The "Hot Hand" Advantage: Can You Ride the Wave with Anti-Martingale Sizing?

In the fast-paced world of the currency markets, most traders focus intensely on where to enter a trade. Yet, seasoned professionals often whisper a different truth: your entry matters far less than your position sizing. While many beginners stumble upon the infamous Martingale strategy—doubling down on losses in a desperate bid to "break even"—there is a more sophisticated, momentum-based cousin that flips the script.

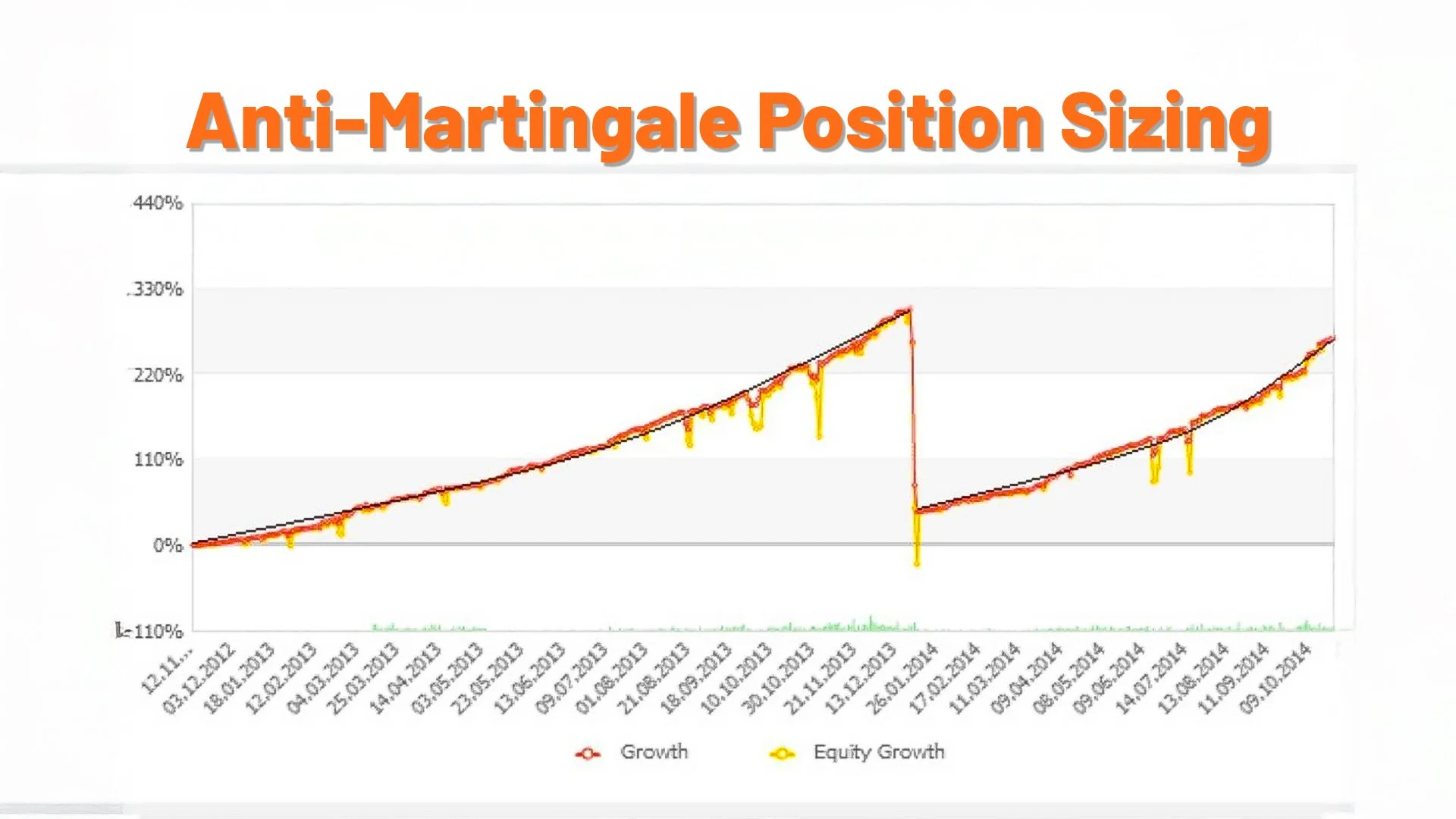

Welcome to the world of Anti-Martingale Position Sizing, a methodology designed to reward your success and protect your capital when the tides turn.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Logic of the Winner: What is Anti-Martingale?

At its core, the Anti-Martingale system is a money management strategy where you increase your trade size after a win and decrease it after a loss. It is the architectural opposite of the traditional Martingale. Instead of "chasing" losses, you are "feeding" your winning streaks.

For those engaging in Forex trading for beginners, understanding this distinction is vital. The Martingale system assumes that a loss makes a win more likely (the "gambler's fallacy"). In contrast, the Anti-Martingale system acknowledges that markets often move in trends. If you win a trade on the EUR/USD, it suggests that your analysis of the current momentum might be correct, warranting a larger follow-up stake to capitalize on that "hot hand."

Why Momentum Matters in Forex Trading

Forex markets are uniquely suited for Anti-Martingale principles because they are driven by macroeconomic trends. When the US Dollar (USD) strengthens due to a Federal Reserve interest rate hike, it doesn't usually happen in a single minute; it creates a multi-day or multi-week trend.

By using Anti-Martingale sizing, a trader might start with a base lot on a GBP/JPY trade. If that trade hits its take-profit target, the next trade's volume is increased. If the streak continues, the profits compound exponentially. However, the moment a loss occurs, the strategy dictates a return to the original, smaller base size. This ensures that a single losing trade doesn't wipe out the entire account—a common tragedy for those using "revenge trading" tactics.

Strategic Implementation: The Global Markets Eruditio Approach

To master this, one must move beyond simple "doubling." Within the curriculum of a refined GME Academy, traders are taught to use "Fixed Ratio" or "Percentage" scaling.

Consider this example on the CAD (Canadian Dollar):

Initial Trade: You risk 1% of your account on a USD/CAD short position.

The Win: The trade is successful.

The Scale-Up: For the next trade, you risk 2% of your updated account balance.

The Loss: If the second trade fails, you immediately revert to risking only 1% on the third trade.

This "aggressive in wins, conservative in losses" mentality aligns with the Global Markets Eruditio philosophy of preserving equity at all costs. It allows you to "pyramid" into a trending market, significantly boosting your ROI during high-conviction moves in currency pairs like the volatile GBP/USD.

The Psychological Edge

Perhaps the greatest benefit of Anti-Martingale sizing isn't mathematical, but psychological. Forex trading is an emotional battlefield. The Martingale system creates immense stress because the stakes get higher precisely when you are losing. Anti-Martingale does the opposite; it lowers the stakes when you are struggling, giving you the "breathing room" to recalibrate your strategy without the looming threat of an account blow-out.

Is It Right For You?

While powerful, this strategy requires discipline. It performs best in trending markets and can struggle in "choppy" or sideways markets where wins and losses alternate frequently. This is why professional education is the bridge between a "gambler" and a "trader."

If you are ready to stop guessing and start managing your capital like the institutions, it’s time to deepen your knowledge. Position sizing is just one pillar of a successful trading career.

Take the Next Step in Your Trading Journey

Mastering the math behind the markets is the only way to achieve consistent profitability. Don't leave your financial future to chance or dangerous "double-down" schemes.

Join our FREE Forex Workshop today! Learn the exact position-sizing models used by professional desk traders and discover how to navigate the global markets with confidence and precision.