Red Flag Raised: US Initial Jobless Claims Surge by 44,000, Sounding a Major Alarm for the Fed and the USD

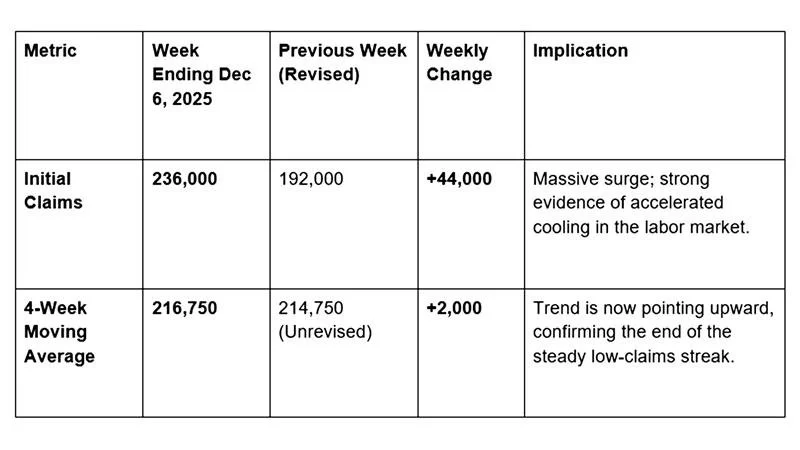

The U.S. labor market just delivered a sharp shock: initial jobless claims for the week ending December 6 surged by a massive 44,000 to 236,000 (seasonally adjusted), a level far exceeding market expectations. This dramatic jump, one of the largest weekly increases this year, strongly suggests that the US Federal Reserve's (Fed) rate cuts are rapidly tightening labor market conditions. The data provides immediate, high-conviction justification for the Fed's recent dovish pivot and puts intense bearish pressure on the US Dollar (USD).

The release of the weekly Unemployment Insurance claims by the U.S. Department of Labor reveals a potential tipping point in the employment landscape. While the Fed's recent actions were preemptive, this sudden spike confirms that downside risks to employment are escalating faster than anticipated. The 4-week moving average also ticked up to 216,750, signaling that the trend of low initial claims is potentially reversing.

The Claims Surge: A Tipping Point for Employment Risk

The jump in initial claims is the most critical takeaway, overshadowing the otherwise stabilizing data points.

Initial Claims Data (Seasonally Adjusted):

Continued Claims Show Mixed Picture

The data for insured unemployment (continued claims) for the prior week (ending November 29) shows a small degree of stability that mitigates the overall panic, but the focus remains on the initial claims figure as the leading indicator.

Insured Unemployment Rate: Decreased by 0.1 percentage point to 1.2%.

Insured Unemployment Volume: Decreased by 99,000 to 1,838,000 (seasonally adjusted).

The decrease in continued claims suggests that, as of late November, many job seekers were still managing to find employment quickly. However, the subsequent spike in initial claims for the first week of December suggests that the pace of layoffs and firings is now sharply accelerating, and the drop in continued claims will likely be quickly reversed in upcoming reports.

Forex Trading: A Clear Path to USD Weakness

This data release provides immediate, high-conviction support for the bearish fundamental bias against the US Dollar (USD).

Validating the Dovish Pivot

The surge in jobless claims retroactively validates the Fed's recent dovish shift (the rate cut and Powell's comments) where they explicitly flagged "downside risks to employment" as the primary concern.

Accelerated Easing: The market will now price in a faster and potentially deeper series of rate cuts in 2026. This anticipation of reduced interest rate differentials sharply diminishes the attractiveness of USD assets, creating a negative carry trade environment.

Currency Pairs: This makes pairs like EUR/USD and GBP/USD fundamentally bullish targets, as the interest rate advantage of the USD rapidly erodes. Conversely, the USD/JPY pair is under intense downward pressure, driven by lower U.S. yields.

Sectoral Warning: The largest increases in initial claims were seen in industrial states like Pennsylvania (+2,208) and Wisconsin (+1,092) (unadjusted data), suggesting that the economic slowdown is starting to hit industrial and manufacturing sectors, often cited by experts in Global Markets Eruditio as a precursor to a wider recession.

For Forex Trading for Beginners, this is a textbook example of high-impact data overriding prior trends. The move from 192,000 to 236,000 is a statistical anomaly signaling a potential break in the labor market's strength.

Regional and Trend Analysis: Layoffs are Spreading

The raw, unadjusted data for initial claims rose by a massive 58.0% week-over-week, far exceeding the expected seasonal increase of 28.7%. This indicates genuine, non-seasonal weakness.

Largest Increases (Week Ending Nov 29): Pennsylvania, Wisconsin, and Nebraska reported the largest absolute increases, signaling specific industry layoffs in those states.

Largest Decreases (Week Ending Nov 29): California, Texas, and New York saw large decreases, which are typical post-holiday adjustments, but are not enough to offset the overall, national trend.

The sheer size of the initial claims jump ensures that the labor market, which was the final pillar of U.S. economic strength, is now visibly cracking. This leaves the Fed with a clear imperative: continue easing policy to support employment, which translates directly into a soft-currency environment for the USD.

Is Your USD Strategy Prepared for the Labor Market Breakout?

The surge in jobless claims to 236,000 is a critical, market-moving event that defines the bearish trade for the USD.

Master the skill of translating high-impact labor data into immediate, high-conviction currency trades.

Join the GME Academy community today and sign up for our FREE Forex Workshop to learn how to analyze the claims report and position yourself on USD currency pairs for the acceleration of the easing cycle, securing a comprehensive understanding of the forces that move the market.