Canada at a Crossroads: Governor Macklem’s Vision for a Restructured Economy

In a landmark address to the Empire Club of Canada in Toronto, Bank of Canada Governor Tiff Macklem laid out a sobering yet proactive roadmap for the nation’s economic future.

Urgency in Tokyo: Top Diplomat Mimura Draws a Line for the Yen

In a swift attempt to contain currency volatility following a weekend of major political shifts, Japan’s top currency diplomat, Atsushi Mimura, issued a high-stakes warning to the markets on Monday, February 9, 2026.

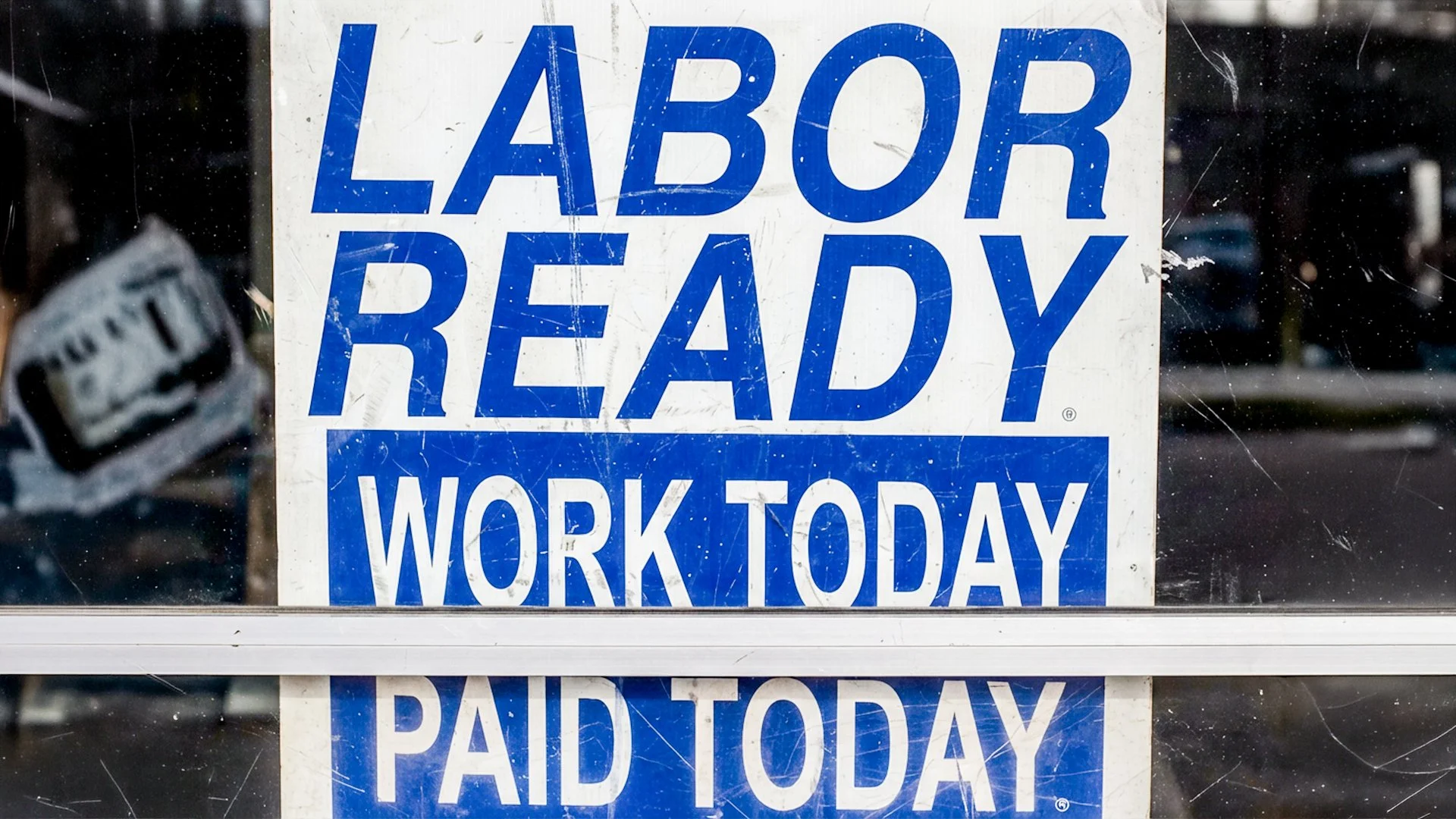

Winter Chill: US Jobless Claims Jump to 231,000 Amid Severe Weather

The U.S. labor market showed unexpected signs of cooling in late January, as new applications for unemployment benefits surged to their highest level in nearly two months.

Steady Hands in Frankfurt: ECB Holds Rates as Eurozone Hits a "Good Place"

At its first meeting of 2026 on February 5, the European Central Bank (ECB) Governing Council decided to keep its key interest rates unchanged for the fifth consecutive time.

The Great Hesitation: US Job Openings Sink to 5-Year Low in December JOLTS Report

The U.S. labor market ended 2025 on a significantly cooler note than many anticipated. According to the Job Openings and Labor Turnover Survey (JOLTS) released by the Bureau of Labor Statistics on February 5, 2026, the number of unfilled positions dropped to 6.5 million in December.

Diplomatic Deadlock: Plans for U.S.-Iran Nuclear Talks Are Collapsing

The high-stakes effort to revive direct diplomacy between Washington and Tehran is on the brink of failure. According to a "scoop" report from Axios on Thursday, February 5, 2026, U.S. officials are warning that plans for a landmark meeting scheduled for this Friday have effectively collapsed.

Super-Long Yields Surge: Analyzing the 30-Year JGB Auction Results (Feb 5, 2026

The Japanese bond market faced a critical test on February 5, 2026, as the Ministry of Finance (MOF) auctioned 30-year Japanese Government Bonds (JGBs).

Service Sector Steady: ISM US Services PMI Holds Firm at 53.8% to Start 2026

The U.S. services sector maintained its momentum in January 2026, signaling a resilient start to the year. According to the latest ISM® Services PMI® Report released on February 4, 2026, the headline index registered 53.8%, matching December's seasonally adjusted figure.

The Great Hiring Break: Private Jobs Add Only 22,000 in Lackluster January

The U.S. labor market hit a significant speed bump to start 2026, as private sector employment increased by a meager 22,000 jobs in January.

Energy Market Shock: API Reports Massive 11.1M Barrel Crude Draw

The energy markets received a major jolt on the evening of Tuesday, February 3, 2026, as the American Petroleum Institute (API) released its weekly inventory report.

Arabian Sea Flare-Up: U.S. F-35C Shoots Down Iranian Drone Near Aircraft Carrier

Tensions in the Middle East reached a new boiling point on Tuesday, February 3, 2026, after a U.S. Navy stealth fighter shot down an Iranian drone that "aggressively approached" the USS Abraham Lincoln (CVN-72).

The Midnight Relief: Trump Signs $1.2 Trillion Bill to Reopen Government

In a swift conclusion to the four-day federal standoff, President Donald Trump signed a $1.2 trillion Consolidated Appropriations Act on the afternoon of Tuesday, February 3, 2026.

New Zealand Labour Market: Unemployment Hits Decade High of 5.4% Amid Record Participation

New Zealand's labour market continues to signal a complex "cooling" period. According to the latest data from Stats NZ for the December 2025 quarter, the unemployment rate has ticked up to 5.4%—the highest level seen since 2015.

Shutdown Showdown: Trump Demands Immediate House Action to End Federal Stoppage

In a high-stakes moment for the U.S. government, President Donald Trump issued a stern ultimatum to the House of Representatives on Monday, February 2, 2026, demanding the immediate passage of a Senate-backed funding package to end the ongoing partial government shutdown.

The Engines Roar Back: U.S. Manufacturing Returns to Expansion in January

For the first time in a year, the hum of American factories is getting louder. The January 2026 ISM® Manufacturing PMI® surged to 52.6%, shattering market expectations of 48.5% and marking a definitive exit from a 12-month period of stagnation.

RBA Pivots: Interest Rates Hit 3.85% as Inflation Regathers Momentum

The Reserve Bank of Australia (RBA) has officially shifted gears, ending its brief easing cycle with a 25-basis-point hike, bringing the official cash rate to 3.85% at its February 3, 2026, meeting.

Damage Control in Tokyo: Government Clarifies PM Takaichi’s "Weak Yen" Remarks

In a swift effort to settle volatile currency markets, a Japanese government spokesperson clarified on Monday, February 2, 2026, that Prime Minister Sanae Takaichi was not advocating for a weaker currency during her recent campaign stops.

The Dragon’s New Year Spark: China’s Private Manufacturing Hits 3-Month High

While global markets were transfixed by US trade threats and central bank reshuffling, the world's second-largest economy quietly signaled a manufacturing rebound. In January 2026, the RatingDog China General Manufacturing PMI rose to 50.3, up from 50.1 in December.

The Great Stagnation: Canada’s Economy Flatlines in November Amid Supply Bottlenecks

The Canadian economy entered a "holding pattern" in November 2025, as real Gross Domestic Product (GDP) remained essentially unchanged (0.0%). This stagnation followed a worrying 0.3% decline in October, signaling a fragile end to the year for America's northern neighbor.

The Road to the Fed: Trump Predicts "Smooth Sailing" for Kevin Warsh Confirmation

President Donald J. Trump expressed supreme confidence this weekend that his nominee for Federal Reserve Chair, Kevin Warsh, will bypass the typical partisan gridlock in Washington.