INR at the Crossroads: Rupee Braces for US CPI as the $500B "Interim Deal" Reframes the Outlook

The Indian Rupee (INR) is currently trading at a pivotal technical juncture against the US Dollar (USD). As global investors shift their focus to the January US CPI report (releasing shortly), the USD/INR pair is consolidating within a critical range, caught between the structural strength of the Greenback and a massive geopolitical "reset" in US-India trade ties.

At the GME Academy, we are watching the 91.00 level with hawk-like precision. A breakout here would signal a new regime for the Rupee, while a failure to clear resistance could lead to a significant corrective pullback.

1. The USD Narrative: CPI as the "Final Boss"

The US Dollar surged following last week’s strong Non-Farm Payrolls (NFP) but has since given back those gains. This "wait-and-see" behavior suggests the market is skeptical of the Fed's hawkishness until inflation confirms the trend.

The Bull Case (Hot CPI): If inflation prints above the 2.5% consensus, the USD will likely rally. Markets would quickly price out the remaining two rate cuts for 2026, pushing the USD/INR toward the record high of 92.51.

The Bear Case (Soft CPI): An in-line or soft print (near 2.4%) would give the Fed room to move by summer, potentially cooling the Dollar and allowing the Rupee to appreciate toward the 90.00 psychological support.

2. The INR Narrative: The "Oil-for-Access" Breakthrough

The biggest fundamental shift for the Rupee in 2026 is the February 6 "Interim Trade Agreement" between the Trump administration and Prime Minister Modi.

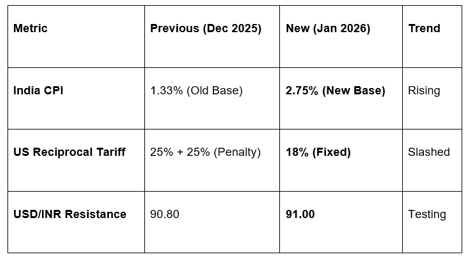

Tariff Cliff: The US has slashed total tariffs on Indian goods from a staggering 50% (which included a 25% "Russian oil penalty") down to just 18%.

The $500 Billion Pledge: In exchange for lower tariffs, India has committed to purchasing $500 billion in American energy (LNG/Coal), aircraft, and ICT over the next five years.

The Oil Pivot: Crucially, India has agreed to halt the purchase of Russian Federation oil, a move that removes the primary source of diplomatic and economic friction with Washington.

3. RBI and Inflation: No More Rate Cuts?

While the trade deal provides a "long-term bullish tailwind" for Indian industry, the domestic inflation data has thrown a wrench into expectations for a dovish Reserve Bank of India (RBI).

Inflation Rebound: January's retail inflation (under the new 2024 rebased series) accelerated to 2.75%, up from 1.33% in December.

The 4% Target: While still well within the RBI’s 2–6% comfort zone, the acceleration—driven by food and precious metals—suggests the "easy" phase of disinflation is over.

RBI Stance: Most analysts, including those at HDFC and Kotak, now believe the RBI's rate-cutting cycle has officially ended. A "Higher for Longer" RBI supports a stronger Rupee by maintaining attractive yield differentials.

The GME Academy Analysis: "Trading the USD/INR Consolidation"

At Global Markets Eruditio, we are advising traders to prepare for a "Volatility Spike" upon the US CPI release.

Trader's Takeaway for February 16, 2026:

The Breakout Level: The pair is squeezed in a descending channel. A daily close above 91.00 opens the door to 92.50. Conversely, support at the 50-day EMA (90.52) must hold to keep the bullish structure intact.

Trade Deal Beneficiaries: Keep an eye on Indian Textile, Leather, and Chemical stocks. These sectors now enjoy a significant tariff advantage over competitors in Pakistan (19%) and China (37%).

Energy Impact: India's $500B energy commitment will create massive, periodic demand for USD. This "structural outflow" may act as a natural ceiling on how much the Rupee can appreciate, even if the US Dollar weakens globally.

Join our FREE Macro Workshop at Global Markets Eruditio!

Is the Rupee heading for 93 or 89? We’ll map out the USD/INR Technical Channel and show you how to hedge your export-import exposure in the wake of the Trump-Modi deal.