The Pulse of Nations: Decoding the Central Bank Balance Sheet

To the average observer, a central bank is often seen as a mysterious institution that simply "sets interest rates." However, the true story of a nation’s economic health is told through its financial statements. For those engaged in Forex Trading, understanding the balance sheet of a central bank is like reading the blueprint of the global economy.

Whether it is the Federal Reserve handling the US Dollar (USD) or the Bank of Canada managing the Canadian Dollar (CAD), these balance sheets are the primary tools used to maintain stability, control inflation, and manage liquidity.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

Assets vs. Liabilities: A Unique Equilibrium

Unlike a private corporation, a central bank’s balance sheet isn't designed to maximize profit. Instead, it is a reflection of monetary policy.

1. The Assets: What the Bank Owns. The asset side represents how the central bank "injects" money into the economy. Common assets include:

Government Securities: Bonds and bills issued by the domestic government.

Foreign Currency Reserves: Holdings of other currencies like the EUR/USD or gold to stabilize the domestic exchange rate.

Lending to Commercial Banks: Short-term loansare provided to ensure the banking system stays liquid.

2. The Liabilities: What the Bank Owes. This is where it gets interesting. A central bank's primary liability is actually the money in your pocket.

Currency in Circulation: Every physical note is technically a liability of the issuer.

Commercial Bank Reserves: Deposits that private banks must keep at the central bank.

Equity: The capital base provided by the government or shareholders.

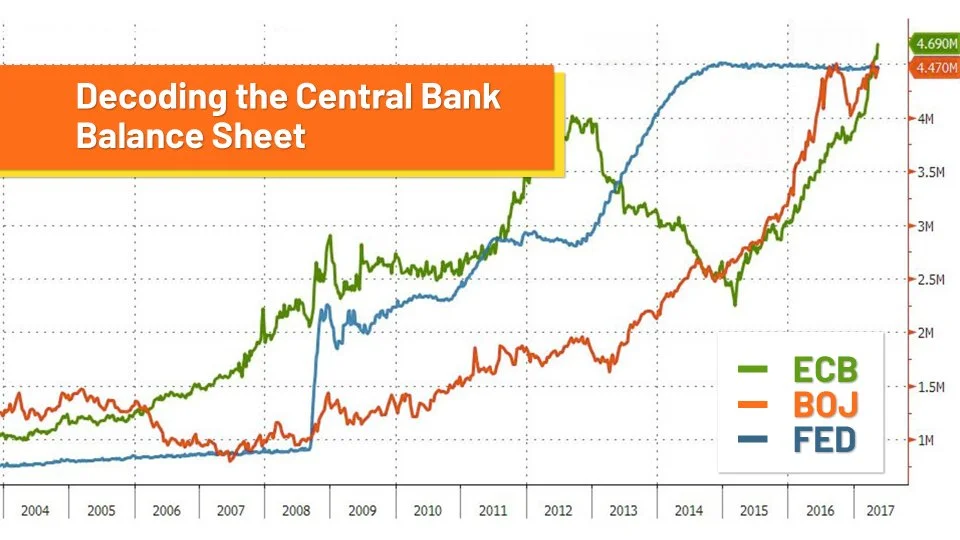

Quantitative Easing and the "Expanding" Sheet

In the world of Forex Trading for Beginners, you will frequently hear the term "Quantitative Easing" (QE). When a central bank wants to stimulate the economy, it "expands" its balance sheet. It buys government bonds (Assets) and pays for them by crediting the reserves of commercial banks (Liabilities).

This increase in the money supply typically puts downward pressure on the currency's value. For example, if the Fed aggressively expands its balance sheet, the US Dollar might weaken against cross-economy pairs like GBP/JPY or EUR/USD. Conversely, "Quantitative Tightening" (QT) involves shrinking the balance sheet, which often supports the currency's strength.

Why Forex Traders Must Pay Attention

Central bank transparency has become a hallmark of modern finance. Institutions like Global Markets Eruditio teach that shifts in the balance sheet are often "leading indicators" of future interest rate moves.

If you notice a central bank rapidly accumulating CAD or increasing its gold reserves, it signals a shift in sentiment that will eventually manifest in the spot Forex market. The GME Academy emphasizes that while technical analysis is vital, the balance sheet provides the fundamental "gravity" that pulls currency prices in specific directions over the long term.

The Risks of a Bloated Balance Sheet

While expansion can save an economy during a crisis, a balance sheet that stays too large for too long risks runaway inflation. As the supply of money increases, the purchasing power of the US Dollar or any other domestic currency can erode. Traders watch the "tapering" process—where the bank begins to slow its asset purchases—as it often marks the beginning of a new trend in the Forex market.

Master the Fundamentals of Finance

Understanding the mechanics of a central bank is the difference between a retail trader and a professional market participant. If you want to move beyond basic charts and understand the true forces moving the Forex market, you need a structured education.

Take Control of Your Trading Career. Don't let complex financial jargon hold you back. Join our FREE Forex Workshop and learn how to interpret central bank data to make informed, high-probability trading decisions.