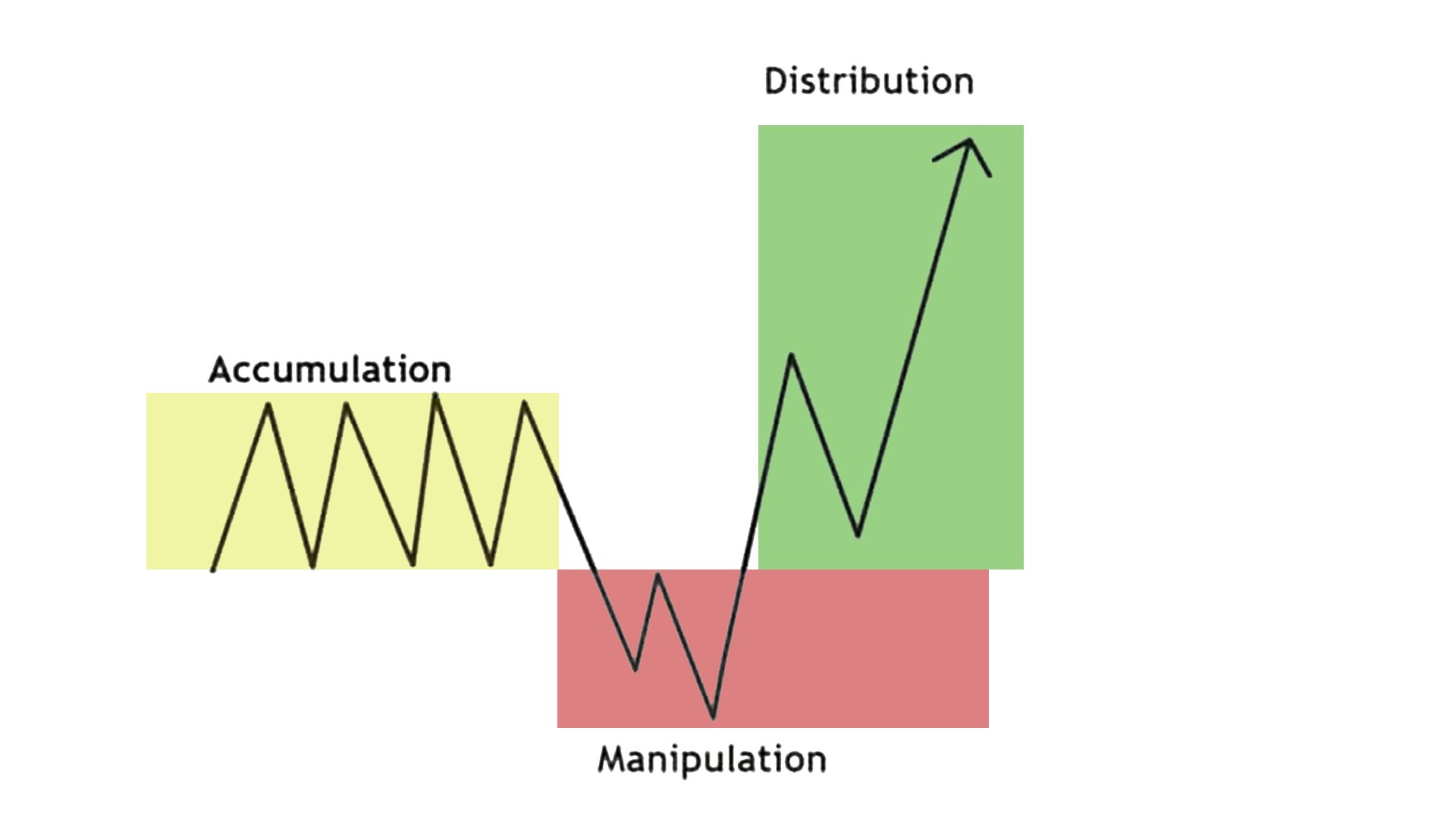

The Silent Engine of the Market: Understanding the AMD Cycle

If you have ever felt like the market "waited" for you to enter a trade just to hit your stop-loss and then move in your original direction, you haven't been cursed—you’ve likely been a victim of the AMD Cycle.

Market Manipulation or Market Mechanics? Decoding the Fine Line That Separates Illegal Swindles from Sophisticated Trading

Every sudden price spike, deep plunge, or sharp reversal in the Forex market or stock indices raises a perennial question: Is this organic market behavior, or is it a calculated move to mislead traders?

Liquidity Pools: The Smart Money’s Hunting Grounds—Where Price is Programmed to Strike

In the world of Forex Trading, the concept of Liquidity Pools is key to understanding institutional movements. These are not just random clusters of orders; they are predictable price levels—the "Big Money Zones"—where retail traders place their stop-loss orders.