The Golden Hours: Harnessing the Explosive Power of the Asia-London-New York Overlaps

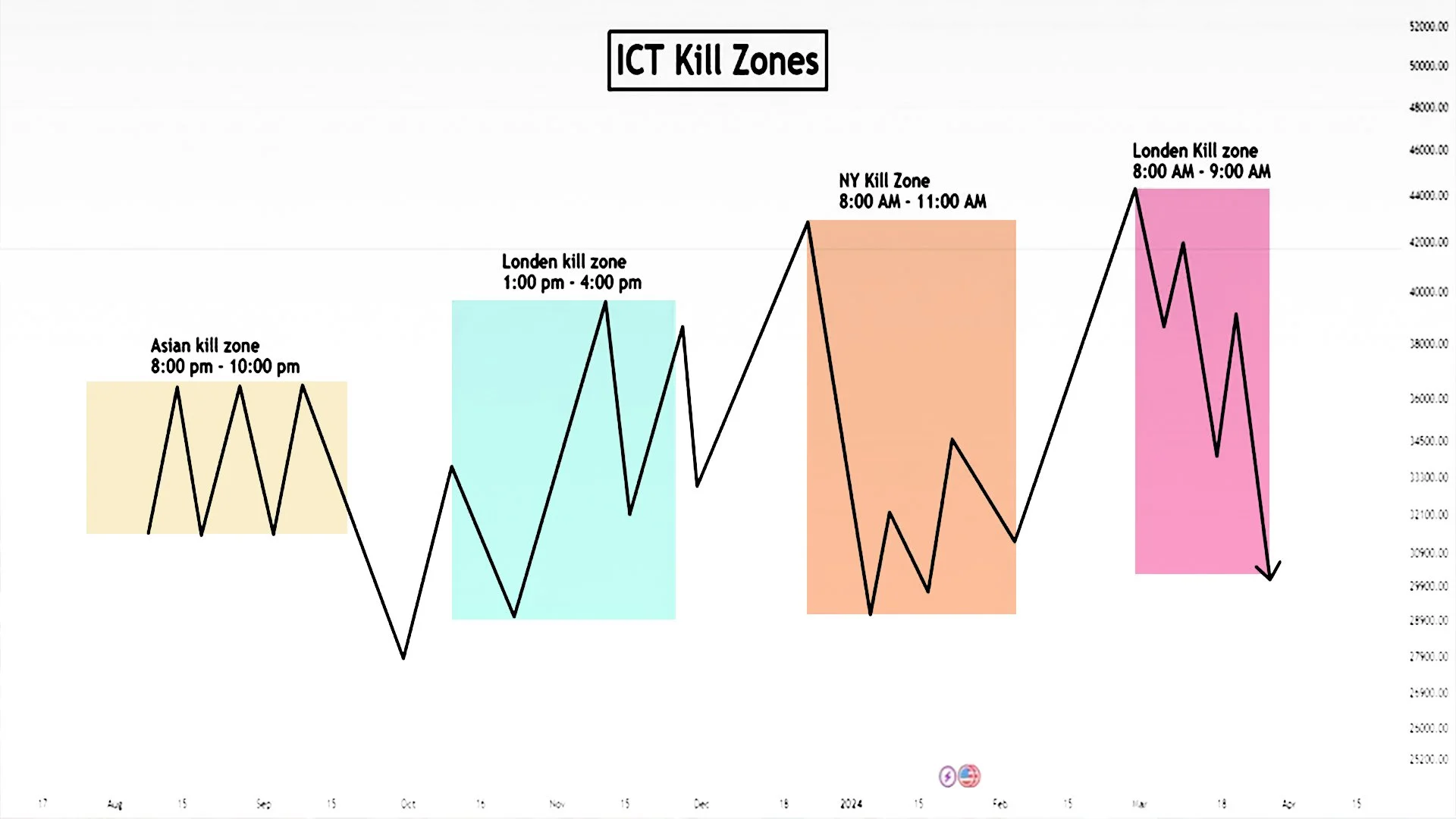

The 24-hour nature of the currency market is often described as a single, endless stream, but professional traders know the truth: it is a series of distinct "liquidity surges." The moments where the sun sets on one financial capital and rises on another create the most fertile ground for profit in Forex Trading. Known as "session overlaps," these windows represent the peak of global participation, where volatility and volume converge to create the market's biggest moves.

At Global Markets Eruditio, we teach that timing is not just a preference—it is a strategy. Understanding the transition from the Asia session into the London open, and finally the London-New York "power hour," is the key to achieving professional-grade market mastery.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Asia-London Handover: The Breakout Catalyst

The transition between the Tokyo (Asia) and London (European) sessions occurs between 7:00 AM and 9:00 AM GMT. During this window, the "calm" of the Asian session meets the "storm" of the European open.

The Mechanism: Breaking the Asian Range

The Context: The Asian session is typically characterized by lower volatility and consolidation. Traders often refer to this as the "Asian Range."

The Surge: When London opens, institutional banks and hedge funds enter the market, injecting massive liquidity. This often leads to a breakout from the consolidation levels established overnight.

Top Pairs: This overlap is prime time for GBP/JPY and EUR/JPY. Since the Yen (JPY) is the hero of the Asian session and the Pound (GBP) and Euro (EUR) dominate London, these crosses see intense, directional movement during the handover.

2. The London-New York Overlap: The "Power Hour"

The most significant window in all of Forex Trading occurs between 1:00 PM and 5:00 PM GMT (8:00 AM – 12:00 PM EST). This is when the world's two largest financial centers are active simultaneously.

Why It’s the Most Powerful Window:

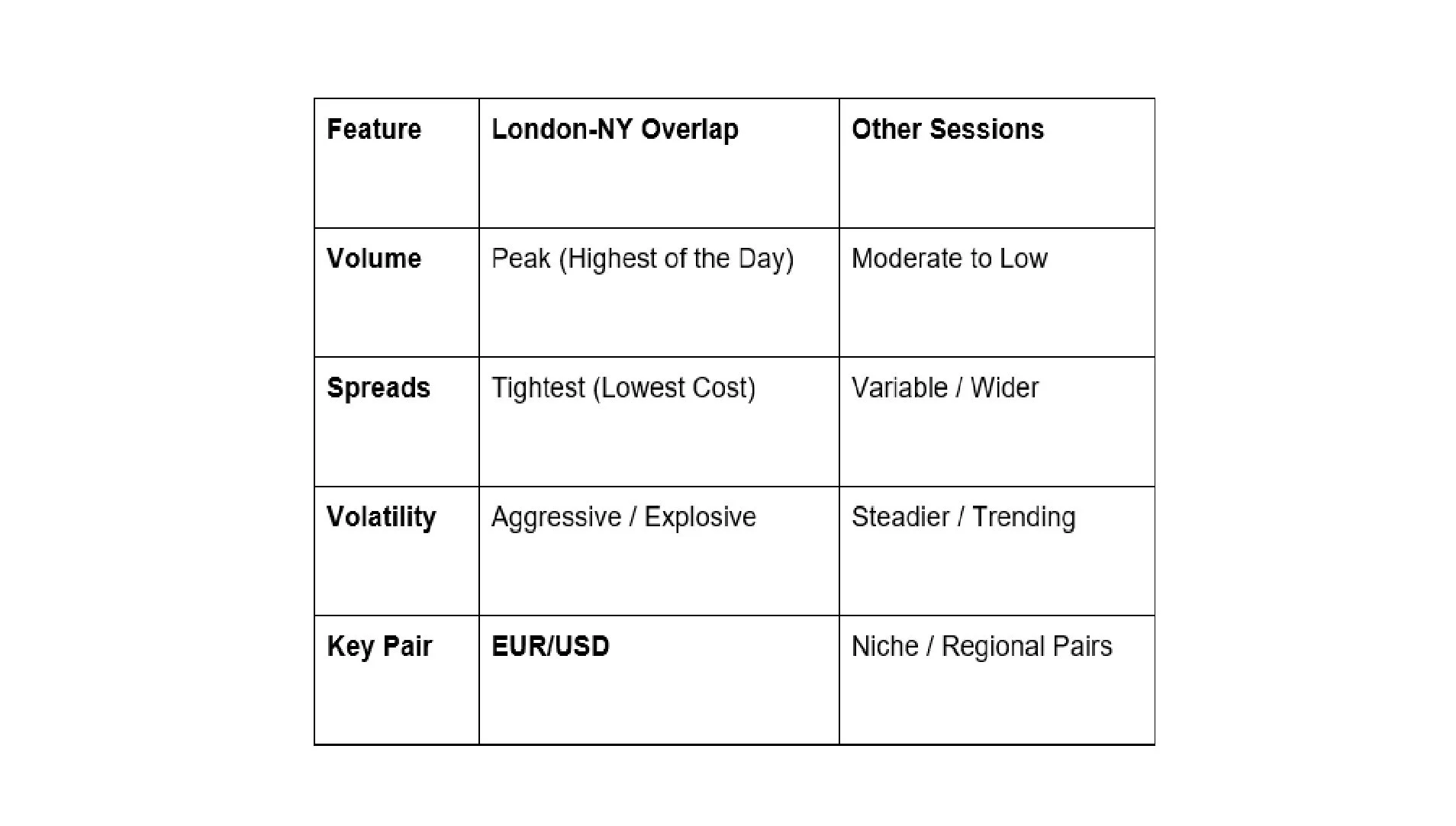

Maximum Liquidity: This 4-hour window accounts for more than 50% of the daily total trading volume. This means spreads are at their tightest, making it the most cost-effective time to trade.

Economic Data Clusters: Major news from the US Dollar (USD)—such as Non-Farm Payrolls or CPI—is released just as London traders are finishing their lunch and US traders are logging in.

The Trend Setter: High-impact moves during this overlap often dictate the closing direction of the day.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

3. Strategic Tactics for the Overlaps

For Forex Trading for Beginners, these overlaps can be overwhelming. To trade them successfully, you must adapt your strategy to the specific "personality" of the window.

Trade the EUR/USD and GBP/USD: These "Majors" are most liquid during the London-NY overlap. If you are looking for clean trends and the lowest transaction fees, focus your energy here.

Watch for "Stop Hunts": Because liquidity is so high, institutional "smart money" often pushes price just past the Asian High or Low to trigger stop losses before reversing the trend. Always wait for a 15-minute candle to close beyond a level to confirm a breakout.

The "Mid-Session Pullback": During the London-NY overlap, watch for a brief reversal around 3:30 PM GMT as London traders begin to close their positions and lock in profits before the European close.

Stop Trading the Lulls—Start Trading the Surges

The market does not move equally at all hours. By focusing your activity on the Asia-London and London-New York overlaps, you are aligning yourself with the flow of global capital. Whether you are trading the EUR/USD or hunting for momentum in GBP/JPY, these windows offer the highest probability of success.

Don’t get caught in the "choppy" low-volume hours. Learn to identify the footprints of the world's biggest banks as they enter the market during these golden hours.

Join our FREE Forex Workshop today to learn how to master session-timing strategies and capitalize on the explosive moves of the London-New York overlap!