The Great Snap-Back: Can You Profit When Markets Overextend?

In the world of financial physics, what goes up must eventually come down—or at least return to its historical average. This is the fundamental premise of Mean Reversion Strategies.

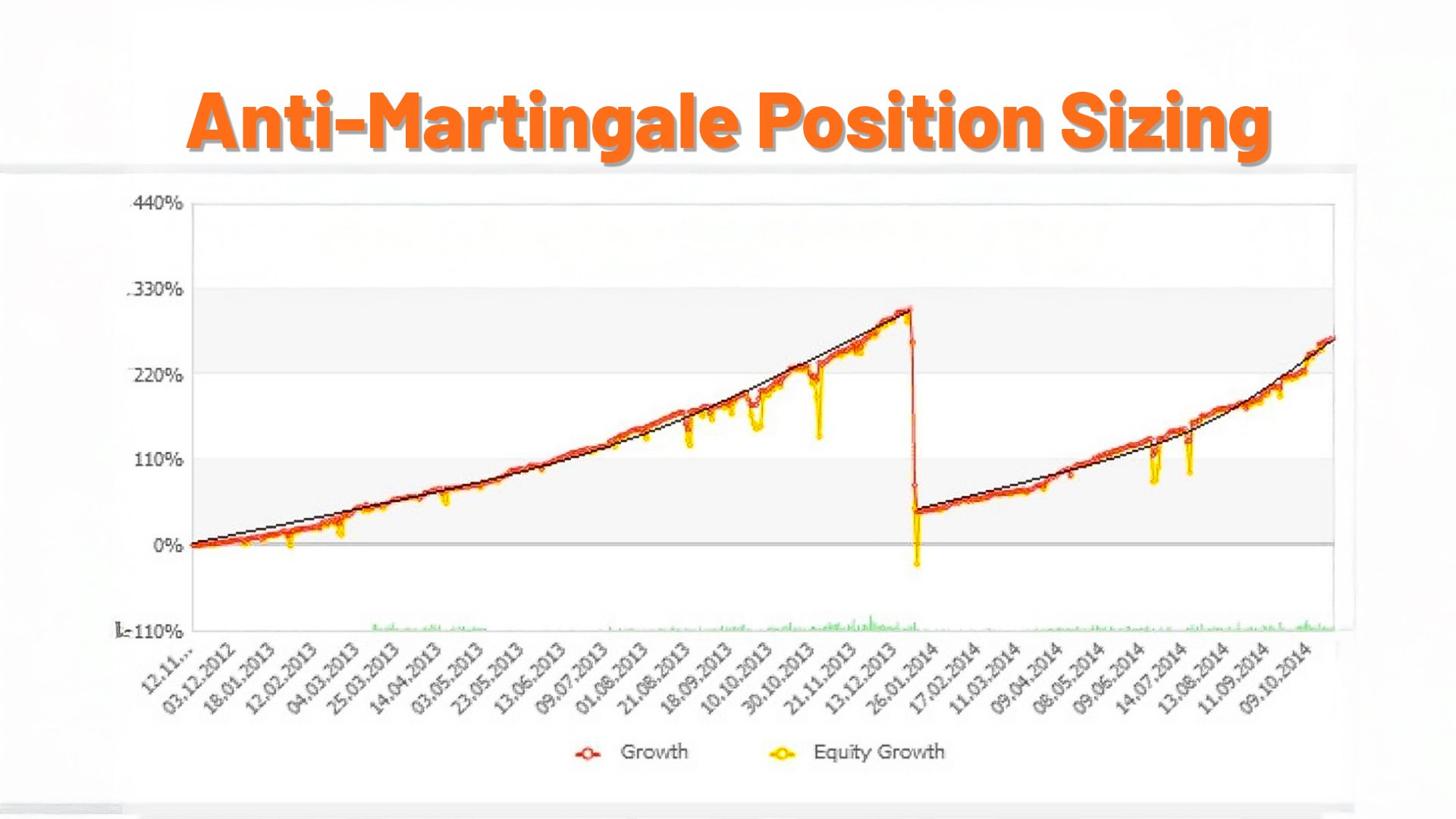

The "Hot Hand" Advantage: Can You Ride the Wave with Anti-Martingale Sizing?

In the fast-paced world of the currency markets, most traders focus intensely on where to enter a trade. Yet, seasoned professionals often whisper a different truth: your entry matters far less than your position sizing.

The Hidden Driver of Currency Strength: Understanding Interest Rate Differentials in Forex Trading

When people first enter Forex trading, they often focus on charts, indicators, and patterns. But behind every sharp move in currency pairs like EUR/USD, GBP/JPY, or USD/CAD, there’s one powerful fundamental factor — interest rate differentials.

Turning Dates into Profits: How to Read Economic Calendars and Use Them in Your Forex Strategy

In the fast-moving world of Forex trading, knowing when key economic events happen can make or break a trade. For many beginners, it’s easy to get caught up in charts and price action — but one tool often overlooked is the economic calendar. This calendar is your roadmap to understanding what drives currencies like the USD, EUR, GBP, JPY, or CAD.