The Autopsy: Analyzing Losing Trades Without Emotion

In the trading world of 2026, the difference between a professional and a gambler isn't their win rate—it’s their Autopsy Process. Losing is a statistical certainty, yet most retail traders treat a loss like a personal insult, leading to the "Revenge Trade" spiral.

At the GME Academy, we teach that a losing trade is simply a "data point" you’ve already paid for. If you don't analyze it, you've lost the money and the lesson. To move from emotional frustration to objective growth, you must transform your review process into a clinical, rule-based procedure.

1. The "Depersonalization" Mindset

The first step in objective analysis is to separate your self-worth from your net worth.

The "Outcome Bias" Trap: Just because a trade lost money doesn't mean it was a "bad" trade. If you followed your rules and the market simply hit your stop, that is a Good Losing Trade.

The "Process" over "Profit": Professionals at Global Markets Eruditio judge themselves by how perfectly they executed their plan. A "bad" win (where you broke rules but got lucky) is more dangerous than a "good" loss, as it reinforces toxic habits.

2. The Clinical Checklist: 4 Questions for Every Loss

When a trade hits your stop-loss, wait at least 30 minutes for the "Cortisol Spike" to subside. Then, open your journal and answer these four questions with "Yes" or "No" answers only:

Was the Setup Valid? Did the price action meet 100% of your pre-defined entry criteria?

Was the Risk Correct? Did you risk exactly the percentage (e.g., 1%) defined in your plan?

Did I Follow the Exit? Did I wait for the stop-loss to hit, or did I "panic-close" early?

Was the Market Context Right? Was I trading against a major news event or a Higher Timeframe (HTF) trend?

If you answered "Yes" to all four, the loss is a "Cost of Doing Business." If you answered "No" to even one, you didn't lose to the market; you lost to yourself.

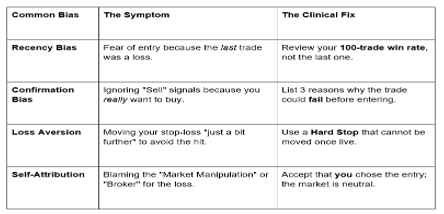

3. Identifying the "Bias" Fingerprint

In 2026, the most common reason for non-strategic losses is Cognitive Bias. By tracking which bias you fell for, you can start to predict your own self-sabotage.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. The 2026 "Post-Game" Review Strategy

With the integration of AI tools in MetaTrader 5 and TradingView, 2026 traders have access to deeper analytics.

The "Equity Curve" Health Check: Don't look at individual losses in a vacuum. Look at your Drawdown Duration. Is the current losing streak within the statistical norms of your backtest?

Volume Profiling: Analyze if your losses are happening in "Low Volume Nodes." Often, traders lose because they are trying to trade during the "Lunch Lull" or holiday-thin markets where price action is erratic.

The GME Academy Analysis: "Data is the Antidote to Drama"

At Global Markets Eruditio, we believe the journal is the trader's most powerful weapon.

Trader's Takeaway for 2026:

Screenshot the Failure: Save a chart of your loss. Mark exactly where you entered and where you exited. Re-visit this "Wall of Shame" every weekend. You'll find that 80% of your losses probably come from the same 2 mistakes.

The "Next Trade" Rule: If a loss makes you feel angry or "scattered," close your laptop. You are in no mental state to trade. The market will be there tomorrow; your capital might not be if you revenge trade.

USD/PHP Context: Many local traders feel emotional when the Peso weakens, fearing for their local purchasing power. Don't let your "National Sentiment" dictate your USD/PHP trade. Treat the pair like a math problem, not a political statement.

Join our FREE Forex Workshop at Global Markets Eruditio!

Ready to turn your losses into a roadmap? We’ll provide you with our "2026 Digital Trading Journal" and show you how to perform a Root Cause Analysis on your last three losing trades.