The Architect’s Blueprint: How to Build Your Own Trading System

In the fast-paced markets of 2026, a "gut feeling" is no longer a viable strategy. With AI-driven algorithms and high-frequency traders dominating the tape, the retail trader’s only edge is a systematic approach. At the GME Academy, we teach that a trading system is not a "magic box" that prints money; it is a business plan designed to manage uncertainty.

Building a robust system requires moving from a discretionary mindset—where you trade based on "vibes"—to a rule-based framework where every action is pre-defined.

1. Defining Your Trading Identity

Before you look at a single chart, you must audit yourself. A system that works for a 20-year-old scalper will fail a 50-year-old professional with a full-time job.

Time Horizon: Are you a Scalper (seconds/minutes), Day Trader (hours), or Swing Trader (days/weeks)?

Risk Appetite: Can you handle a 10% drawdown without panicking? Your system must reflect your psychological "breaking point."

Asset Class: In 2026, many traders are choosing between the high liquidity of Forex, the volatility of Crypto, or the fundamental clarity of Stocks.

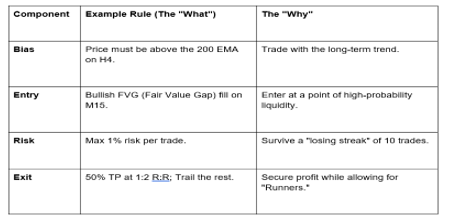

2. The Four Pillars of a Trading System

A professional-grade system is built on four non-negotiable pillars. If one is missing, the system will eventually collapse.

Pillar 1: Market Context (The Bias)

You need a "filter" to tell you which way the wind is blowing.

Technical: Using Higher Timeframe (HTF) structure like the Daily or 4-Hour chart.

Fundamental: Incorporating the "Macro" views we discuss at Global Markets Eruditio, such as Central Bank policy or the War Premium.

Pillar 2: The Setup (The Trigger)

This is your entry signal. It must be objective. "I think it’s overbought" is not a signal. "RSI above 70 with a bearish engulfing candle at a supply zone" is a signal.

2026 Trend: Many successful systems now use Smart Money Concepts (SMC), looking for Liquidity Sweeps followed by a Market Structure Shift (MSS).

Pillar 3: Risk Management (The Survival)

This is the most important part of the system.

Position Sizing: Never risk more than 1% of your equity on a single trade.

Stop-Loss Logic: Your stop should be placed where your "idea" is proven wrong, not just at a random dollar amount.

Pillar 4: Exit Strategy (The Payday)

Knowing when to leave is harder than knowing when to enter.

Fixed R:R: Aiming for a minimum 1:2 or 1:3 Risk-to-Reward ratio.

Trailing Stops: Using tools like the ATR (Average True Range) to lock in profits as the market moves in your favor.

3. The Validation: Backtesting & Forward Testing

You wouldn't buy a car without a test drive; don't trade a system without data.

Backtesting: Manually or automatically test your rules against 2-3 years of historical data. Look for your Profit Factor and Maximum Drawdown.

Forward Testing (Demo): In 2026, the "Market Regime" can shift quickly due to geopolitical tensions. Test your system in a live demo environment for at least 30–50 trades to see how it handles current volatility.

4. The Feedback Loop: Journaling & Refinement

Your trading system is a living document.

The Journal: In 2026, we use digital journals like Edgewonk or Tradervue. Track not just the pips, but your emotional state. Did you follow the rules? If not, why?

Review: Every weekend, conduct a "Post-Game Analysis." If a specific setup has a 20% win rate over 50 trades, cut it. Double down on what works.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The GME Academy Analysis: "Consistency Over Intensity"

At Global Markets Eruditio, we see traders fail not because their strategy is bad, but because they can't stick to it.

Trader's Takeaway for 2026:

Simplify the System: If your chart looks like a bowl of "indicator spaghetti," you will suffer from analysis paralysis. Use 2-3 confluences maximum.

The Checklist: Create a physical or digital checklist. If every box isn't checked, no trade.

USD/PHP Systematization: For our local traders, ensure your system accounts for Time of Day. A strategy that works in the New York Kill Zone may be completely useless during the quiet Philippine afternoon session.

Join our FREE Forex Workshop at Global Markets Eruditio!

Ready to build your first "Rule-Book"? We’ll provide you with our "System Blueprint Template" and show you how to backtest a simple Trend-Following strategy using MetaTrader 5.