The Silent Engine of the Market: Understanding the AMD Cycle

If you have ever felt like the market "waited" for you to enter a trade just to hit your stop-loss and then move in your original direction, you haven't been cursed—you’ve likely been a victim of the AMD Cycle.

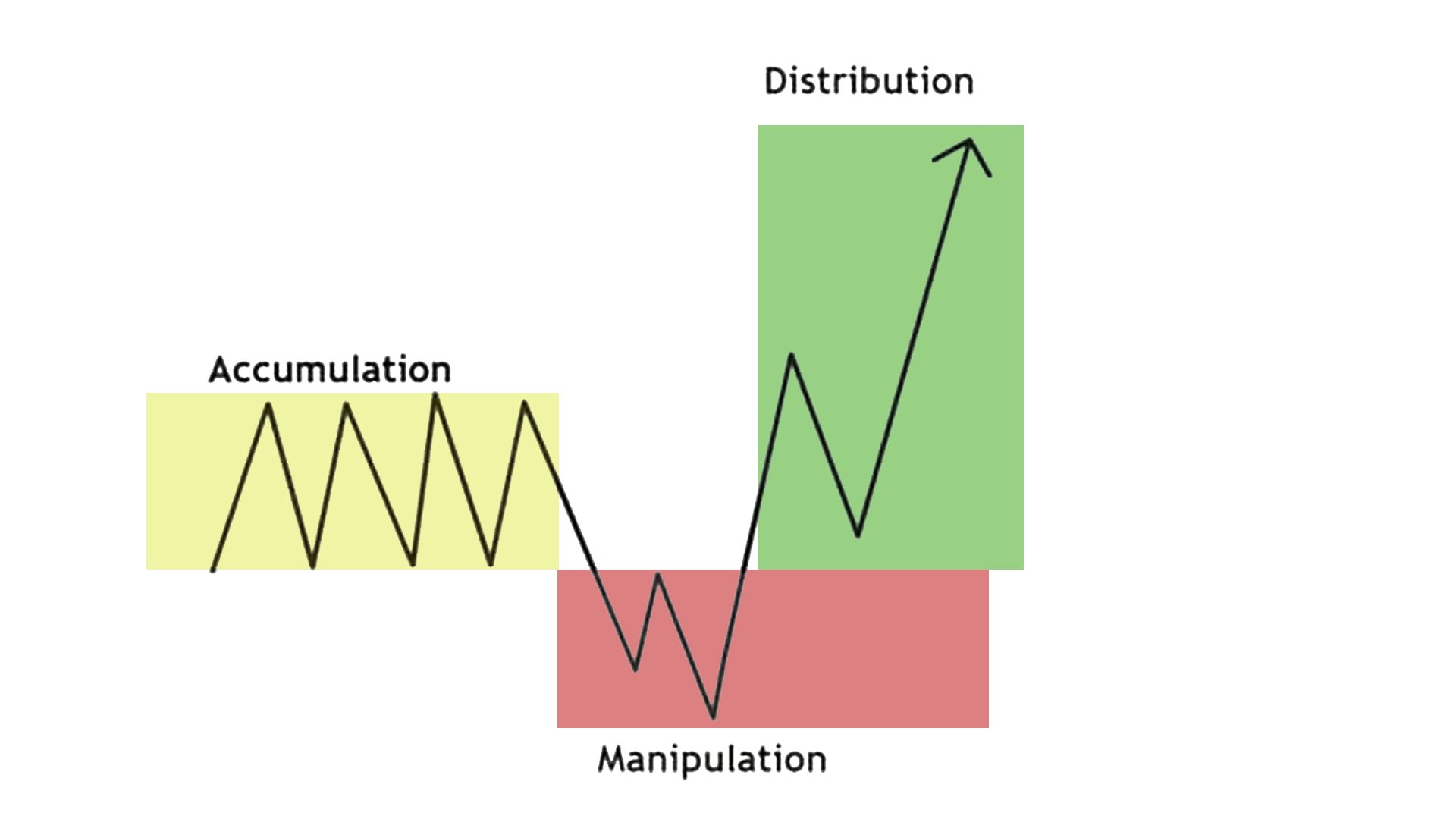

Standing for Accumulation, Manipulation, and Distribution, the AMD model (also known as the "Power of 3") is the fundamental rhythm used by institutional "Smart Money" to move the markets. At Global Markets Eruditio (GME Academy), we teach our students that the market does not move randomly; it moves to find liquidity. Understanding these three phases is the difference between being the "liquidity" and trading alongside the "hunters."

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Phase 1: Accumulation (The Setup)

The cycle begins with a period of sideways movement. During this phase, institutional players—central banks and hedge funds—quietly build their positions. Because these entities handle billions of dollars, they cannot enter the market all at once without causing a massive price spike that would ruin their average entry price. Instead, they "accumulate" their positions over time within a defined range.

Characteristics: Price is trapped in a tight range, often seen during the Asian session or before major news like the Non-Farm Payroll (NFP). Volatility is low, and the price action often looks "boring" or directionless to the untrained eye.

The Goal: To build "liquidity." As the price moves sideways, retail traders begin to project support and resistance levels. They place Buy Stops above the range (expecting a breakout) and Sell Stops below it (expecting a breakdown). These orders represent the "fuel" the big players need. For every billion-dollar "Buy" order an institution wants to place, they need a corresponding "Sell" order to match it. The accumulation phase effectively "engineers" these orders.

Phase 2: Manipulation (The Trap)

Once enough liquidity has been engineered in the Accumulation phase, the market makers trigger a "fake-out." This is the most frustrating phase for retail traders but the most profitable for the pros. It is the moment where the "Smart Money" finally reaches out to grab the liquidity they spent hours building.

Characteristics: A sudden, sharp move breaks out of the Accumulation range. In a bullish cycle, the price will ironically drop first to sweep the sell stops. This is commonly known as a Stop Hunt.

The Goal: To trick retail traders into thinking a new trend has started in the wrong direction. When the price breaks below the Asian range, breakout traders enter "Short" positions, and those already "Long" have their stop-losses triggered. This creates a massive pool of sell orders. The Smart Money then buys into this flood of selling, effectively filling their large buy orders at a "discounted" price.

Pro Tip: At GME Academy, we call this the "Judas Swing." It is a deceptive move designed to leave "weak hands" behind before the real trend begins. If you see a move that looks too fast and too "easy" right at a session open, ask yourself: Is this the trend, or am I the liquidity?

Phase 3: Distribution (The Expansion)

After the stops have been swept and the institutions have filled their bags, the real move begins. This is where the price "expands" rapidly and clearly in the true intended direction. The market finally has the fuel it needs to reach its true destination.

Characteristics: Large, aggressive candles that often ignore minor support or resistance levels. This phase is characterized by high momentum and "displacement," leaving behind Fair Value Gaps (FVGs) and Order Blocks.

The Goal: To push the price to its ultimate target—usually a previous day's high/low or a major liquidity pool—where the institutions will finally sell their positions to the late-coming retail crowd. Ironically, as the price reaches its peak, retail traders finally feel "safe" enough to enter, providing the liquidity the institutions need to exit (distribute) their profit.

Timing the Cycle: The Session Model

The AMD cycle isn't just a pattern; it’s a clock. In the Forex market, the cycle often aligns with the global trading sessions, creating a repeatable daily narrative:

Asia (Accumulation): The market builds the range and "engineers" the liquidity.

London (Manipulation): The "fake move" or the daily low/high is usually formed during the London Open (the London Killzone).

New York (Distribution): The real trend of the day plays out, often continuing the move started by London or reversing it if London was the manipulator.

How to Trade with the "Smart Money"

Instead of chasing the first breakout you see, the GME strategy teaches patience. The goal is to wait for the market to reveal its hand before you place yours.

Wait for the Range: Identify the Asian session high and low. This is your "Accumulation Zone."

Identify the Sweep: Look for the price to break the range and then quickly reject back into it. This rejection is your confirmation that the move was Manipulation, not a true breakout.

Enter on the Retest: Once the manipulation is confirmed and the price begins its Distribution phase, look for an entry (such as a return to an Order Block or a Fair Value Gap) in the opposite direction of the fake-out.

Are you tired of being the market’s liquidity?

Stop guessing and start reading the institutional narrative. Mastering the AMD cycle is the first step toward professional-grade consistency.

Join our FREE Forex Workshop to see live chart examples of these phases and learn how to position yourself for the next big Distribution.