The Great Escape: Master the Art of Spotting True Breakouts Before the "Fakeout" Trap Snaps Shut

Every trader has been there. You’ve spent hours analyzing a consolidation zone on the EUR/USD. The price finally pierces the resistance level with a strong green candle. You enter a "Buy" order, convinced that the "Moon" is the next destination. Ten minutes later, the price reverses sharply, leaving you with a loss and a "wick" that looks more like a middle finger than a trend.

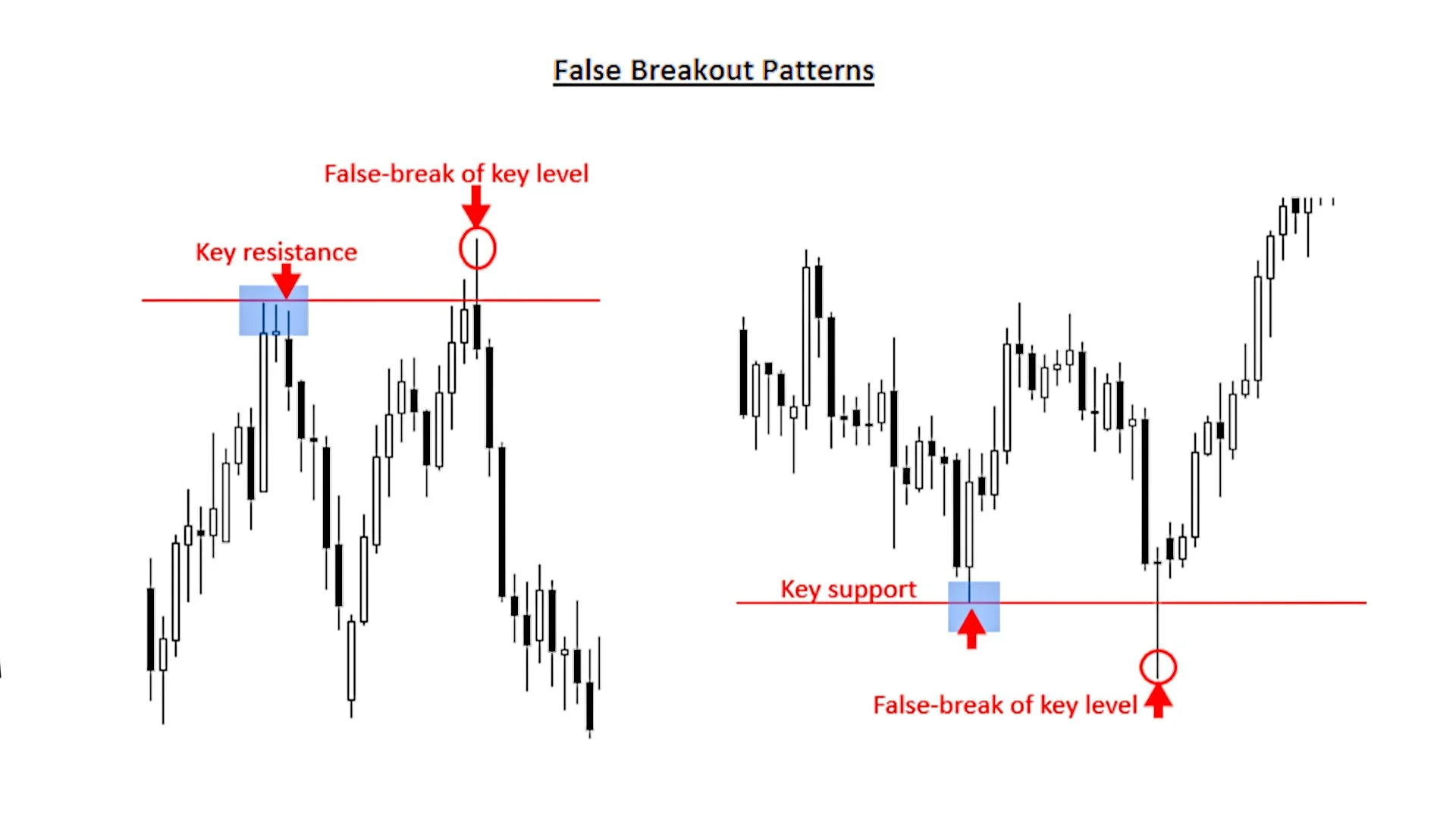

In the world of Forex Trading, this is known as a "Bull Trap" or a "Fakeout." For institutional players, these are liquidity hunts. For the retail trader—especially in Forex Trading for Beginners—they are the leading cause of blown accounts. Learning to distinguish between a genuine breakout and a deceptive trap is what separates the "gamblers" from the "market technicians."

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Anatomy of a Fakeout: Why the Market Lies

Markets spend the majority of their time (roughly 70-80%) in ranges. During these periods, liquidity builds up just above resistance and just below support. Large institutional players need this liquidity to fill their massive orders. By pushing the price slightly past a key level, they trigger "Stop Loss" orders and "Breakout Entry" orders from retail traders.

Once that liquidity is grabbed, the "Big Fish" reverse their positions, causing the price to snap back into the range. If you are trading volatile pairs like the GBP/JPY, these fakeouts can be hundreds of pips deep, wiping out a beginner’s margin in seconds.

The Checklist: 3 Signs of a "True" Breakout

At Global Markets Eruditio, we teach our students that a breakout is not just a price movement—it is a change in the fundamental and technical "state" of the market. Here is how to verify a move:

1. The Volume Pulse

Price action without volume is like a car without fuel. A true breakout should be accompanied by a significant spike in trading volume. If the US Dollar (USD) is breaking out against the Canadian Dollar (CAD) but the volume is lower than the 20-period average, the move lacks conviction.

2. The "Close" is King

Beginners often enter the moment the price touches a new high. Professionals wait for the candle close. A true breakout requires a strong body closing outside the zone. If the candle closes back inside the range, it’s a fakeout.

3. The Retest of Truth

One of the most reliable ways to trade a breakout is to wait for the "Kiss of Goodbye." Once the price breaks resistance, wait for it to return and test that same level as new support. If the level holds, the breakout is confirmed.

Context Matters: Single-Economy vs. Cross-Economy Drivers

A breakout on a chart rarely happens in a vacuum. Understanding the "Why" behind the move is a core pillar of the GME Academy curriculum.

Single-Economy Breakouts: Watch the US Dollar (USD). If the Fed announces a surprise interest rate hike, a breakout on the USD/CAD is likely a true fundamental shift rather than a technical fluke.

Cross-Economy Breakouts: When trading the EUR/USD, you must look at both sides of the bridge. Is the Euro strengthening, or is the Dollar weakening? A "True" breakout occurs when both economies' data points align to push the pair in one direction.

Risk Management: Your Shield Against Deception

Even with the best analysis, the market can be unpredictable. When trading a breakout on a pair like the GBP/JPY, where volatility is the norm, your "Stop Loss" should never be placed exactly at the breakout point.

Instead, place it back inside the range or below the "breakout candle." This gives the trade room to breathe during the "Retest" phase. Remember, in Forex, being right is secondary to staying alive.

Eruditio: Knowledge is the Ultimate Indicator

The difference between a trader who loses money on fakeouts and one who profits from breakouts is Education. At Global Markets Eruditio, we believe that "Eruditio" (knowledge) is the only tool that doesn't lag behind the price.

Most "beginner" mistakes happen because of emotional haste—the "Fear of Missing Out" (FOMO). By mastering the technical structures of ranges and the psychology of institutional liquidity, you stop being the "liquidity" and start being the "hunter."

Stop Guessing. Start Trading with Precision.

The charts are speaking to you, but are you fluent in their language? Identifying breakouts is just the tip of the iceberg. To truly thrive in the Forex market, you need a comprehensive understanding of price action, global macroeconomics, and disciplined risk management.

Don't let another "Bull Trap" catch you off guard. It’s time to level up your trading IQ and see the markets with professional clarity.

Are you ready to stop being the "Liquidity" and start being the "Leader"?

Join our FREE Forex Workshop Today!

Discover the exact strategies our mentors use to identify high-probability setups and protect capital in a volatile digital age. Your journey to market mastery starts with one click.