The Global Gold Standard: A Guide to MiFID II, FCA, and ASIC Licensing

In the fast-moving world of global finance and Forex Trading, navigating the "alphabet soup" of regulatory bodies is more than just a box-ticking exercise—it’s the difference between a secure investment and a total loss of funds.

If you are looking to become a regulated entity or a trader seeking a safe haven, understanding the differences between MiFID II, the FCA, and ASIC is your first step toward financial literacy.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

1. MiFID II: The European Blueprint

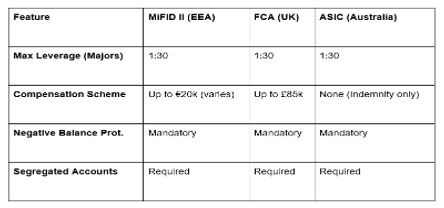

The Markets in Financial Instruments Directive II (MiFID II) is not a single regulator but a massive legislative framework that governs the entire European Economic Area (EEA). Introduced in 2018, its goal was to make European financial markets more transparent and better protected after the 2008 financial crisis.

Key Focus: Transparency and "Best Execution."

The "Passporting" Power: One of the biggest perks of MiFID II is that a firm licensed in one EU country (e.g., CySEC in Cyprus) can "passport" its services to any other EU member state without needing a separate local license.

Investor Protection: MiFID II forces brokers to segregate client funds and provide Negative Balance Protection, ensuring you can’t lose more than your initial deposit.

2. FCA: The Gold Standard in the UK

Following Brexit, the Financial Conduct Authority (FCA) "onshored" MiFID II into UK law but has since begun to diverge. The FCA is widely considered the world’s most stringent regulator.

High Barriers to Entry: Getting an FCA license is notoriously difficult and expensive, requiring a minimum capital of €730,000 for many brokers.

FSCS Protection: One of the biggest draws of the FCA is the Financial Services Compensation Scheme (FSCS). If an FCA-regulated broker goes bust, eligible clients can be compensated up to £85,000.

Crypto Ban: Unlike its peers, the FCA has banned the sale of crypto-asset CFDs (Contracts for Difference) to retail consumers, citing high volatility and risk.

3. ASIC: The "Tier 1" Giant of the Pacific

The Australian Securities and Investments Commission (ASIC) is the primary regulator for the Australian financial markets. For years, ASIC was famous for its high leverage (up to 1:500), but in 2021, it aligned its rules closely with the UK and Europe.

Leverage Limits: ASIC now caps Forex leverage at 1:30 for retail traders, matching the FCA and MiFID II standards.

Global Reputation: ASIC is highly respected because it combines strict enforcement with a "business-friendly" approach.

No Compensation Fund: Unlike the FCA, ASIC does not have a specific government-backed compensation scheme like the FSCS, though it mandates professional indemnity insurance for all licensees.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The GME Academy Analysis: Which License Wins?

At Global Markets Eruditio, we tell our Forex Trading for Beginners students that your "Regulation" is your "Insurance."

For Traders: If you want the absolute highest level of safety and a government-backed "safety net" for your cash, the FCA is your best bet.

For Businesses: If you want to access the entire European market with one license, MiFID II (specifically through CySEC) is the most efficient path.

For the APAC Region: ASIC remains the dominant choice for those wanting a Tier-1 reputation with strong ties to Asian markets.

Final Verdict

The convergence of these three giants—MiFID II, FCA, and ASIC—means that for the first time in history, global retail trading standards are largely unified. Whether you are in London, Paris, or Sydney, the rules for leverage, transparency, and fund safety are now remarkably similar.

Join our FREE Forex Workshop at Global Markets Eruditio!

Want to learn how to check if a broker is actually regulated or if they are just "borrowing" a license number? Our experts will show you how to navigate the FCA Register and ASIC Portal to protect your capital.