Yen Worries Force BOJ’s Hand: Rate Hike Bets Surge for December

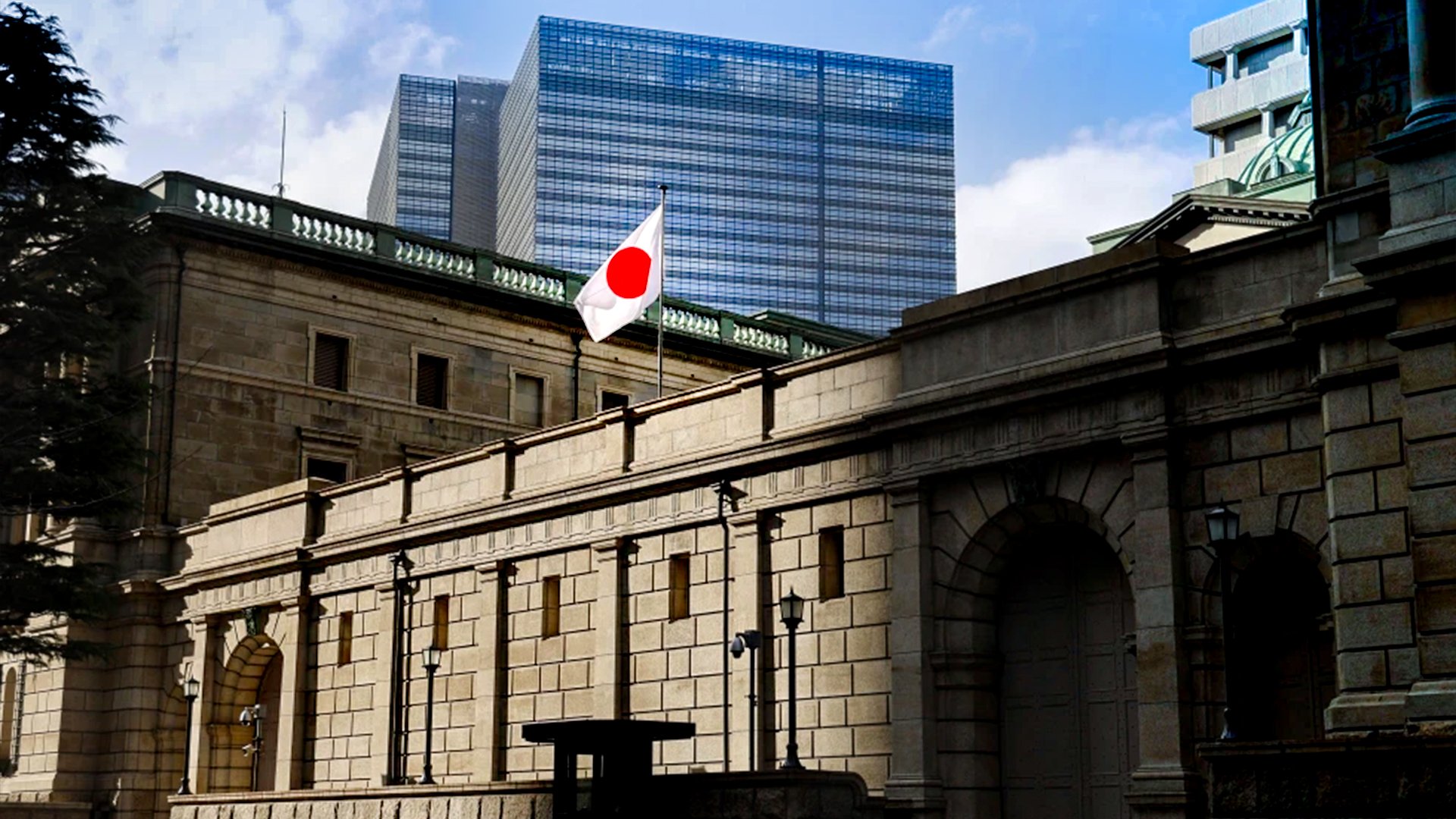

The Bank of Japan (BOJ) is actively preparing markets for a potential interest rate increase at its upcoming December policy meeting, according to market sources. This marks a notable hawkish pivot in the central bank’s messaging, as the risk of sustained inflation driven by a depressed Japanese Yen (JPY) takes precedence over cautiousness regarding the U.S. economic outlook.

The change in tone follows recent high-level discussions, including a key meeting between Prime Minister Sanae Takaichi and BOJ Governor Kazuo Ueda. This meeting appears to have cleared immediate political roadblocks that had previously constrained the bank's willingness to normalize policy.

The Hawkish Chorus Gets Louder

The shift toward a near-term hike is now being echoed by several members of the BOJ's nine-member policy board, with many explicitly tying policy action to currency risk.

Governor Ueda's Pivot: Even Governor Ueda, often viewed as the board’s most dovish member, stated to parliament on Friday that the BOJ would discuss the "feasibility and timing" of a rate hike in upcoming meetings. This is a significant change from his previous stance, which suggested no preset timing for a policy shift. Ueda also explicitly warned that the weak yen's impact on underlying inflation may have become stronger than in the past due to changes in corporate pricing behavior.

Board Member Signals: Board member Kazuyuki Masu commented that the timing of a rate hike was "nearing"—remarks that sent the 5-year government bond yield to a 17-year high. Another board member, Junko Koeda, stressed the necessity of continually raising real interest rates given the sustained strength in prices.

These hawkish comments signal a broadening consensus that conditions are ripe for tightening, opening the door for Masu and Koeda to potentially join the two existing hawkish board members who previously voted unsuccessfully for a rate increase.

Weak Yen: The Inflationary Trigger

The primary factor driving the BOJ’s renewed hawkishness is the weak yen. The currency’s persistent decline against pairs like the US Dollar (USD) makes imports—particularly energy and food—more expensive, accelerating domestic inflation.

The bank is now concerned that the yen's weakness is not just causing temporary price spikes but is influencing underlying inflation—the crucial metric the BOJ relies on to gauge sustainable price stability. This realization underscores a growing urgency to act to stabilize the currency and manage inflation expectations.

The Trading Edge: December or January?

While the market messaging points clearly toward policy tightening, the exact timing remains a close call. A narrow majority of economists in a recent poll anticipate the BOJ will raise rates from the current 0.5% at its meeting on December 18-19.

The Fed Factor: The decision is complicated by the timing of the U.S. Federal Reserve's rate decision, which precedes the BOJ’s meeting by one week. The Fed's stance on the USD will directly influence the JPY's value, which the BOJ is closely watching.

Wages and Tariffs: Governor Ueda previously cited caution over next year's wage talks and the impact of U.S. tariffs. However, early signs of solid upcoming pay hikes and limited economic fallout from tariffs are diminishing these reasons for delay.

For Forex Trading professionals and beginners alike, this period represents a high-volatility opportunity in the USD/JPY and other JPY pairs. The BOJ's deliberate signaling—"dropping signals now to ensure it won't surprise markets"—is a valuable piece of forward guidance. Traders must prepare for an immediate rally in the JPY if the hike is delivered in December, or a temporary sell-off if the bank opts to delay until January. Understanding this strategic central bank communication is vital for making profitable trades.

At Global Markets Eruditio (GME Academy), we guide our students on how to track this "hawkish chorus" and translate the subtle shifts in central bank language into actionable trading plans.

Are You Ready for the BOJ's Next Big Move?

The potential December rate hike is the biggest event for the Japanese Yen this quarter, creating massive volatility and opportunity in the JPY pairs. Don't be caught off guard by the RBNZ’s policy shift.

Join our FREE Forex Workshop today! Learn the advanced fundamental analysis techniques required to interpret central bank signals, gauge market expectations, and capitalize on major events like the upcoming BOJ decision.