Economic Engineering: Why Countries Devalue Their Currency on Purpose

In the world of Forex Trading, we often see currencies fluctuating due to market news or economic data. However, there are times when a country decides to pull the trigger itself, deliberately lowering the value of its own money. This is known as Currency Devaluation.

The Invisible Hand: Decoding Central Bank Intervention in the 2026 Forex Market

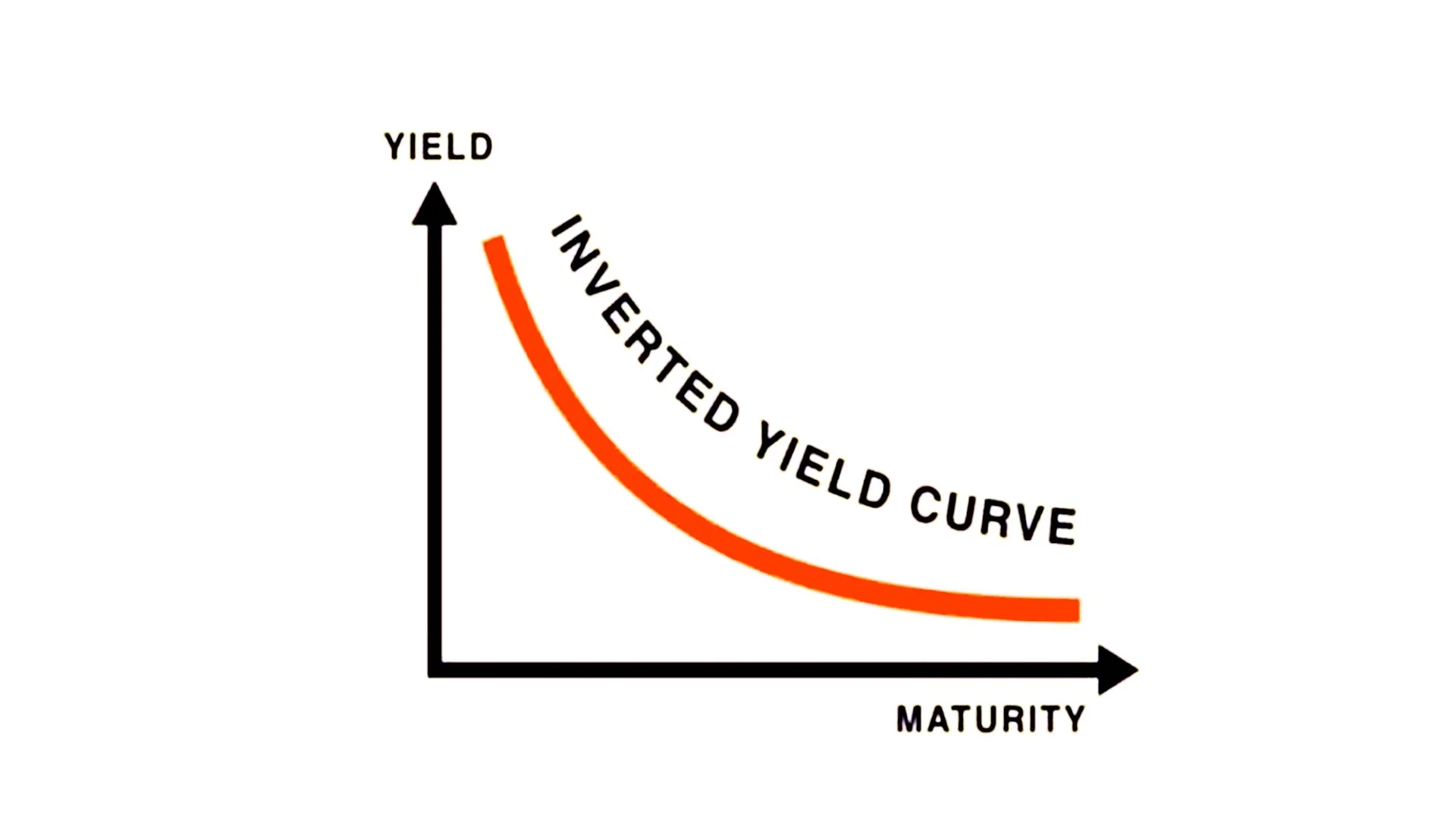

In the high-stakes world of global finance, few phrases send a shiver down the spine of an investor quite like "Inverted Yield Curve."

When the Compass Flips: Decoding the Inverted Yield Curve as a Recession Signal

In the high-stakes world of global finance, few phrases send a shiver down the spine of an investor quite like "Inverted Yield Curve."

The Invisible Hand: Why the Bond Market is the Real Boss of Forex

To the uninitiated, the Forex market seems like a chaotic tug-of-war between headlines, central bank speeches, and flashing red and green candles.

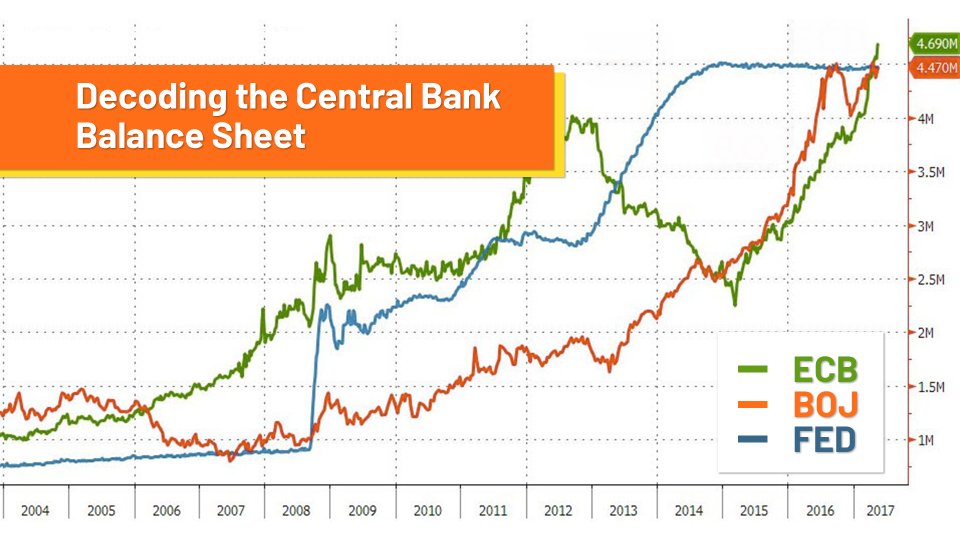

The Pulse of Nations: Decoding the Central Bank Balance Sheet

To the average observer, a central bank is often seen as a mysterious institution that simply "sets interest rates." However, the true story of a nation’s economic health is told through its financial statements.

Is Your Safety Net Too Small? Why Volatility-Based Stops Are the Secret to Longevity

Many traders enter a position on a promising currency pair, only to see their stop-loss hit by a momentary price spike before the market ultimately moves in their favor.

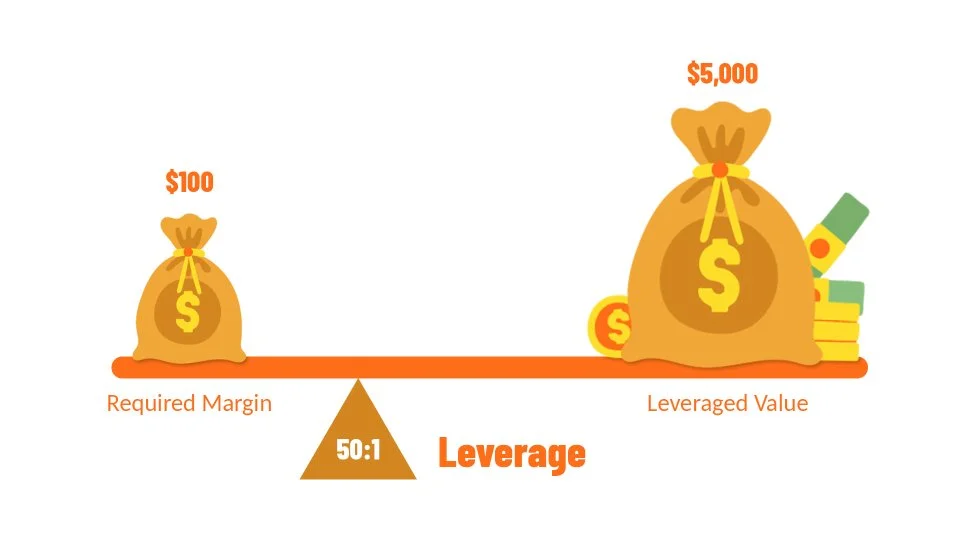

The Engine Under the Hood: How Broker Leverage Really Works

In the world of Forex trading, leverage is often described as a "loan" or a "double-edged sword." While most traders understand that a 1:100 ratio allows them to control $100,000 with just $1,000 of margin, very few understand the mechanical reality of what happens at the broker level.

The Silent Account Killer: Why "Doing Nothing" Is Sometimes the Best Trade

In the fast-paced world of Forex trading, there is a common misconception that more screen time equals more profit. For many, the itch to click "buy" or "sell" is constant. However, one of the most vital lessons taught at Global Markets Eruditio is that knowing when not to trade is just as important as knowing your entry signals.

The Great Snap-Back: Can You Profit When Markets Overextend?

In the world of financial physics, what goes up must eventually come down—or at least return to its historical average. This is the fundamental premise of Mean Reversion Strategies.

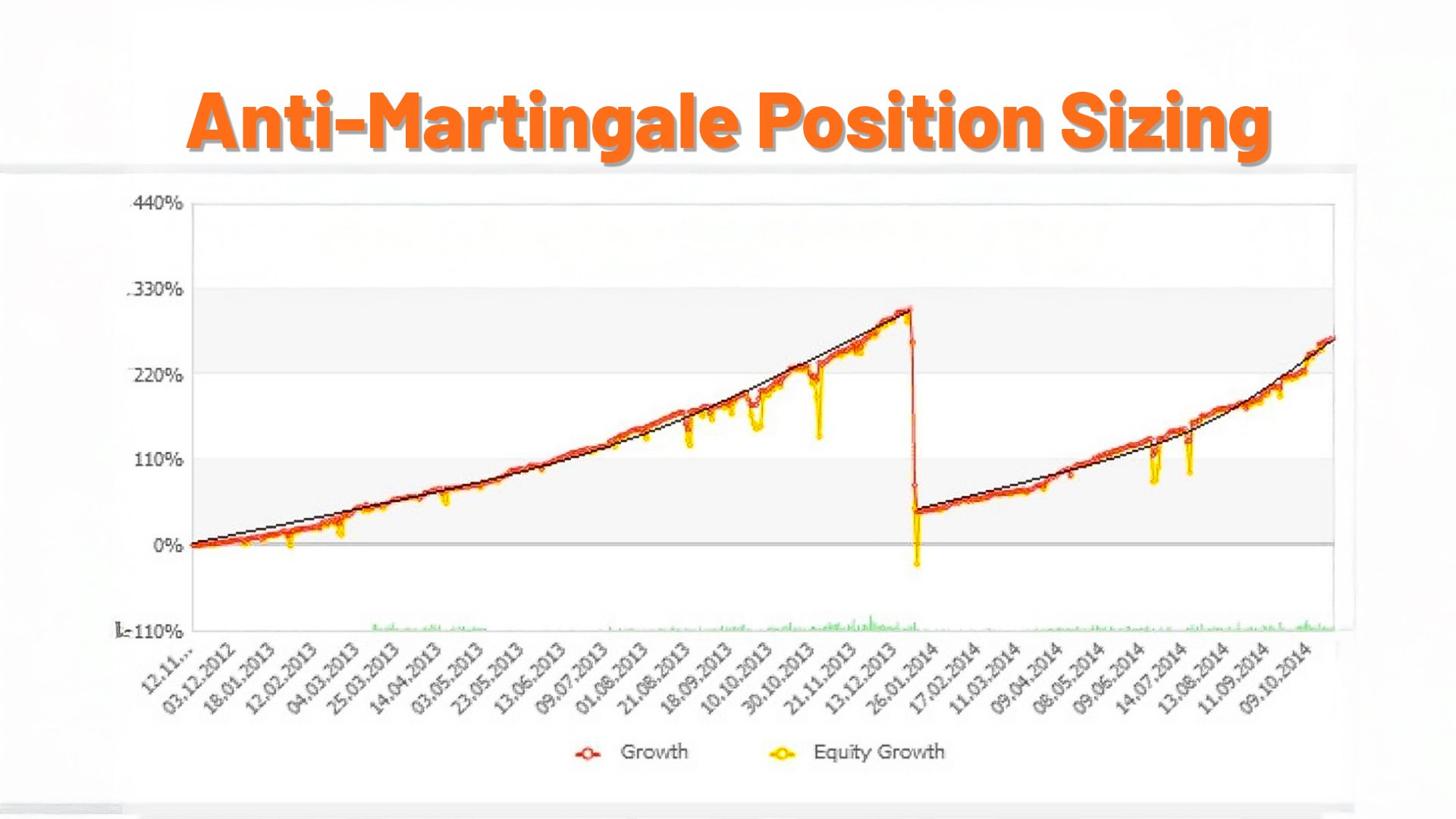

The "Hot Hand" Advantage: Can You Ride the Wave with Anti-Martingale Sizing?

In the fast-paced world of the currency markets, most traders focus intensely on where to enter a trade. Yet, seasoned professionals often whisper a different truth: your entry matters far less than your position sizing.

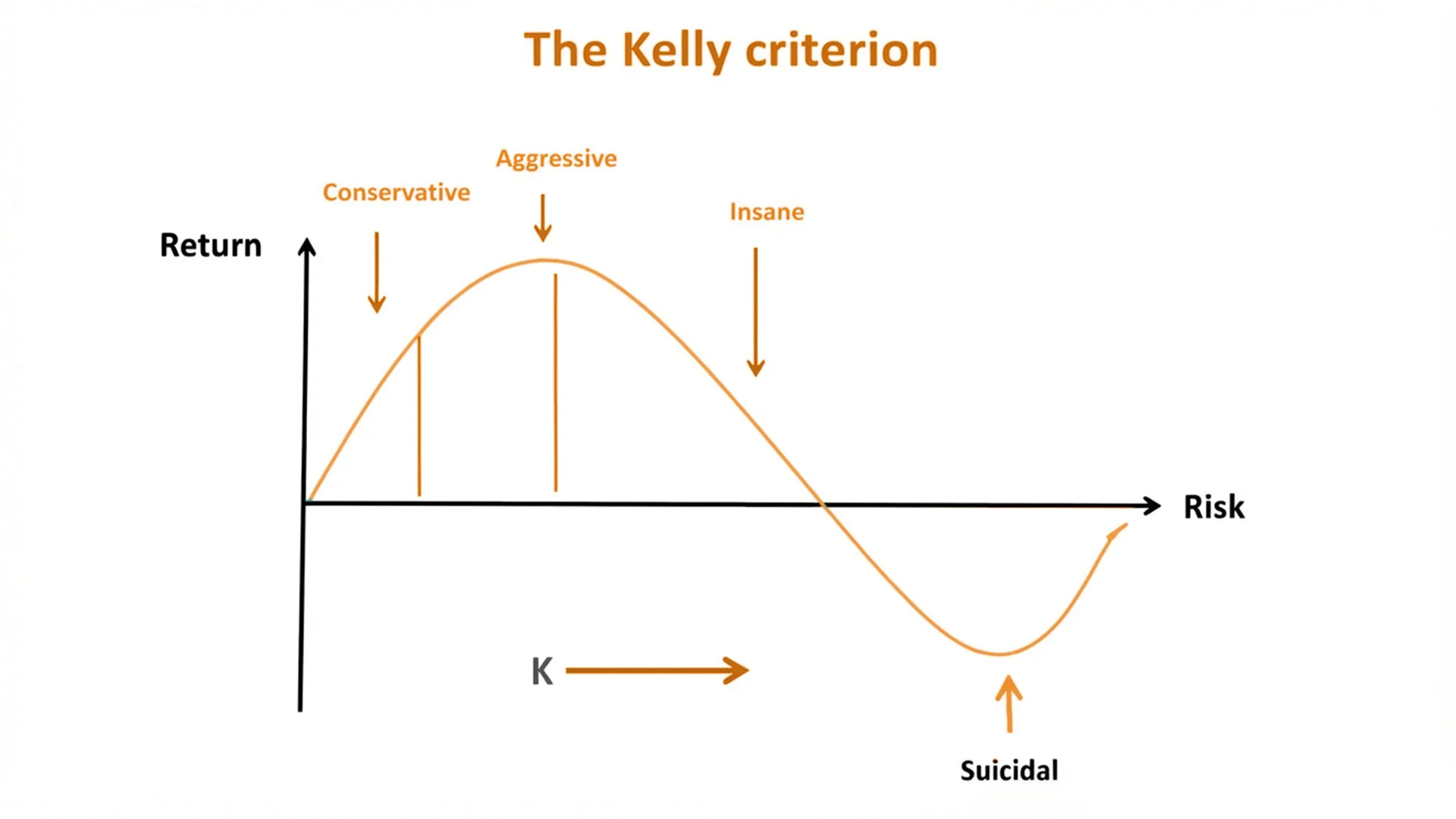

The Mathematician’s Edge: Mastering the Kelly Criterion in Forex

In the high-stakes world of Forex trading, most beginners spend their time hunting for the "perfect" entry signal. They master support and resistance on the EUR/USD or follow momentum shifts on the GBP/JPY.

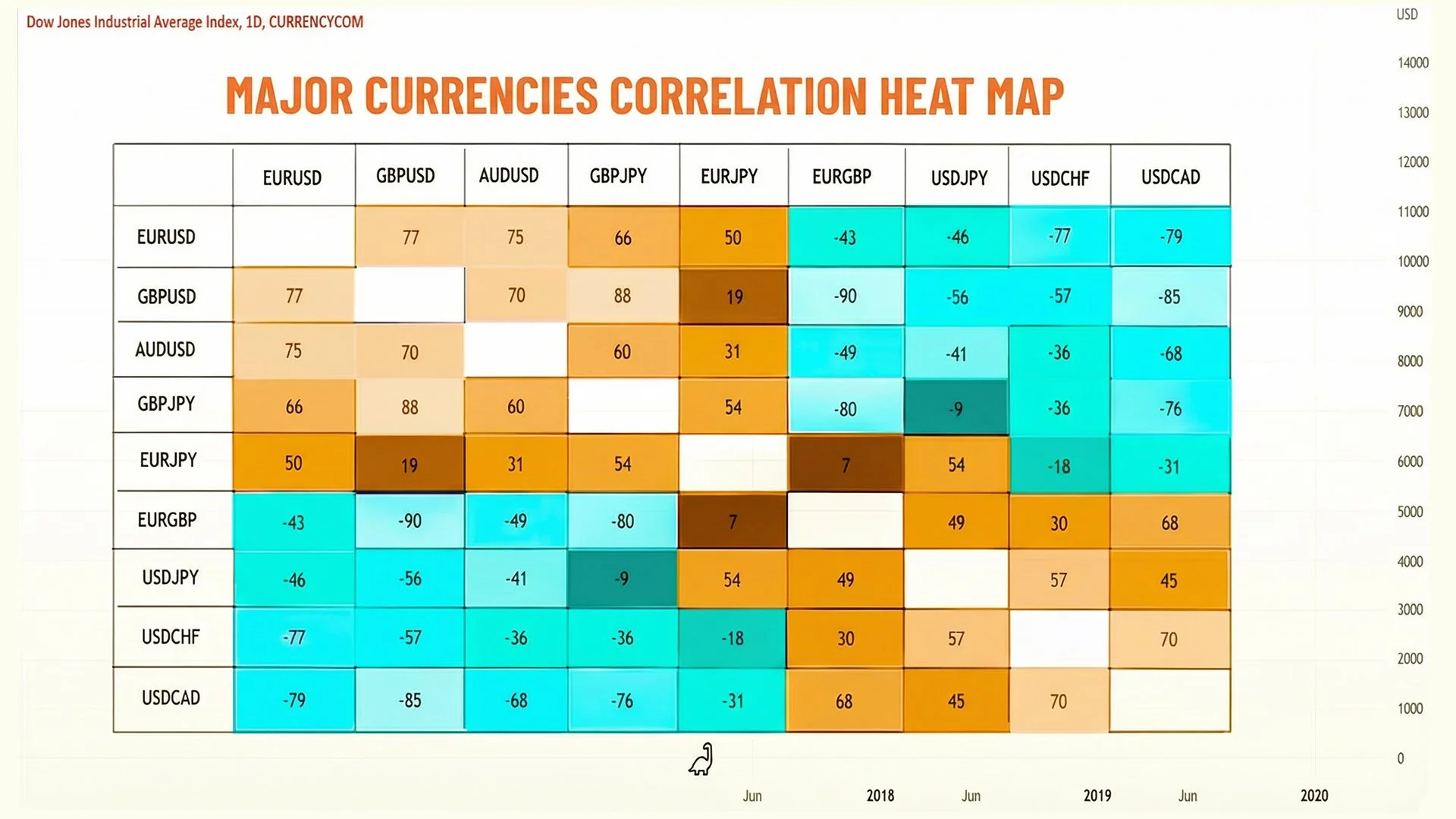

Is Your Portfolio Overheating? The Silent Risk of "Heat Exposure" in Forex Trading

Many traders enter the world of Forex trading for beginners with a laser focus on the individual trade. They meticulously analyze the USD (US Dollar) price action or wait for a specific signal on the GBP/JPY.

The Lone Wolf Myth: Why Your Forex Journey Needs a Pack

The image of a solitary trader, backlit by glowing monitors in a dark room, is a common trope in Hollywood. In reality, that image is often a recipe for burnout and account depletion.

The Winning Streak Trap: Is Your Success Sabotaging Your Strategy?

It is the feeling every trader chases. You’ve closed three, four, maybe five consecutive profitable trades on the EUR/USD. The charts seem crystal clear, your entries are surgical, and the profits are stacking up. In the world of Forex, this is the "Goldilocks Zone."

The Silent Edge: Why Your Trading Journal Is More Powerful Than Your Strategy

In the fast-paced world of Forex trading, most beginners spend hundreds of hours hunting for the "Holy Grail" indicator. They swap from the EUR/USD to the GBP/JPY, searching for a magic formula that never misses.

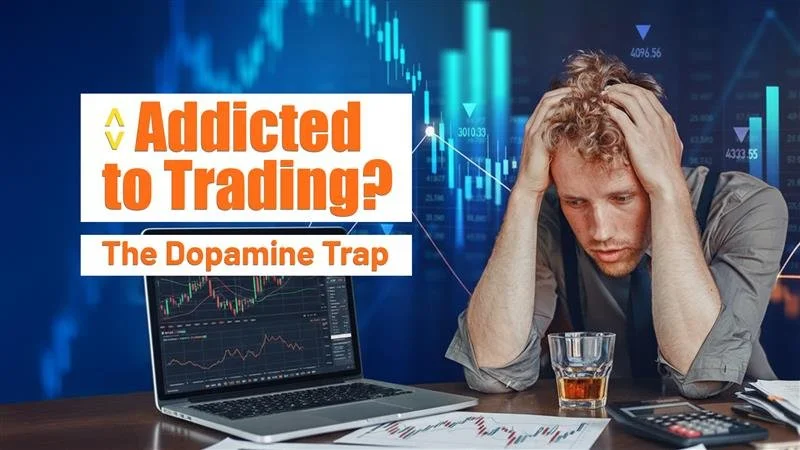

The Invisible Hand in Your Head: Breaking the Dopamine Loop of Trading Addiction

Have you ever found yourself staring at a USD chart late into the night, your heart racing as a single candle flicker determines your mood for the next four hours? If you have, you aren’t just battling the market; you are battling your own biology.

The Edge of Certainty: Why Successful Traders Think Like Probabilists

In the early stages of Forex trading for beginners, many newcomers share a common, albeit dangerous, misconception: they believe that being a "pro" means knowing exactly what the market will do next.

The Biology of the Bottom Line: The Science of Fear and Loss Aversion

In the high-stakes arena of the financial markets, we like to believe we are rational actors making calculated decisions based on data, charts, and economic indicators.

The Silent Architect of Wealth: Building Trading Habits and Discipline

While high-speed fiber optics and advanced algorithms dominate the headlines, the most powerful tool in Forex trading remains the human brain—specifically, its ability to adhere to a routine.

The "Genius" Trap: Why Consistency Beats Intelligence in Forex Trading

Many newcomers enter the world of Forex trading believing that success is a byproduct of high IQ or complex mathematical prowess.