The Midnight Toll: Understanding Swap Fees and Overnight Charges

In the world of Forex Trading, the clock doesn't just measure time—it measures cost. While most day traders focus on the "spread" (the difference between the buy and sell price), those who hold positions past the market close encounter a different kind of fee: the Swap Fee, also known as the Overnight Charge or Rollover.

At the GME Academy, we teach our students that swaps are not just "hidden fees" to be avoided; they are a fundamental part of the global interest rate landscape. If managed correctly, swaps can even become a source of profit.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. What is a Swap Fee?

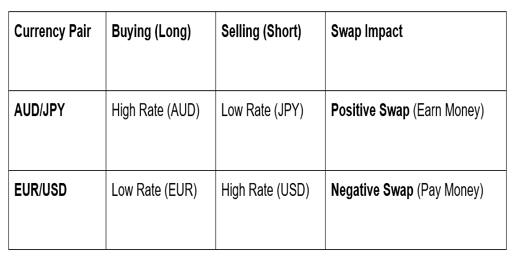

A swap is the interest rate differential between the two currencies in a pair. When you trade Forex, you are effectively borrowing one currency to buy another. Because every currency is tied to a central bank (like the RBA or the Federal Reserve), each has its own interest rate.

● Positive Swap: You earn interest because the currency you bought has a higher interest rate than the one you sold.

● Negative Swap: You pay interest because the currency you bought has a lower interest rate than the one you sold.

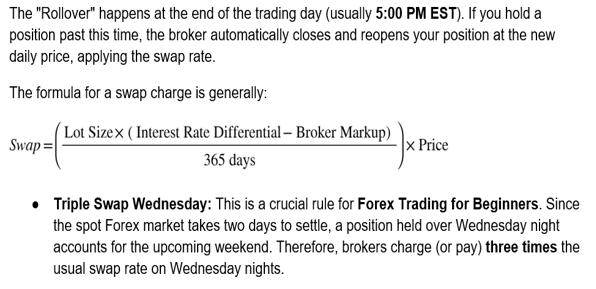

2. How is Swap Calculated?

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

3. The "Carry Trade" Strategy

Professional traders often use swaps to their advantage through the Carry Trade. This involves buying a currency with a high interest rate (like the Australian Dollar after the recent RBA pivot to 3.85%) and selling one with a low interest rate (like the Japanese Yen).

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. Swap-Free (Islamic) Accounts

For traders who cannot pay or receive interest due to religious beliefs, many brokers offer Islamic Accounts.

How they work: Instead of an interest-based swap, the broker may charge a fixed administration fee or widen the spread.

The Catch: These accounts are often monitored closely to prevent "swap-arbitrage," where traders try to exploit the lack of fees during high-interest periods.

The GME Academy Analysis: "Managing the Carry"

At Global Markets Eruditio, we advise long-term "Swing Traders" to always check the Swap Tab in their terminal before entering a trade. A negative swap might seem small—perhaps a few cents a day—but over a month-long trade, it can eat significantly into your profit margins.

Our Pro Tips:

Check the Calendar: Be wary of holding high-volume positions over Wednesday night unless the swap is in your favor.

Trade the Trend: If you are in a "Short" position on a pair with a massive negative swap, the market needs to move in your favor much faster just to break even.

Use it for Income: In a stable market, "Positive Swap" pairs can provide a steady "dividend" while you wait for your price target to hit.

Join our FREE Forex Workshop at Global Markets Eruditio!

Are swaps eating your profits? We’ll show you how to find the "Positive Swap" gems in the current 2026 market and how to use them to build a passive income stream alongside your active trading.