The Destiny of the ICI: Marcos Leaves Fate of Anti-Corruption Body to Itself

In a notable move toward reinforcing institutional independence, President Ferdinand R. Marcos Jr. has declared that he will not dictate the future of the Independent Commission for Infrastructure (ICI). Instead, the commission—tasked with unraveling a decade’s worth of anomalous public works—will decide for itself whether to continue its hunt or conclude its mandate.

Speaking at a Palace briefing on Tuesday, February 3, 2026, Palace Press Officer Claire Castro emphasized that the President respects the "destiny" of the commission. "The fate of the ICI rests on the decision of the ICI itself," Castro stated, signaling that the executive branch will remain a supportive partner rather than a commanding voice.

1. A Mandate of Independence

The ICI was established through Executive Order (EO) 94 in September 2025 following a national outcry over "ghost" and substandard flood control projects. Its mission: to investigate irregularities in infrastructure projects implemented between 2015 and 2025.

The "Sunset" Question: Under the EO, the ICI is a fact-finding body designed to be functus officio (effectively dissolved) once its purpose is accomplished.

The President’s Stance: Rather than invoking the sunset clause himself, Marcos is awaiting a complete report from the commission. This report will detail their accomplishments and their own recommendation on whether their work is finished or if more stones need to be turned.

2. The Investigation So Far: By the Numbers

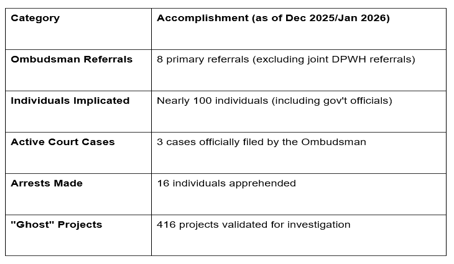

Despite being an ad hoc body, the ICI has moved with significant speed since its inception five months ago. As of late 2025 and into early 2026, its impact on accountability has been measurable:

3. Avoiding the "Interference" Narrative

The President’s hands-off approach appears designed to protect the integrity of the commission’s findings. With high-profile names—including former senators and top-tier contractors—linked to the ₱545 billion flood mitigation scandal, any direct move by Malacañang to dissolve the body could be perceived as "shielding" allies.

Direct Communication: Castro encouraged the ICI, currently chaired by retired Justice Andres Reyes Jr., to communicate directly with the President regarding their needs.

Executive Support: While Marcos won't interfere, the Palace assured that resources from the executive branch—such as the PNP-CIDG and NBI—remain at the commission’s disposal for as long as they choose to operate.

4. Forex and Economic Impact: The "Transparency Premium."

For Forex traders and investors watching the Philippines in 2026, the ICI's fate is a barometer for Political Risk.

Fiscal Discipline: The investigation into "ghost" projects aims to ensure that the ₱6.793 trillion national budget for 2026 is spent on real steel and stone, not pocketed.

Market Confidence: A transparent conclusion to the ICI’s work—where cases are successfully handed over to permanent bodies like the Ombudsman—bolsters the "Transparency Premium" of the Peso.

Institutional Strength: Investors generally favor "independent" oversight. If the ICI recommends its own dissolution because the "system has been fixed," it sends a bullish signal for the country’s governance score.

The GME Academy Analysis: "The Transition to Permanent Accountability"

At Global Markets Eruditio, we view the ICI as a "temporary bridge." The goal was never to create a permanent bureaucracy, but to jumpstart the anti-graft machine. The fact that the Ombudsman is now "ready to take on the task" suggests that the Philippines is moving from an emergency investigation phase to a permanent prosecutorial one.

Are You Watching the "Governance Factor"?

In 2026, the Peso's strength isn't just about interest rates; it's about trust. The successful prosecution of infrastructure anomalies is a key ingredient in the Philippines' push for a "stable" credit outlook.

Join our FREE Forex Workshop

Learn how to incorporate "Governance and Corruption Indices" into your fundamental analysis. We’ll show you how political reforms impact the USD/PHP and how to spot the long-term currency trends driven by institutional shifts.