UK Unemployment Hits 5-Year High of 5.2%: The "Cooling Signal" the Bank of England Needed

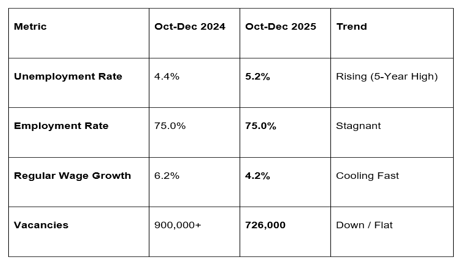

The UK’s labour market is emitting a clear "distress signal" according to the latest data from the Office for National Statistics (ONS). For the period of October to December 2025, the UK unemployment rate climbed to 5.2%, up from 5.1% in the previous quarter. This marks the highest jobless rate since early 2021, signaling that the Bank of England's (BoE) restrictive monetary policy is finally loosening the tight grip of the post-pandemic jobs market.

At the GME Academy, we view this as a pivotal moment for Sterling (GBP). The combination of rising unemployment and cooling wage growth has shifted the odds of a March 2026 rate cut from 72% to nearly 83%.

1. Payrolls and Vacancies: The Hiring Freeze Deepens

The decline in employment is no longer a "statistical blip"—it is now a five-month trend.

Payrolls Shed 134,000 Jobs: Early estimates for January 2026 show payrolled employees fell to 30.3 million. This is a 0.4% decrease compared to a year ago, with the Wholesale and Retail sector bearing the brunt of the losses (-65,000 jobs).

Flat Vacancies: The number of open roles remained broadly flat at 726,000. While not collapsing, the lack of growth suggests that businesses are opting for "natural attrition" and automation rather than active recruitment.

Sector Divergence: While Retail and Construction are struggling, Health and Social Work remains the primary engine of growth, adding 39,000 employees over the year.

2. The Wage Slowdown: "Inflation Genie Back in the Bottle?"

For the Bank of England, the most critical data point in this release is the easing of wage pressures.

Regular Pay (4.2%): Annual growth in regular earnings (excluding bonuses) fell to 4.2%. Crucially, private sector wage growth slowed to 3.4%—bringing it within touching distance of the BoE’s "target-consistent" rate of 3.25%.

The Public Sector Buffer: Public sector pay growth remains significantly higher at 7.2%, though this is largely attributed to "base effects" from earlier pay settlements in 2025 that will soon wash out of the data.

Real Wages (+0.8%): When adjusted for CPI inflation, workers saw a modest 0.8% increase in purchasing power. While positive, the slowing momentum in nominal pay is the key indicator for future interest rate decisions.

3. Youth Unemployment and Inactivity: The Growing "NEET" Crisis

Despite the rise in headline unemployment, there was a slight improvement in Economic Inactivity, which fell to 20.8%. However, a darker trend is emerging among the youth.

Youth Joblessness (14%): The unemployment rate for those aged 16–24 has hit a five-year high. Experts at Blick Rothenberg warn that this could worsen as nearly 900,000 graduates and school leavers enter a "bleak" job market this summer.

NEET Rate: Over 15% of all 16 to 24-year-olds are now classified as "Not in Employment, Education, or Training" (NEET), prompting calls for urgent government intervention.

The GME Academy Analysis: "Sterling’s Sell-Off is a Rate-Cut Bet"

At Global Markets Eruditio, we are tracking the immediate impact on the Pound Sterling (GBP).

Trader's Takeaway for February 18, 2026:

GBP/USD Impact: Sterling dropped a full cent to $1.3512 following the ONS release. Markets are now discounting a much higher probability that the BoE will join the Fed in a synchronized easing cycle starting in March.

The "Inflation Wrench": All eyes now turn to the UK Inflation data (CPI) scheduled for tomorrow. If inflation also surprises to the downside, the GBP/EUR could break its 1.15 support level.

Investment Strategy: We are shifting our bias to Bullish UK Gilts (Bonds). As unemployment rises and wage pressure fades, bond yields should continue to compress, providing a capital gain opportunity for fixed-income investors.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the UK entering a "Labour Recession"? We’ll break down the ONS LFS Quality Revisions and show you how to trade the GBP/USD ahead of tomorrow's critical inflation print.