Canada’s CPI Hits 2.3% in January: The "Base-Effect" Battle vs. Cooling Shelter Costs

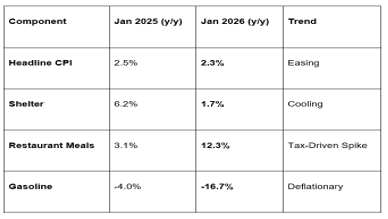

Canada’s inflation story for early 2026 is becoming a tale of two pressures. According to Statistics Canada data released on February 17, 2026, the Consumer Price Index (CPI) rose 2.3% on a year-over-year basis in January, a slight deceleration from December’s 2.4%.

While the headline number is drifting closer to the Bank of Canada’s 2.0% target, the "under the hood" data reveals that inflation would be significantly lower if not for a massive statistical distortion caused by a temporary tax holiday exactly one year ago.

1. The "Ghost of GST Past": Tax Distortions in Focus

The most significant upward pressure on January’s data didn't come from new price hikes, but from a "base-year effect" linked to the GST/HST tax holiday of late 2024 and early 2025.

The Comparison Gap: In January 2025, the federal government temporarily removed the GST/HST on a wide range of goods (restaurant meals, toys, clothing). Because prices were "artificially" low a year ago, today’s normal-tax prices appear much higher by comparison.

Restaurant & Alcohol Surges: Prices for restaurant meals jumped 12.3% year-over-year, and alcoholic beverages rose by roughly 8-9%. These figures are largely inflated by the return of the 5-15% tax that wasn't there in January 2025.

The "Pure" Rate: Economists at RBC and Scotiabank estimate that without these tax-related distortions, Canada’s year-over-year inflation would likely be sitting at 2.1%.

2. Shelter Inflation Finally Breaks Sub-2%

In a milestone for Canadian households, shelter cost growth—once the primary driver of the inflation crisis—has fallen below 2.0% for the first time in nearly five years.

1.7% Growth: Shelter costs decelerated to 1.7% in January, driven by a cooling rental market and a steady decline in mortgage interest costs (MIC).

The MIC Pivot: The mortgage interest cost index rose just 1.2% year-over-year, continuing a long-dated deceleration as the "renewal shock" of the high-rate 2023-2024 era finally fades from the data.

Regional Cooling: Rent prices decelerated most sharply in Prince Edward Island (+0.2%) and Saskatchewan (+1.8%), signaling that the supply-demand imbalance in the housing market is beginning to stabilize nationally.

3. Gas and Groceries: Mixed Signals at the Checkout

Gasoline Plunge: Prices at the pump fell 16.7% year-over-year. This 17% drop acted as the single largest "brake" on the headline inflation rate, preventing the GST tax distortions from pushing the CPI back toward 3%.

Grocery Moderation: Food purchased from stores rose 4.8%, down from 5.0% in December. A surprise harvest surplus led to a 3.1% decline in fresh fruit prices—specifically berries, oranges, and melons.

Cellular Savings: Prices for cellular services saw a massive "base-effect" drop, decelerating to +4.9% from a staggering 14.6% in December.

The GME Academy Analysis: "BoC Flexibility Increases"

At Global Markets Eruditio, we are analyzing what this means for the Bank of Canada’s March 18 meeting.

Trader's Takeaway for February 2026:

CAD/USD Impact: The Canadian Dollar (Loonie) slid slightly to 1.36 following the report. The "softer than expected" 2.3% print suggests the BoC doesn't need to be as aggressive as the U.S. Fed, which is still battling sticky 3% services inflation.

Yields Falling: Government of Canada 2-year bond yields edged lower to 2.45%. Markets are beginning to price in a "Goldilocks" scenario where the BoC can focus on supporting growth rather than just fighting prices.

The "Core" Victory: The BoC’s preferred core measures (CPI-trim at 2.4% and CPI-median at 2.5%) are now at their lowest levels in nearly five years. This gives Governor Macklem the "green light" to remain patient and potentially cut rates later this summer.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the BoC ready to pivot before the Fed? We’ll break down the January Core Inflation Revisions and show you how to trade the USD/CAD as it tests major resistance at 1.37.