The Dragon’s New Year Spark: China’s Private Manufacturing Hits 3-Month High

While global markets were transfixed by US trade threats and central bank reshuffling, the world's second-largest economy quietly signaled a manufacturing rebound. In January 2026, the RatingDog China General Manufacturing PMI rose to 50.3, up from 50.1 in December. This marks the fastest pace of expansion for the sector in three months, defying the more pessimistic "official" government data.

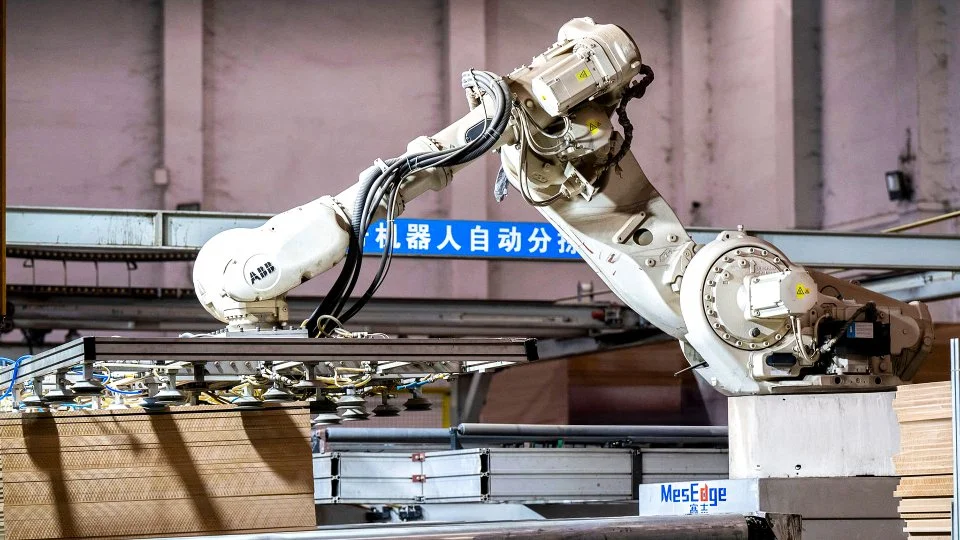

At the GME Academy, we find this divergence particularly fascinating for Forex Trading. While the official government survey (NBS) showed a contraction at 49.3, the private-sector RatingDog survey—which focuses on smaller, export-oriented firms—paints a picture of resilience. This suggests that while domestic "state-run" demand remains sluggish, the "Engine of the East" is being powered by foreign buyers, specifically from Southeast Asia.

1. Export Orders: The ASEAN Lifeline

The headline expansion was largely driven by a fresh rise in new export orders. Chinese manufacturers reported a surge in interest from overseas, with Southeast Asian clients front-loading orders ahead of the nine-day Lunar New Year festival in mid-February.

Production Speed: Output growth accelerated to a three-month high as factories scrambled to clear outstanding workloads.

Hiring Trends: In response to the workload, firms raised their staffing levels for the first time in three months. For those looking at Forex Trading for Beginners, higher employment in China is often a "Leading Indicator" for the AUD/USD (Aussie Dollar), as Australia is a major exporter of the raw materials used in these Chinese factories.

2. The Price Pivot: Goodbye Deflation?

Perhaps the most significant "hidden" stat in the report was the movement in pricing. For the first time in 14 months, Chinese manufacturers raised their output charges (factory gate prices).

Input Costs: Raw material expenses, especially for metals, climbed at the fastest rate since last September.

Passing the Buck: Faced with rising costs, firms finally stopped slashing prices and started passing those costs onto their customers. This is a massive signal for global markets; it suggests that the "Deflation Export" phase from China might be ending, which could keep global inflation stickier than the Fed or the ECB would like.

3. The Confidence Paradox

Despite the uptick in production and hiring, business confidence fell to a nine-month low.

The Fear: Manufacturers are worried about the "Cost Squeeze"—rising raw material prices paired with fragile global demand.

The "Trump" Factor: With the US administration threatening 50% tariffs on neighbors like Canada and potential escalations with China, private business owners are remaining "hopeful but cautious" about their 12-month outlook.

4. Forex Impact: The Yuan vs. The World

The CNH (Offshore Yuan) strengthened to around 6.95 per Dollar following this report.

AUD/USD Impact: The Australian Dollar typically rallies on positive Chinese manufacturing data. However, the gains were capped by the conflicting official "contraction" data from the NBS.

Commodity Currencies: Stronger purchasing activity for raw materials is a net positive for "Commodity FX" like the AUD, NZD, and CAD, though the latter is currently distracted by its own tariff drama.

Inflation Watch: If China continues to raise output charges, it could force the US Dollar (USD) to stay stronger for longer as the Fed fights "Imported Inflation."

The GME Academy Analysis: "Watch the Private Pulse"

At Global Markets Eruditio, we advise traders to give more weight to the private PMI (RatingDog) during export-heavy months. The official government data often fails to capture the agility of the small-to-medium enterprises that actually drive the "real" economy.

Are You Trading the Asia Opening? China’s manufacturing health is the "tide that lifts all boats" in Asia. If factory charges continue to rise, we could be looking at a major shift in the global inflation narrative for 2026.

Join our FREE Forex Workshop. Learn how to trade "PMI Divergences." We’ll show you why the private survey often predicts price action better than the government data and how to use China's "Output Charges" to predict the next move in Gold and the AUD.