Europe’s Geoeconomic Pivot: Lagarde Warns of 3% Manufacturing Hit in a Fragmenting World

In a landmark speech at the Munich Security Conference on February 14, 2026, ECB President Christine Lagarde redefined the role of a central banker, shifting the focus from interest rates to the high-stakes world of global supply chains. Labeling trade a "security issue," Lagarde warned that Europe must urgently transition to "strategic autonomy" as the era of hyper-globalization gives way to geoeconomic fragmentation.

At the GME Academy, we see this as a pivot toward "Economic Fortress Europe." Lagarde’s remarks signal that the ECB is no longer just managing inflation—it is actively buffering the Eurozone against the weaponization of global trade.

1. The Cost of Fragility: A 2-3% Manufacturing Blow

Lagarde presented sobering data from the Eurosystem, mapping out exactly what is at stake if Europe’s dependencies are cut off.

The Stress Test: A sudden 50% drop in supply from "geopolitically distant" partners would slash European manufacturing value-added by 2-3%.

Critical Chokepoints: The impact would be dangerously concentrated in three sectors: Electrical Equipment, Chemicals, and Electronics.

The "Hollow Champion" Risk: Lagarde warned against "independence at all costs." Pursuing full autonomy in sectors like semiconductors could create "hollow" firms—substandard and uncompetitive companies that ultimately weaken the strategic industries they are meant to support.

2. The Three-Pillar Strategy for Autonomy

Lagarde outlined three distinct paths for Europe to navigate this new era. While all are legitimate, she cautioned that they must be applied with granular precision:

Independence: Rebuilding domestic supply chains for the most critical technologies (e.g., space launches, where Europe conducted only 3 launches in 2023 compared to the U.S.'s 114).

Indispensability: Developing "must-have" niches within global supply chains that make Europe an essential partner.

Diversification: Spreading risk across "coalitions of the willing" to ensure no single disruption—intentional or accidental—can paralyze the economy.

3. The ECB’s New Shield: EUREP Goes Global

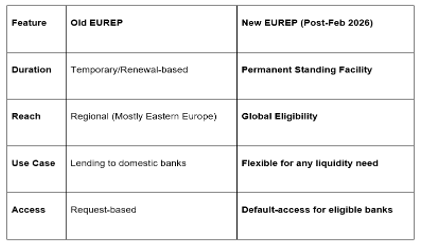

To support this shift, the ECB Governing Council has fundamentally overhauled its financial architecture. On February 14, 2026, the ECB announced the expansion of its EUREP (Eurosystem Repo Facility).

Permanence: The facility is moving from a temporary crisis tool to a standing, permanent facility.

Global Perimeter: Access is expanding from regional partners to central banks worldwide.

Speed & Agility: Access will be granted by default to all central banks meeting basic reputational criteria (excluding those linked to money laundering or sanctions).

This move is designed to prevent "fire sales" of euro-denominated securities. By ensuring that global partners have reliable access to euro liquidity, the ECB aims to reinforce the Euro’s role as a global reserve currency, especially as investors reassess the stability of the U.S. dollar amid policy shifts.

The GME Academy Analysis: "A Stronger Euro in a Fragmented World"

At Global Markets Eruditio, we believe Lagarde’s move to globalize the EUREP facility is a masterstroke in "Financial Geopolitics."

Trader's Takeaway for 2026:

Euro (EUR) Stability: By acting as a "Lender of Last Resort" for the world, the ECB is making euro-denominated assets much more attractive to foreign central banks. This provides a long-term bullish floor for the EUR/USD.

Strategic Autonomy Premium: Expect European industrial policy to drive massive investments into Aerospace, Defense, and AI Infrastructure. This "assertive industrial policy" will likely lead to higher government debt, but it also creates growth opportunities in specialized EU tech sectors.

Volatility is the New Normal: Lagarde explicitly stated that "financial market stress is likely to become more frequent." Traders should keep a higher cash buffer and focus on "Resilience Trades" rather than "Efficiency Trades."

Join our FREE Macro Workshop at Global Markets Eruditio!

Is Europe the new "Safe Haven"? We’ll break down the EUREP launch in Q3 2026 and show you how to position your portfolio for a world of geoeconomic shifts.