The "Virtuous Cycle" Reaffirmed: Decoding the Bank of Japan’s January 2026 Outlook

The Bank of Japan (BoJ) has released its highly anticipated Outlook for Economic Activity and Prices for January 2026, painting a picture of a nation steadily navigating a path toward sustainable growth. For those involved in Forex Trading, particularly in the USD/JPY or GBP/JPY pairs, the report offers a critical roadmap for Japan’s monetary trajectory over the next two fiscal years.

The overarching theme is one of resilience. Despite a complex global landscape, the BoJ maintains that Japan’s economy is poised to continue growing moderately, fueled by a strengthening "virtuous cycle" between rising incomes and increased spending.

Growth Projections: Higher Now, Lower Later

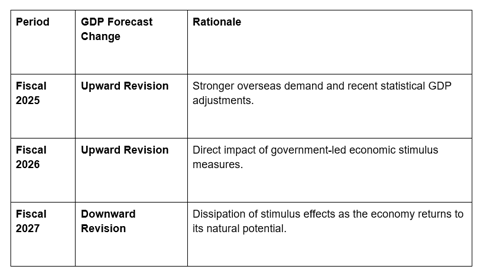

In a notable shift from its previous reports, the BoJ has upwardly revised its growth forecasts for the immediate future while tempering expectations for the long term.

This "front-loaded" growth is a key indicator for Forex market participants. While the Japanese Yen has faced pressure from a strong US Dollar (USD), these upgraded near-term forecasts suggest that domestic demand remains a powerful anchor for the economy.

The Inflation Tug-of-War: Deceleration vs. Sustainability

The report highlights a fascinating divergence in price action. In the first half of 2026, the year-on-year rate of the Consumer Price Index (CPI) is expected to dip below the 2 percent target.

Why the temporary slowdown?

Waning Food Inflation: The "rice price shock" and other food spikes of 2025 are finally fading.

Government Intervention: Subsidies and measures to address the cost of living are taking a bite out of headline numbers.

However, the BoJ is looking past these "transitory" dips. The bank notes that underlying inflation—driven by the interaction of wages and prices—is still trending upward. By the second half of the projection period, inflation is expected to settle at a level "generally consistent" with the 2 percent stability target.

Global Risks and the Trade Policy Wildcard

No outlook in 2026 is complete without acknowledging the "elephant in the room": global trade policy. The BoJ explicitly warns that trade measures in "each jurisdiction"—a subtle nod to the shifting landscape in the US and Europe—could impact Japanese exports and corporate profitability.

For Forex Trading for Beginners, this highlights why currency pairs like EUR/USD often move in tandem with Japanese assets. If global trade tensions rise, the safe-haven status of the Japanese Yen may collide with the BoJ's desire to maintain accommodative financial conditions.

The Institutional Perspective

Organizations like Global Markets Eruditio emphasize that the BoJ's focus on "accommodative conditions" suggests that while rate hikes are on the table, they will be measured. The GME Academy teaches that in Japan, the "sense of labor shortage" is now a permanent structural feature, which will eventually force wages higher regardless of global headwinds.

A Balanced Risk Profile

The Bank concludes that the risks to both economic activity and prices are now "generally balanced." This neutrality is a sign of confidence. It suggests that Japan has moved past the era of deflationary threats and is now a "normal" economy managing "normal" risks.

Are you ready to trade the Yen?

The BoJ's outlook is the foundation for the next major move in the Asian markets. If you want to learn how to translate these central bank reports into winning trade setups, you need to be in the room.

Join our FREE Forex Workshop

Discover the strategies professional traders use to navigate BoJ decisions and Master the Japanese Yen.