The Autopsy: Analyzing Losing Trades Without Emotion

In the trading world of 2026, the difference between a professional and a gambler isn't their win rate—it’s their Autopsy Process. Losing is a statistical certainty, yet most retail traders treat a loss like a personal insult, leading to the "Revenge Trade" spiral.

The Architect’s Blueprint: How to Build Your Own Trading System

In the fast-paced markets of 2026, a "gut feeling" is no longer a viable strategy. With AI-driven algorithms and high-frequency traders dominating the tape, the retail trader’s only edge is a systematic approach.

The 4 PM Rush: Navigating the Month-End Fix (WM/Reuters)

If the "January Effect" is a seasonal breeze, the Month-End Fix is a recurring hurricane. In the Forex world, no single hour is more scrutinized than the 4 PM London Fix (officially the WM/Reuters Closing Spot Rate) on the last trading day of the month.

The $100 Trillion Shadow: Global Debt and Currency Crisis Risks

As we navigate February 2026, the global financial landscape is defined by a staggering paradox: while GDP growth remains resilient at 3.3%, global public debt is hurtling toward the $100 trillion mark.

Political Aftershocks: Elections, Referendums, and Currency Spikes

In the world of Forex, if central banks are the navigators, then elections and referendums are the unpredictable weather systems. In 2026, political risk has evolved from localized "flare-ups" into a primary source of global market volatility.

Intraday Power Shifts: The London Kill Zone & NY Reversal

In the modern Forex landscape of 2026, the "market day" isn't a continuous line—it’s a series of high-stakes power shifts. For traders at the GME Academy, the most critical tactical transition happens between the London Kill Zone and the New York Reversal.

Trend-Following vs. Mean-Reversion: Choosing Your Algorithmic Edge

In the competitive world of algorithmic trading, most strategies fall into two opposing philosophical camps: Trend-Following and Mean-Reversion.

The Pulse of the Market: Sentiment Analysis Using News and Social Data

In the financial landscape of 2026, "hard numbers" like GDP and earnings reports are no longer the only drivers of price action.

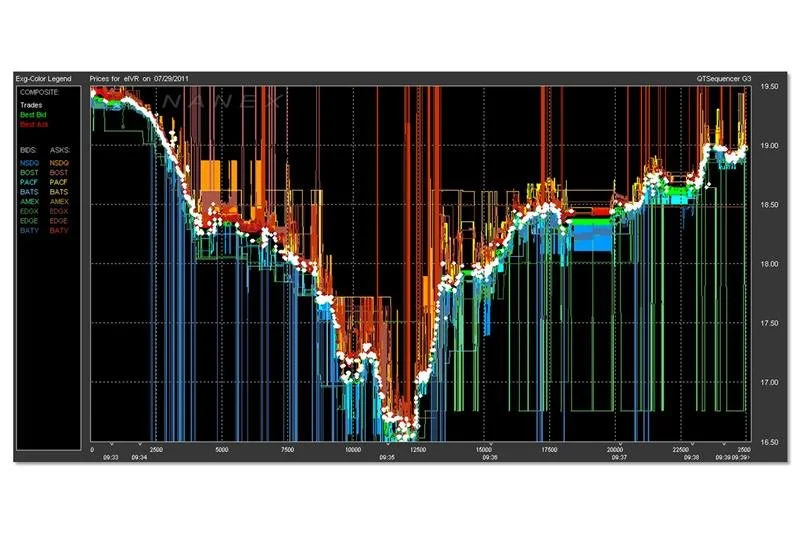

The Microsecond War: How High-Frequency Trading Shapes the Market

In the modern financial landscape of 2026, the traditional image of traders shouting on an exchange floor has been replaced by silent, air-conditioned server rooms.

Python for Backtesting: Building Your Forex Laboratory

In the world of Forex Trading, "backtesting" is the process of testing a trading strategy against historical data to see how it would have performed in the past. While platforms like TradingView or MetaTrader offer built-in testers, Python is the industry standard for 2026.

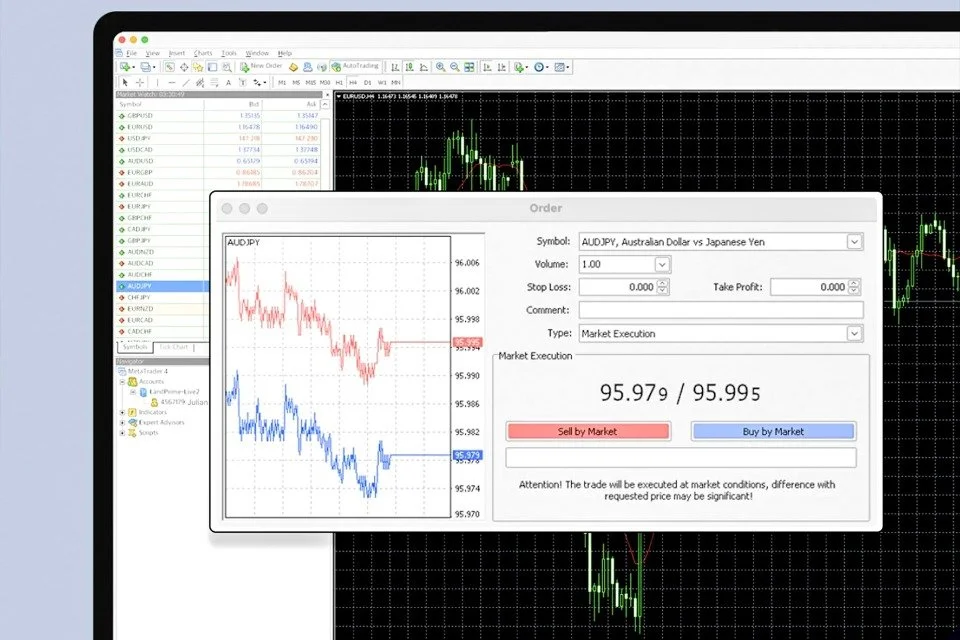

MetaTrader EAs: Pros, Cons, and the Myths of "Automated Wealth"

In the fast-paced markets of 2026, the dream of "trading while you sleep" has never been more popular. Expert Advisors (EAs)—the automated trading robots that run on MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—are the primary tools for this automation.

The Rise of the Machines: Algorithmic Trading Basics for 2026

In the modern financial landscape, the image of a trader shouting over a phone or staring intensely at six monitors is becoming a relic of the past. Today, more than 80% of U.S. equity trading volume is driven by Algorithmic Trading (also known as "Algo Trading" or "Black-Box Trading").

The Midnight Toll: Understanding Swap Fees and Overnight Charges

In the world of Forex Trading, the clock doesn't just measure time—it measures cost. While most day traders focus on the "spread" (the difference between the buy and sell price), those who hold positions past the market close encounter a different kind of fee: the Swap Fee, also known as the Overnight Charge or Rollover.

Segregated Accounts: The Invisible Shield Protecting Your Capital

In the world of Forex Trading, your biggest risk isn't just a bad trade—it’s the safety of the institution holding your money. Imagine a scenario where your broker goes bankrupt, and your trading balance is used to pay off their office rent or corporate debts.

The Silent Profit Killers: How to Master Slippage and Requotes

In the fast-paced world of Forex Trading, speed is everything. You spot a perfect setup on the EUR/USD, you hit the "Buy" button, and you expect to enter at exactly the price you see on your screen.

The Global Gold Standard: A Guide to MiFID II, FCA, and ASIC Licensing

In the fast-moving world of global finance and Forex Trading, navigating the "alphabet soup" of regulatory bodies is more than just a box-ticking exercise—it’s the difference between a secure investment and a total loss of funds.

Safe Haven vs. Wild West: Regulated vs. Unregulated Brokers

In the world of high-stakes trading, the most critical decision you make isn't which currency pair to buy, but which broker to trust with your capital.

Which Broker Model is Right for You? STP vs. ECN vs. Market Maker

In the Forex world, your broker is more than just a platform; they are your bridge to the global market. However, not all bridges are built the same. The way a broker executes your trades—and how they make their money—can significantly impact your profitability and trading experience.

The Business of Pips: How Forex Brokers Make Money

In the fast-paced world of Forex trading, brokers are often seen simply as the "gatekeepers" to the global markets. However, a broker is not just a facilitator; it is a business with sophisticated revenue models designed to profit regardless of whether the market goes up or down.

The Engines of Equity: SSS, GSIS, and Pag-IBIG in Philippine Financial Flows

In the complex machinery of the Philippine economy, three institutions act as the primary "pumps" of domestic capital: the Social Security System (SSS), the Government Service Insurance System (GSIS), and the Home Development Mutual Fund (Pag-IBIG).