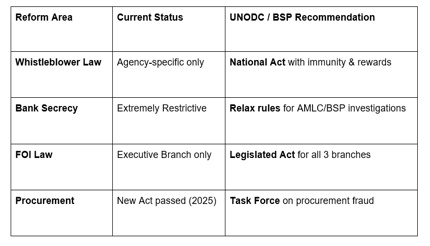

Summary of the Anti-Corruption "Toolkit" for 2026

The GME Academy Analysis: "Clean Governance is Good Economics"

At Global Markets Eruditio, we often tell our students that a country's currency is a "share" in that country's management. When corruption scandals go unpunished, the "share price" (the Peso) suffers.

Trader's Takeaway for 2026:

Institutional Risk: If the Philippines returns to the FATF Gray List, expect higher transaction costs for OFWs and a potential 100–150 basis point risk premium on Philippine bonds.

The "Transparency Rally": If the Senate passes the Bank Secrecy amendments by mid-2026, it will be a major Bullish signal for the PSEi, as it signals to foreign investors that the "flood control" era of impunity is ending.

Watch the Ombudsman: The ongoing strategic planning in Baguio City suggests that the Ombudsman is preparing for a "long game" investigation. Traders should watch for any high-profile arrests that might cause short-term market volatility but long-term structural health.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are you ready for the "2026 Regulatory Wave"? We’ll teach you how to analyze Governance Risk and how to protect your portfolio from sudden policy shifts in the Philippine market.