Is Your Portfolio Overheating? The Silent Risk of "Heat Exposure" in Forex Trading

Many traders enter the world of Forex trading for beginners with a laser focus on the individual trade. They meticulously analyze the USD (US Dollar) price action or wait for a specific signal on the GBP/JPY. However, a fatal mistake often occurs not in the individual trade setup, but in the collective "heat" the entire portfolio is generating.

Portfolio Heat Exposure is the total risk your entire account is carrying across all open positions at any given moment. Think of it like a circuit breaker: each trade adds a certain amount of electrical current. If you plug in too many devices—even if each device is "safe" on its own—you eventually blow the fuse. In Forex, blowing the fuse means a margin call or a devastating drawdown that ends your trading career prematurely.

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

https://images.squarespace-cdn.com/content/619b666b5842697e2af69258/a9d57b27-4fad-4532-874a-89133d6a85bc/P477.02.jpg?content-type=image%2Fjpeg

The Domino Effect: Why Multiple Pairs Multiply Risk

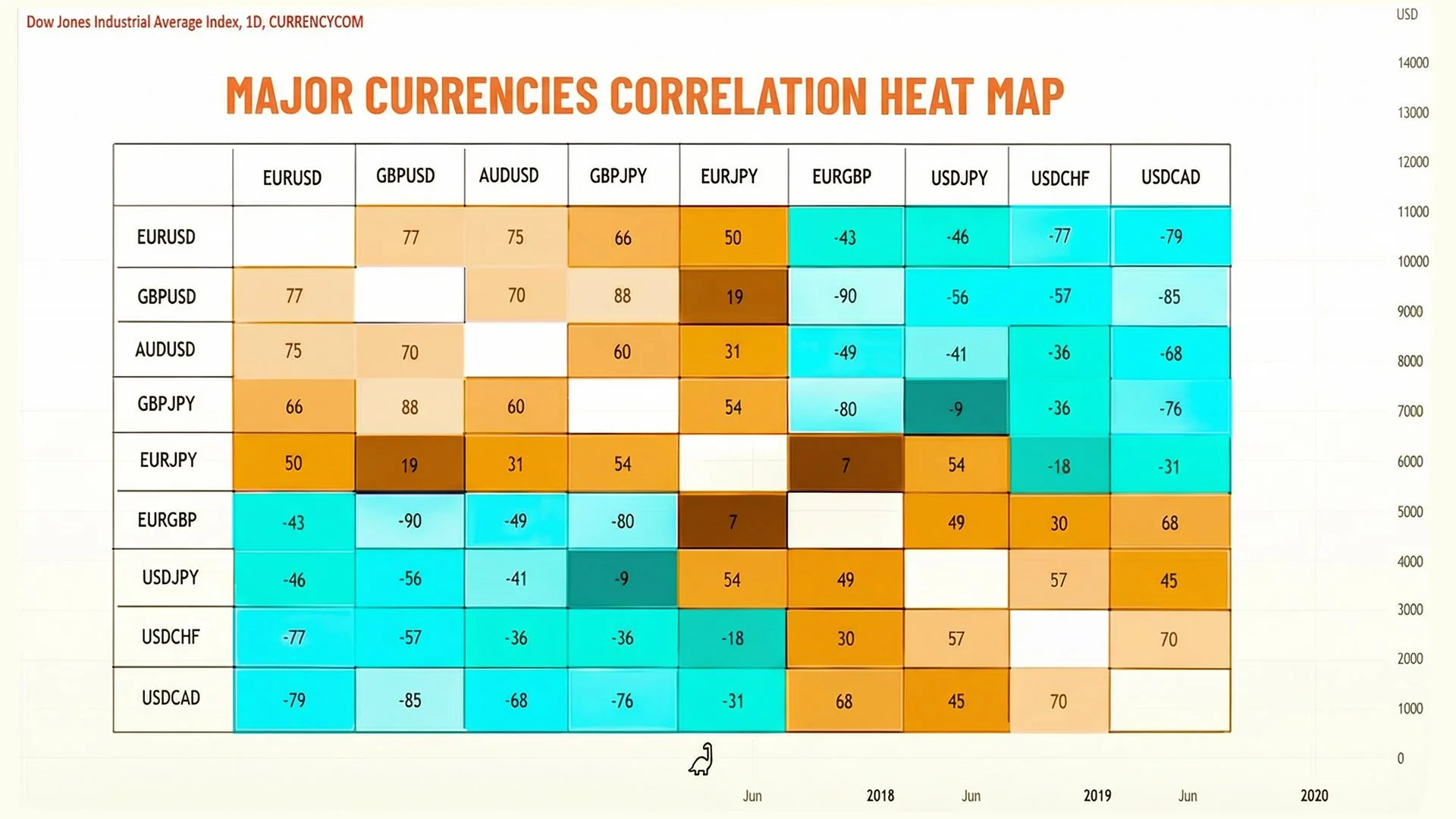

For many, the appeal of the Forex market is the ability to diversify. You might think that by trading the EUR/USD, the CAD (Canadian Dollar), and the AUD/CHF simultaneously, you are spreading your risk. But in the interconnected world of global finance, true independence between currency pairs is rarer than you might think.

When you have multiple trades open, you are subject to correlation risk. If you are "Long" on EUR/USD and "Long" on GBP/USD, you aren't really in two different trades; you are essentially in one giant "Short US Dollar" position. If a piece of high-impact single-economy news—like a surprise Federal Reserve interest rate hike—strengthens the Greenback, both trades will bleed simultaneously. This is the definition of high portfolio heat.

Calculating the Temperature: How Much is Too Much?

At the GME Academy, we emphasize that professional trading is a business of capital preservation. To manage your "heat," you must look at your Total Open Risk.

Individual Trade Risk: Most mentors suggest risking 1-2% of your account per trade.

Portfolio Heat: This is the sum of all individual risks. If you have five trades open, each risking 2%, your portfolio heat is 10%.

For most traders, a portfolio heat exceeding 5-7% is considered "overheating." In a volatile market, a single cross-economy news event—such as a shift in European Central Bank policy—can cause massive swings in EUR-related pairs, turning a 7% risk into a 15% drawdown in seconds.

Strategies to Cool Down Your Portfolio

To keep your account from melting down, you must adopt a holistic view of the market, a philosophy championed by Global Markets Eruditio. Here are three ways to manage your exposure:

Mind the Correlation: Before entering a new trade on GBP/JPY, check if you are already exposed to the Yen through USD/JPY. If you are, your "heat" on the Yen is doubling.

Stagger Your Entries: Don't fire off five trades on Monday morning. Let one trade move into profit and move your stop-loss to break even before adding the next "unit" of heat.

Diversify via Themes: If you have exposure to the US Dollar, look for opportunities in "commodity currencies" like the CAD or AUD that are moving based on oil or gold prices rather than just Greenback strength.

Master the Art of Professional Risk Management

Understanding portfolio heat is the bridge between being a "gambler" and a professional speculator. Forex trading isn't just about predicting where the EUR/USD will go; it's about ensuring that even if you are wrong, you have the capital to trade again tomorrow.

Are you ready to stop guessing and start calculating your way to success? Join our community of disciplined traders and learn the exact frameworks used by the pros to navigate the world's largest financial market.

Ready to turn the heat down and the profits up?

Join our FREE Forex Workshop Today!