Safe Havens in a Shifting Market: A Guide to Philippine Government Bonds

As global markets grapple with geopolitical uncertainty and local economies adjust to new growth targets, Philippine Government Bonds are re-emerging as the anchor of many local portfolios. Whether you are a retail saver looking for a low-risk home for your ₱5,000 or a high-net-worth investor managing millions, understanding the "Yield Curve" of the Republic is essential for 2026.

At the GME Academy, we track bond auctions as the "early warning system" for interest rate shifts. The latest results from the Bureau of the Treasury (BTr) suggest a market that is pricing in lower rates, making now a critical time to "lock in" returns.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

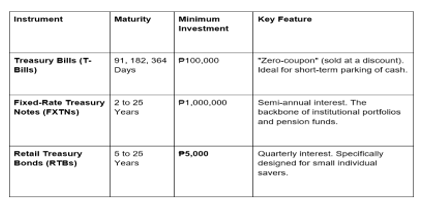

1. The Three Pillars: T-Bills, Treasury Notes, and RTBs

The Philippine government borrows money from its citizens and institutions through three primary instruments. Each serves a different timeframe and risk appetite.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

2. Current Market Snapshot: The February 2026 Yield Curve

The "Yield" is the annual return an investor earns on a bond. As of early February 2026, yields have been trending downward following a disappointing Q4 2025 GDP report (which came in at just 3.0%). This "anemic" growth has strengthened the case for the Bangko Sentral ng Pilipinas (BSP) to cut interest rates.

Latest Benchmark Yields (February 2, 2026):

2-Year Bond: 5.175% (Down from 5.37% in January)

5-Year Bond: 5.634% (Down from 5.78%)

10-Year Bond: 5.969% (Down from 6.07%)

The Inverse Rule: In the bond world, when prices go up, yields go down. The current dip in yields means existing bondholders are seeing their bond values increase, while new investors will get slightly lower returns than they would have a month ago.

3. Why Yields are Falling: The "Rate Cut" Narrative

Why are bond yields dropping in 2026?

Slower Economy: With the 2025 full-year GDP at 4.4% (below the government's 6-7% target), the market expects the BSP to lower its policy rate from 4.75% to 4.50% at the February 19 meeting.

Inflation Stabilization: Inflation has cooled to approximately 1.8% (as of December 2025), giving the central bank plenty of "room to move."

Safe-Haven Influx: Geopolitical flare-ups (like the recent drone shoot-down in the Arabian Sea) often cause investors to sell "risky" stocks and buy "safe" government bonds, driving prices up and yields down.

4. For the Retail Investor: Is it Time to Buy?

For most Filipinos, the Retail Treasury Bond (RTB) remains the best entry point.

Passive Income: RTBs pay interest every three months. If you invest ₱100,000 in a 5-year bond at a 5.6% yield, you receive roughly ₱1,400 every quarter (before tax) for five years.

Low Risk: These are "direct, unconditional obligations" of the Republic. Unless the government itself ceases to function, your principal is safe.

Liquidity: While you are meant to hold them until maturity, you can sell them in the secondary market if you need cash—though you may gain or lose money depending on current market rates.

The GME Academy Analysis: "Trade the Cycle"

At Global Markets Eruditio, we tell our students: Watch the calendar to time your conversions. If you are an OFW family receiving Dollars, your "spending power" is usually highest in November/January when the Peso is weaker. Conversely, if you are a business paying for imports in Dollars, your best window to buy is during the December remittance flood.

Are You Ready for the Next Cycle Shift? With February 2026 historically being a "lean" month, we expect the Peso to remain under pressure. If you missed the December strength, the next major window for Peso stability isn't until the school-related surge in June.

Join our FREE Forex Workshop. Learn how to use the BSP Remittance Calendar to predict USD/PHP movements. We’ll show you how to read "Seasonal Adjustments" and how to hedge your family's budget against the lean months of the year.