The Silent Profit Killers: How to Master Slippage and Requotes

In the fast-paced world of Forex Trading, speed is everything. You spot a perfect setup on the EUR/USD, you hit the "Buy" button, and you expect to enter at exactly the price you see on your screen. But suddenly, your order is filled at a worse price, or worse, a pop-up appears telling you the price has changed.

These phenomena are known as Slippage and Requotes. For those diving into Forex Trading for Beginners, understanding these two concepts is the difference between a disciplined strategy and a frustrated exit. At the GME Academy, we believe that knowing how your broker handles your orders is just as important as the trade itself.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. What is Slippage? (The Price Gap)

Slippage occurs when your order is executed at a price different from the one you requested. This usually happens because the market is moving so fast that by the time your order reaches the "Liquidity Provider," the original price is no longer available.

Positive Slippage: Rare but welcome. This happens when you get a better price than you asked for (common in ECN models).

Negative Slippage: The most common type. You buy at a higher price or sell at a lower price than intended.

When it happens: High volatility events like the NFP (Non-Farm Payrolls) report, central bank interest rate decisions, or during "market gaps" over the weekend.

2. What are Requotes? (The "Order Denied")

A requote happens when your broker is unable (or unwilling) to execute your trade at the price you clicked. Instead of filling you at the next best price (slippage), the platform pauses and asks: "The price has changed. Do you still want to trade at this new price?"

The Cause: This is almost exclusively a feature of Market Maker (Dealing Desk) brokers. Because they are the ones taking the other side of your trade, they won't fill you if the price has moved too far against them in a millisecond.

The Result: You often miss the entry entirely as you fumble with the "Accept" button while the market continues to race away.

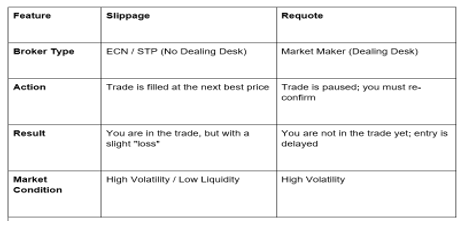

3. Slippage vs. Requotes: A Quick Comparison

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

4. How to Minimize the Impact

While you can never completely eliminate these issues, you can control them. At Global Markets Eruditio, we teach our students these three professional "hacks":

Use Limit Orders: Instead of a "Market Order" (which says "Get me in now at any price"), use a "Limit Order" (which says "Get me in ONLY at this price or better"). This prevents negative slippage.

Avoid News Spikes: Trading during the first 5 minutes of a major news release (like a Bank of Canada rate hike) is an invitation for massive slippage. Wait for the spread to stabilize.

Check Your "Max Deviation": Most platforms like MetaTrader allow you to set a "Maximum Deviation." If you set this to 2 pips, and the market slips by 3 pips, the order will simply cancel rather than fill you at a bad price.

The GME Academy Perspective: "The Cost of Doing Business"

Think of slippage as a "transaction tax." In a perfectly liquid market like the USD/JPY, slippage is minimal. In "exotic" currency pairs, it can be massive. At Global Markets Eruditio, we encourage traders to keep a "Trading Journal" that tracks not just your wins and losses, but also how much you are losing to slippage. If your broker is consistently slipping you by 3–5 pips on every trade, it might be time to look for a more transparent STP or ECN provider.

Are you tired of "Requotes" ruining your entries?

Most professional traders prefer slippage over requotes. Why? Being filled at a slightly worse price is often better than missing a 100-pip move because of a "Price Changed" pop-up.

Join our FREE Forex Workshop at Global Markets Eruditio!

Learn the secrets of "Order Execution." We’ll show you how to choose the right broker model for your style and how to set your platform settings to ensure you get the best possible fills, even during volatile markets.