The Price Magnet: Unlocking the Secret Behind Market Reversals at 1.0000, 50.00, and Other Round Numbers

Why does the EUR/USD often stall at 1.1000? Why does a major stock struggle to break $100.00? This phenomenon, far from random, is a profound psychological principle that governs price action across all liquid markets, including Forex Trading. Round numbers act as powerful self-fulfilling support and resistance levels because they are the preferred "anchors" for the massive, clustered orders of retail and, crucially, institutional traders. Mastering this concept is foundational for Forex Trading for Beginners and a key component of Global Markets Eruditio.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. The Cognitive Bias: Why Our Brains Love the Zeros

The market's respect for round numbers (those ending in 00, 000, or 0000) originates in human psychology. These levels, often called "psychological levels" or "figure levels," are easy to recall and process, leading to a collective bias that impacts global price movements.

The Simplicity Heuristic

Mental Anchors: Traders and investors worldwide use these numbers as simple, convenient reference points for setting goals, judging value, and assessing market trends. It is cognitively simpler to aim for a profit at 100.00 than 100.03 or 99.97.

Media and Attention: When a major index (like the S&P 500) or a major currency pair (like GBP/JPY at 180.00) breaches a round number, it becomes major news. This media attention draws even more eyeballs and, consequently, more liquidity to that specific price level, reinforcing its magnetic effect.

Significance Scale: Not all round numbers are equal. The stronger the psychological level, the more zeros it has. Levels like 1.0000 (parity), 1.5000, or 1000.00 (a thousand dollars) tend to create significantly stronger barriers than levels ending in .50 or .25.

2. The Institutional Order Clustering Effect

The psychological preference of millions of individual traders is compounded exponentially by the way large institutional players—banks, hedge funds, and proprietary trading desks—execute their huge orders.

Institutions do not want their intent to move the market revealed, so they often use round numbers as camouflage or liquidity points. This practice leads to a massive, measurable clustering of pending orders (Take Profit and Stop Loss) around these psychological levels.

A. Reversal Mechanics (The Wall of Take Profit Orders)

When the price approaches a round number, the most common immediate effect is a reversal or strong consolidation, caused by an overload of Take Profit orders.

Scenario (Resistance): Imagine a major Forex pair, USD/CAD, is rising toward the major figure of 1.4000. Traders who went long at a lower price (e.g., 1.3500) will likely set their automatic Take Profit orders at or just before 1.4000 (e.g., 1.3995 or 1.4000).

The Reaction: When the price hits this zone, thousands of accumulated buy orders are instantly closed by matching sell orders (the Take Profits). This massive, sudden influx of selling pressure creates a "liquidity wall" that stalls the trend, often causing a sharp pullback or reversal.

B. Breakout Mechanics (The Stop-Loss Cascade)

If the price manages to push decisively through the round number, the resulting move is often violent and rapid, fueled by the clustering of Stop-Loss orders.

Scenario (Breakout): Continuing the USD/CAD example, if the price pushes above 1.4000, it hits the Stop-Loss orders of all the traders who were shorting the pair, betting on a reversal at that level.

The Cascade: A short position's Stop-Loss is a buy order. When these clustered orders are triggered, they add a tremendous amount of buying volume to the market, accelerating the move past the round number. This creates a Stop Hunt that results in a rapid continuation, often referred to as a breakout run.

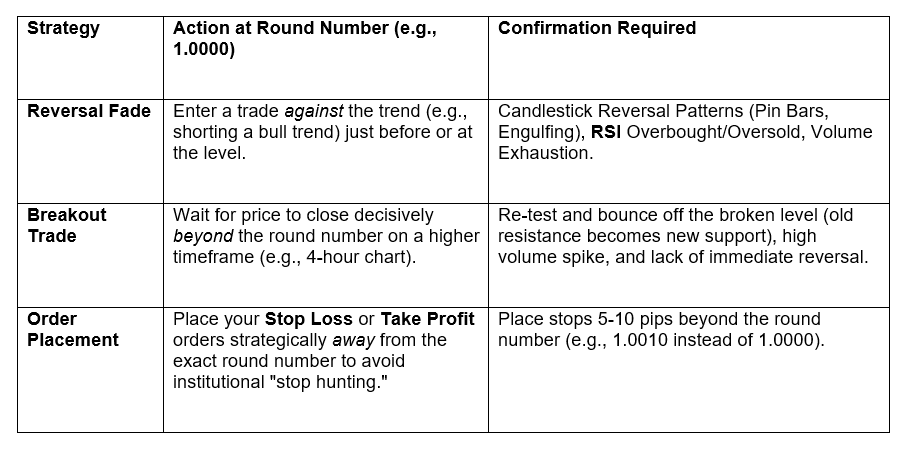

3. Trading Strategies: Capitalizing on the Figure Levels

For successful Forex Trading, one must treat round numbers not as guaranteed reversal points, but as high-probability zones that require technical confirmation.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

For those looking to achieve true Global Markets Eruditio, understanding this psychological underpinning of price action—and how major players strategically exploit it—is far more valuable than memorizing complex indicators. It is the key to reading the market's true intent.

Ready to Trade the Unseen Walls of the Market?

The difference between successful and struggling Forex Trading for Beginners often comes down to recognizing the simple, yet profound, truths that govern market movements—like the power of the round number. Do not let hidden institutional strategies run your stops.

Take the first step toward trading with the knowledge of a professional.

Join our community and learn the strategies that allow you to anticipate price action instead of chasing it.

Secure your spot in our FREE Forex Workshop today to learn how to master order clustering, trade the figures, and apply this powerful psychological concept to the EUR/USD and all your favorite currency pairs!