Inflation Hits a Glide Path: January CPI Eases to 2.4% as Energy Prices Slump

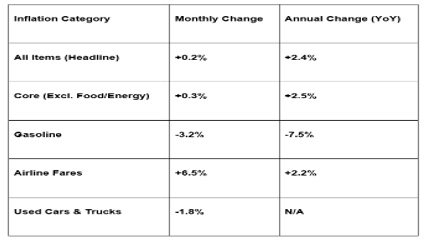

The U.S. inflation story took a definitive turn toward cooling this month. According to the Bureau of Labor Statistics (BLS) report released on February 13, 2026, the Consumer Price Index (CPI) rose just 0.2% in January. This brings the annual inflation rate down to 2.4%, a significant step down from the 2.7% recorded in December and the slowest annual pace since May 2025.

At the GME Academy, we’re calling this "The Great Rebalancing." While the "headline" number is falling, the "core" sticky areas like shelter and services are refusing to budge as quickly. For the Federal Reserve, this report is a green light to stay patient—inflation is moving in the right direction, but it hasn't crossed the finish line.

1. The January Breakdown: Energy vs. Services

The month-over-month move was a classic "tug-of-war" between plummeting fuel costs and rising service prices.

Energy’s Sharp Drop: Overall energy prices fell 1.5% in January, led by a massive 3.2% decline in gasoline. This was the primary "disinflationary" force that pulled the headline number lower.

Core Inflation Persistence: Excluding volatile food and energy, "Core CPI" rose 0.3% for the month. On an annual basis, Core CPI sits at 2.5%, actually tracking slightly higher than the headline rate.

Shelter's Shadow: Shelter costs rose 0.2% and remain the single largest contributor to the monthly increase. Despite high mortgage rates and a "stuck" housing market, the cost of keeping a roof over one’s head remains a persistent inflation floor.

2. Grocery Store Relief: Eggs and Beef Lead the Way

For the American consumer, the most noticeable relief came at the supermarket. While the food index rose slightly (+0.2%), specific staples saw dramatic price corrections:

The Egg Crash: Following a recovery from previous supply chain shocks, egg prices tumbled 7% in January and are now down a staggering 34.2% year-over-year.

Beef Pullback: Beef and veal prices declined 0.4% for the month, though they remain significantly higher than they were in early 2025.

The "Bakery" Burn: In contrast, cereals and bakery products jumped 1.2%, proving that even within the grocery store, inflation is not hitting every aisle equally.

3. Travel and Services: The Hidden Surge

While goods are getting cheaper, the "Experience Economy" is still hot.

Airline Fares: In a shock to many travelers, airline fares surged 6.5% in a single month.

Personal Care: The cost of services like haircuts and personal grooming rose 1.2%.

Medical Care: Professional medical services saw a steady 0.3% increase, keeping pressure on household budgets.

The GME Academy Analysis: "The Fed's Patient Stance"

At Global Markets Eruditio, we look at how this data influences the US Dollar (USD) and central bank policy.

Trader's Takeaway for February 2026:

DXY Neutral to Bullish: The 2.4% headline is a "win" for the economy, but the 2.5% Core rate suggests that the Fed is in no rush to cut interest rates aggressively. We expect the Dollar to remain strong as markets price in a "Higher for Longer" rate environment through at least June 2026.

The "Tariff Watch": Analysts are watching durable goods (like appliances and electronics) for signs of price hikes from the Trump administration's trade policies. In January, used cars fell 1.8%, suggesting that tariff-related inflation hasn't hit the consumer-facing data... yet.

Equities Response: The "Cooling Headline" is a positive for stocks, but the "Sticky Core" prevents a massive rally. Look for sectors like Consumer Staples to outperform as grocery inflation stabilizes.

Join our FREE Macro & Inflation Workshop at Global Markets Eruditio!

Do you know how to trade the "Inflation Spread"? We’ll show you how to use the gap between Headline and Core CPI to predict the next big move in Treasury Yields.